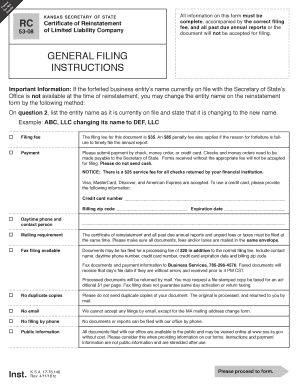

KS RC 53-08 2011 free printable template

Show details

RC 53-08 i Reinstatement of Limited Liability Company Instructions: Contact: Kansas Office of the Secretary of State Memorial Hall, 1st Floor 120 S.W. 10th Avenue Topeka, KS 66612-1594 (785) 296-4564

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS RC 53-08

Edit your KS RC 53-08 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS RC 53-08 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS RC 53-08 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit KS RC 53-08. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS RC 53-08 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS RC 53-08

How to fill out KS RC 53-08

01

Obtain the KS RC 53-08 form from the appropriate state website or office.

02

Read the instructions carefully before starting to fill out the form.

03

Fill in your personal details such as name, address, and contact information in the designated fields.

04

Provide any required identification numbers, such as Social Security Number or tax identification.

05

Complete any specific sections relevant to the purpose of the form, based on your individual circumstances.

06

Review the completed form for accuracy and ensure all necessary fields are filled out.

07

Sign and date the form at the bottom, confirming the information provided is true to the best of your knowledge.

08

Submit the form according to the provided instructions, whether electronically or by mail.

Who needs KS RC 53-08?

01

Individuals seeking assistance or benefits related to the Kansas state program specified by KS RC 53-08.

02

Residents of Kansas who need to report specific information or apply for resources aligned with the guidelines of the form.

03

Organizations or entities required to submit this form for compliance or reporting purposes as mandated by state regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I register as a foreign entity in Kansas?

To register a foreign corporation in Kansas, you must file an Application for Registration of Foreign Covered Entity with the Kansas Secretary of State. . You can submit this document by mail, by fax, or in person. The Foreign Corporation Application for a foreign Kansas corporation costs $115 to file.

Who is required to file Kansas annual report?

All for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period. An annual report may be filed beginning January 1 but must be filed by April 15.

How much does it cost to register a business name in Kansas?

Kansas LLC Cost. Filing the formation paperwork to start your Kansas LLC will cost $165 ($160 online). You'll also need to pay $55 ($50 online) every year to file your Kansas Annual Report.

Do I need to file a Kansas annual report?

All for-profit entities with a tax period other than a calendar year must file an annual report no later than the 15th day of the fourth month following the end of the entity's tax period. Not-for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period.

How do I file a foreign entity in Kansas?

To register a foreign LLC in Kansas, you must file an Application for Registration of Foreign Covered Entity with the Kansas Secretary of State. You can submit this document by mail, fax, or in person. The application costs $165 to file. (Add $20 if filing by fax.)

How much does it cost to register a business in Kansas?

How Much Does a Business License Cost in Kansas? There is no cost to register your business in Kansas or to obtain a sales tax license.

How much does it cost to reinstate an LLC in Kansas?

How much will it cost to revive a Kansas LLC? The filing fee for a Certificate of Reinstatement is $35.

How do I register a foreign entity in the US?

How to Register as a Foreign Entity in Every State Conduct a name availability search. Select a registered agent to represent your business in the state. Many states will require that you provide a certificate of good standing from your business formation state. Provide a copy of your formation documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KS RC 53-08 to be eSigned by others?

To distribute your KS RC 53-08, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit KS RC 53-08 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share KS RC 53-08 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete KS RC 53-08 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your KS RC 53-08. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is KS RC 53-08?

KS RC 53-08 is a specific form used to report various financial details to the state of Kansas, primarily related to tax obligations.

Who is required to file KS RC 53-08?

Individuals or entities that have certain tax liabilities or meet specific financial reporting criteria in the state of Kansas are required to file KS RC 53-08.

How to fill out KS RC 53-08?

To fill out KS RC 53-08, one should follow the instructions provided on the form, which typically includes entering relevant financial data, identifying the taxpayer, and ensuring all required signatures are included.

What is the purpose of KS RC 53-08?

The purpose of KS RC 53-08 is to collect necessary financial and tax information from taxpayers to ensure compliance with state tax laws.

What information must be reported on KS RC 53-08?

KS RC 53-08 requires reporting of financial details such as income, deductions, tax credits, and any other relevant information pertaining to the taxpayer's financial situation.

Fill out your KS RC 53-08 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS RC 53-08 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.