Get the free Final Rule on Low-Income Designation for Federal Credit Unions - ncua

Show details

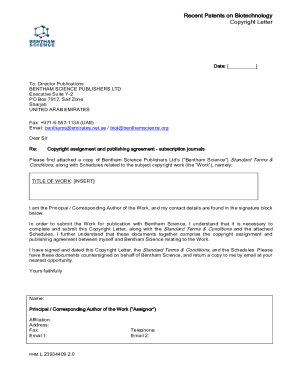

This document outlines the final rule amending the regulation that allows federal credit unions to qualify for a low-income designation based on a statistically valid sample of member income data.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final rule on low-income

Edit your final rule on low-income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final rule on low-income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing final rule on low-income online

To use the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit final rule on low-income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out final rule on low-income

How to fill out Final Rule on Low-Income Designation for Federal Credit Unions

01

Review the eligibility criteria for Low-Income Designation as outlined by the NCUA.

02

Gather necessary documentation that demonstrates your credit union's financial status and member demographics.

03

Complete the application form provided by the NCUA for the Final Rule on Low-Income Designation.

04

Ensure that all required fields are filled out accurately, including information about your credit union's assets and member income levels.

05

Submit the completed application form along with supporting documentation to the NCUA by the specified deadline.

06

Monitor the status of your application through the NCUA’s channels.

Who needs Final Rule on Low-Income Designation for Federal Credit Unions?

01

Federal Credit Unions seeking to provide services to low-income members.

02

Credit Unions looking to access additional resources and funding opportunities.

03

Organizations aiming to expand their member base and improve economic conditions in low-income communities.

Fill

form

: Try Risk Free

People Also Ask about

Do credit unions require proof of income?

Credit unions typically require proof of income to ensure you have the means to repay the loan. So you'll need to provide documents like recent pay stubs, tax returns, or bank statements as part of the application process.

Do credit unions have to follow federal regulations?

A federally charted credit union has a charter from the federal government granting it the ability to operate. Federally charted credit unions follow federal regulations, sometimes more strict than state regulations.

Can I get a loan without proof of income?

Credit unions typically have more flexible lending criteria than banks. Although having a good credit score is an advantage, credit unions might be more willing to work with individuals with average or below-average credit scores.

Do credit unions ask for proof of income?

Members applying for loans will need to supply proof of income for all sources they would like considered in the loan application review process.

What are the requirements for a low income designated credit union?

the NCUA's regulations , a credit union may be designated low-income if more than 50 percent of its members have a family income of 80 percent or less than the median family income for the metropolitan area where they live or national metropolitan area, whichever is greater, or those members who earn 80 percent or less

What makes you eligible for a credit union?

Many credit unions serve anyone that lives, works, worships or attends school in a particular geographic area.

Who is included in a credit union's designation of an official?

An “official” means any member of the board of directors, credit committee or the supervisory committee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Final Rule on Low-Income Designation for Federal Credit Unions?

The Final Rule on Low-Income Designation for Federal Credit Unions establishes guidelines and criteria for designating federal credit unions as low-income, enabling them to access certain benefits and services aimed at assisting low-income members.

Who is required to file Final Rule on Low-Income Designation for Federal Credit Unions?

Federal credit unions that wish to be recognized as low-income designated credit unions must file the necessary documentation to apply for this designation.

How to fill out Final Rule on Low-Income Designation for Federal Credit Unions?

To fill out the Final Rule on Low-Income Designation, credit unions must provide specific data regarding their membership demographics, financial status, and operational plans that demonstrate their commitment to serving low-income members.

What is the purpose of Final Rule on Low-Income Designation for Federal Credit Unions?

The purpose of the Final Rule is to enhance the ability of federal credit unions to serve low-income communities by providing additional resources, regulatory relief, and access to funding opportunities.

What information must be reported on Final Rule on Low-Income Designation for Federal Credit Unions?

Credit unions must report information including membership income levels, demographics, financial performance data, and descriptions of programs designed to serve low-income individuals.

Fill out your final rule on low-income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Rule On Low-Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.