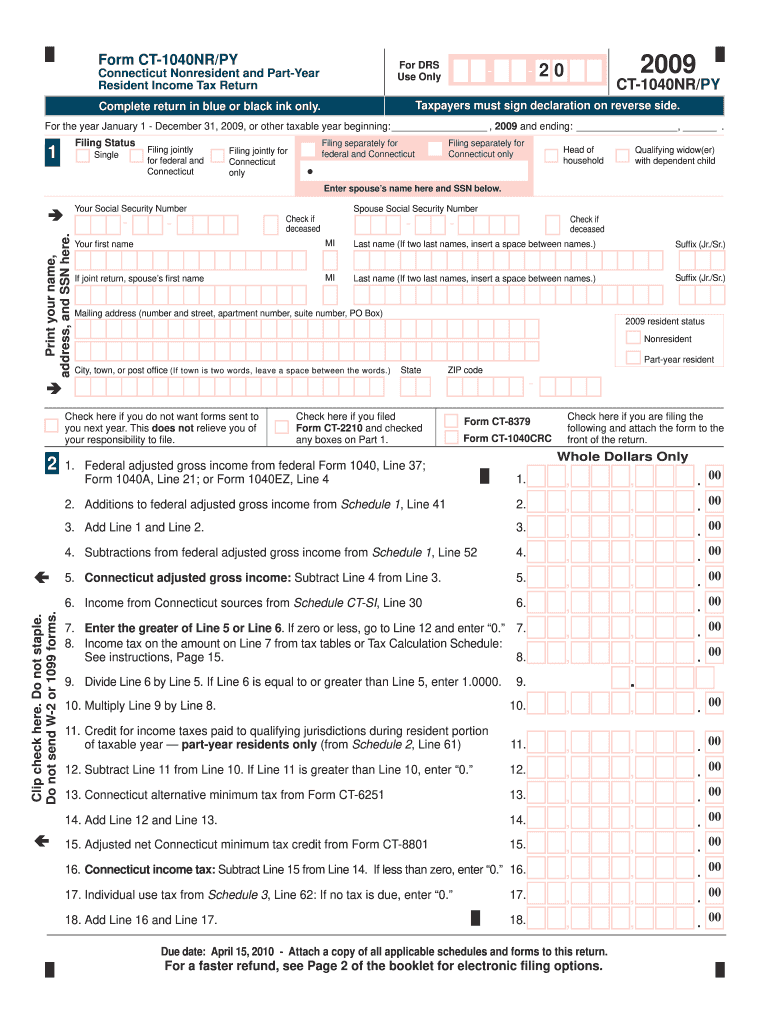

Who needs the CT-1040NR/BY form?

This form is the Connecticut Nonresident and Part-Year Resident Income Tax Return. It must be submitted by nonresidents and part-year residents of Connecticut who worked in the State and meet the following conditions:

-

Connecticut income tax has been withheld from the employee’s wages or other payments;

-

They have made estimated payments of income tax to the state;

-

They have received any type of income from sources based in Connecticut;

-

They are required to pay the federal alternative minimum tax.

What is this form for?

Filing the income tax return allows qualified individuals to report yearly income made in the state and pay due taxes or get a refund for overpayment.

Is the form accompanied by any other documents?

The completed CT-1040NR/BY form must be accompanied by the Connecticut Schedule CT-SI at the moment of submission.

When is the form due?

The Connecticut Nonresident and Part-Year Resident Income Tax Return (CT-1040NR/BY) as well as the CT-1040 form is expected by the 15th day of the fourth month following the end of the tax year. In case the due date falls on a weekend or a federal holiday, the submission deadline is extended until the next business day. For the 2015 tax return, the due date is April 18.

How do I fill out the form?

It is necessary to provide the following information in order to fill out the return form:

-

The reported period;

-

Marital status of the filer;

-

The filer (and their spouse's) name, SSN, address;

-

Calculations of the income, deductions and due tax;

-

Important data from W-2 and 1099 forms;

-

Details about overpayment.

Then, the filer must sign the declaration part of the form.

There are also four schedules to complete (if required):

-

Schedule 1 — Modifications to Federal Adjusted Gross Income;

-

Schedule 2 — Credit for Income Taxes Paid to Qualifying Jurisdictions;

-

Schedule 3 — Individual Use Tax;

-

Schedule 4 — Contributions to Designated Charities.

More helpful details about the form completion can be found here.

Where do I send the completed form?

The filled out CT-1040NR/BY form should be directed to the Department of Revenue Services in Connecticut, the address is PO Box 2969, Hartford CT 06104-2969.