Get the free Application for Business Tax Registration - burnett uwex

Show details

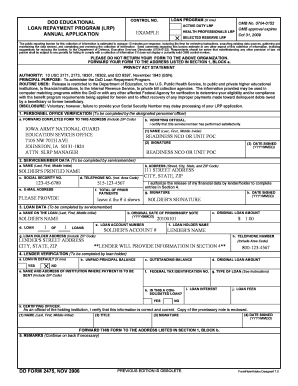

This application is for obtaining business tax registration with the Wisconsin Department of Revenue. Instructions on how to fill out the form, including processing times and fee details, are provided.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for business tax

Edit your application for business tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for business tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for business tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for business tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for business tax

How to fill out Application for Business Tax Registration

01

Start by downloading the Application for Business Tax Registration form from the relevant government website.

02

Fill in your business name, address, and contact information at the top of the form.

03

Provide your Federal Employer Identification Number (EIN) if applicable.

04

Select the type of business entity you are operating (e.g., sole proprietorship, partnership, corporation).

05

Indicate the nature of your business activity by providing a brief description.

06

List any additional owners or partners, if applicable, along with their contact information.

07

Review and double-check all entries for accuracy and completeness.

08

Sign and date the application to certify that the information provided is correct.

09

Submit the completed application to the designated government office in your area.

Who needs Application for Business Tax Registration?

01

Any individual or entity starting a new business that requires a tax registration.

02

Existing businesses that are changing their structure or expanding into new areas.

03

Businesses applying for a sales tax permit or any other state tax obligations.

04

Freelancers and independent contractors who need to comply with local tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I don't get an EIN?

Many business owners, particularly sole proprietors or those running single-member LLCs, might have previously skipped getting an EIN, assuming it was unnecessary. However, with the CTA's implementation, that choice could have serious consequences, including financial penalties or even jail time.

Can you file business taxes without EIN?

Many sole proprietors and single-member LLCs aren't required to have an employer identification number if they don't have employees. Instead, they can generally use their Social Security number or Individual Taxpayer Identification Number when filing their business taxes.

Do I need a business tax registration in Wisconsin?

Although there is no statewide business license, most businesses will need to complete the Business Tax Registration (BTR) with the Wisconsin Department of Revenue.

How to set up a small business for tax purposes?

Refer also to the Small Business Administration's 10 Steps to start your business. Apply for an Employer Identification Number (EIN) if applicable. Select a business structure. Choose a tax year. If you have employees have them fill out Form I-9 PDF and Form W-4. Pay your business taxes.

How do you apply for a business tax ID?

Ways to apply for an EIN Apply online. Get an EIN now, free, direct from the IRS. Fax Form SS-4, Application for Employer Identification Number to 855-641-6935. You'll get your EIN in 4 business days.

Is it illegal to run a business without an EIN?

A disregarded entity is not required to obtain an EIN unless it has: One or more employees. Any behavior that incurs payroll taxes, such as hiring employees or business partners, necessitates an EIN for a small business.

Do I need an EIN for my small business?

Your Employer Identification Number (EIN) is your business's federal tax ID number. You need it to pay federal taxes, hire employees, open a bank account, and apply for business licenses and permits. It's free to apply for an EIN, and you should do it right after you register your business.

Do I need an EIN to file taxes for my business?

Your business needs a federal tax ID number if it does any of the following: Pays employees. Operates as a corporation or partnership. Files tax returns for employment, excise, or alcohol, tobacco, and firearms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

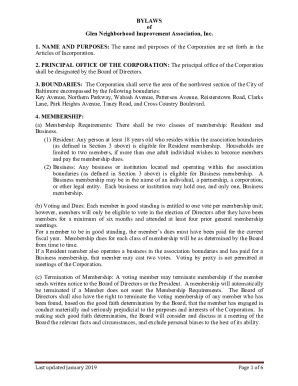

What is Application for Business Tax Registration?

The Application for Business Tax Registration is a form that businesses must complete to register for various taxes imposed by the state or local government. This application helps tax authorities identify the business and ensures compliance with tax regulations.

Who is required to file Application for Business Tax Registration?

Any business entity that operates within a jurisdiction and seeks to engage in business activities is required to file an Application for Business Tax Registration. This includes sole proprietors, partnerships, corporations, and other legal business entities.

How to fill out Application for Business Tax Registration?

To fill out the Application for Business Tax Registration, businesses must provide essential information such as business name, address, type of business entity, owner information, and details about the nature of the business. It's important to follow the specific instructions provided by the tax authority to ensure accurate completion.

What is the purpose of Application for Business Tax Registration?

The purpose of the Application for Business Tax Registration is to formally register a business with the tax authorities, ensuring that the business is accountable for tax obligations and complies with local, state, and federal tax laws.

What information must be reported on Application for Business Tax Registration?

The information required on the Application for Business Tax Registration typically includes the business name, physical and mailing addresses, business ownership details, type of business activities, estimated annual revenue, and any applicable licenses or permits.

Fill out your application for business tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Business Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.