Get the free bright start withdrawal

Show details

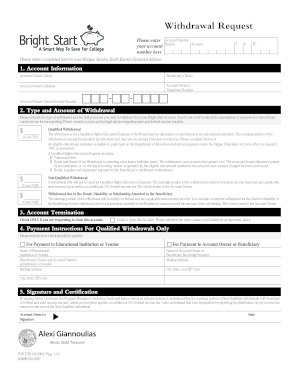

Please mail or fax the completed form with any required documents to the following address Systematic Withdrawal Bright Start College Savings Program P. Before you mail have you Title Entered all Account Owner and Beneficiary information in Section 1 Included a voided preprinted check or savings account deposit slip if applicable Signed your withdrawal request Obtained a signature guarantee if applicable The Bright Start College Savings Progra...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bright start withdrawal

Edit your bright start withdrawal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bright start withdrawal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bright start withdrawal online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit bright start withdrawal. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bright start withdrawal

How to fill out bright start withdrawal:

01

Gather necessary information: Before filling out the bright start withdrawal form, make sure you have all the required information such as your account details, the amount you wish to withdraw, and any specific instructions or documents requested by the bright start withdrawal process.

02

Fill out the withdrawal form: Locate the bright start withdrawal form, which can typically be found on the official bright start website or obtained from a financial advisor. Fill in all the necessary fields accurately, providing your personal information, account details, and the amount you wish to withdraw.

03

Review and double-check: Before submitting the withdrawal form, carefully review all the filled-out information to ensure its accuracy. Any mistakes or missing details could potentially delay or cause issues with your withdrawal request.

04

Submit the form: Once you are confident that all the necessary information has been provided and double-checked, submit the bright start withdrawal form. This can typically be done online through the bright start website or by mailing the physical form to the designated address.

05

Follow up and track the withdrawal: After submitting the withdrawal form, it is recommended to follow up and track the progress of your withdrawal request. This can be done by contacting the bright start customer service or accessing your online account to check the status of the withdrawal.

Who needs bright start withdrawal:

01

Individuals saving for retirement: Bright start withdrawal may be beneficial for individuals who have contributed to a bright start retirement savings account and are now in need of accessing their funds for retirement expenses.

02

Account holders facing financial hardships: In certain situations, account holders may face unexpected financial hardships, such as medical expenses, educational costs, or unemployment, which may necessitate a bright start withdrawal to cover these unforeseen circumstances.

03

Individuals nearing retirement age: As individuals approach their desired retirement age, they may choose to start withdrawing from their bright start account to provide an additional income stream during their retirement years.

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for bright start?

You can withdraw the funds as a non-qualified withdrawal. The earnings portion (not the amount you contributed) is subject to federal and state income taxes and a 10% federal penalty tax*.

Who pays penalty on 529 withdrawal?

Distributions from a 529 plan may be paid directly to the educational institution, to the beneficiary or to the account owner. Either the account owner or the beneficiary will have to pay income tax on the earnings portion of a non-qualified distribution plus a 10% tax penalty.

What is the penalty for withdrawing from a 529 plan?

What is the 529 plan withdrawal penalty? If you don't use your college savings plan for eligible expenses, your 529 plan nonqualified withdrawals may incur a 10 percent penalty and will also be subject to federal income taxes on the investment gains at whatever rate the IRS would normally charge.

How do I withdraw from Bright Directions?

An account owner or custodian (under a state UGMA/UTMA) may request a withdrawal online, by downloading and submitting the Withdrawal Request Form, or by contacting their financial advisor. Be sure to plan ahead when requesting a withdrawal.

How do I withdraw from Bright Start 529?

Request a withdrawal online or by downloading and submitting the Withdrawal Request form. An account owner or custodian (under a state UGMA/UTMA) may request a withdrawal online or by downloading and submitting the Withdrawal Request form. Be sure to plan ahead when requesting a withdrawal.

Can you take money out of 529 without penalty?

How 529 Savings Plans Work. Contributions to 529 plans are not eligible for a federal tax deduction, so they represent money that has already been taxed. As a result, account owners (typically parents) can withdraw any part of their original contributions without taxes or penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find bright start withdrawal?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the bright start withdrawal in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete bright start withdrawal online?

pdfFiller makes it easy to finish and sign bright start withdrawal online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in bright start withdrawal without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your bright start withdrawal, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is bright start withdrawal form?

The bright start withdrawal form is a document that allows individuals to withdraw funds from their bright start account.

Who is required to file bright start withdrawal form?

Any individual who wants to withdraw funds from their bright start account is required to file a bright start withdrawal form.

How to fill out bright start withdrawal form?

To fill out the bright start withdrawal form, you will need to provide your personal information, account details, and specify the amount you wish to withdraw. The form can be obtained from the bright start website or by contacting their customer service.

What is the purpose of bright start withdrawal form?

The purpose of the bright start withdrawal form is to request a withdrawal of funds from a bright start account for personal use or other financial needs.

What information must be reported on bright start withdrawal form?

The bright start withdrawal form typically requires personal details such as name, address, social security number, as well as account information and the amount to be withdrawn.

Fill out your bright start withdrawal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bright Start Withdrawal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.