Get the free NIRC FORM 241 - pbadupws nrc

Show details

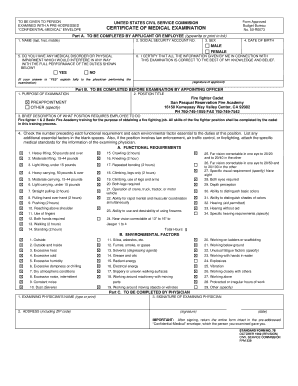

This form is used to report proposed activities involving radioactive materials under a general license granted by the U.S. Nuclear Regulatory Commission, specifically for operations in non-agreement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nirc form 241

Edit your nirc form 241 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nirc form 241 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nirc form 241 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nirc form 241. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nirc form 241

How to fill out NIRC FORM 241

01

Begin by obtaining the NIRC FORM 241 from the official website or local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and Tax Identification Number (TIN).

03

Indicate the tax period for which you are filing the form.

04

Complete the income sections by detailing all sources of income and the corresponding amounts.

05

Calculate the total income and apply any deductions as applicable.

06

Calculate the net taxable income and the tax due based on the current tax rate.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form at the designated area.

09

Submit the completed NIRC FORM 241 to the appropriate tax authority either electronically or in person.

Who needs NIRC FORM 241?

01

Individuals and businesses who are required to report their income and pay taxes under the jurisdiction of the tax authority.

02

Self-employed individuals who need to declare their earnings.

03

Small business owners who are required to file tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose for NRC Form 3 notice to employees?

The U.S. Nuclear Regulatory Commission (NRC) is announcing the availability of the latest version of NRC Form 3, “Notice to Employees.” The NRC Form 3 describes certain responsibilities and rights of employers and employees who engage in NRC-regulated activities, including how employees can report violations or other

What is form 241?

This form is used by a trust deed loan broker when arranging the purchase by a trust deed investor of an existing trust deed note held out for sale, to prepare an offer stating the price and conditions for purchase of the trust deed note.

What is the purpose of employment forms what types of forms do employees need to fill out?

Employee's eligibility to work in the United States Employer must verify the identity and employment authorization of individuals hired for employment in the United States. Employer use Form I-9, Employment Eligibility Verification PDF, for this purpose.

What is the main purpose of the NRC?

The NRC licenses and regulates the Nation's civilian use of radioactive materials, to provide reasonable assurance of adequate protection of public health and safety, to promote the common defense and security, and to protect the environment.

What does the NRC Form 3 describe?

The U.S. Nuclear Regulatory Commission (NRC) is announcing the availability of the latest version of NRC Form 3, “Notice to Employees.” The NRC Form 3 describes certain responsibilities and rights of employers and employees who engage in NRC-regulated activities, including how employees can report violations or other

What are Category 3 sources NRC?

Category 3 sources, if not safely or securely managed, could cause permanent injury to a person who handled them or was otherwise in contact with them for hours. It could possibly—although it is unlikely to—be fatal to be close to this amount of unshielded radioactive material for a period of days to weeks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NIRC FORM 241?

NIRC FORM 241 is a tax form used in the Philippines for the reporting of income tax withheld on wages paid to employees.

Who is required to file NIRC FORM 241?

Employers and companies that withhold income tax from their employees' wages are required to file NIRC FORM 241.

How to fill out NIRC FORM 241?

To fill out NIRC FORM 241, employers must provide information such as the tax identification number (TIN), employee details, total wages paid, total tax withheld, and other relevant information as required by the Bureau of Internal Revenue (BIR).

What is the purpose of NIRC FORM 241?

The purpose of NIRC FORM 241 is to report the amount of income tax withheld by employers from their employees' salaries and to remit this tax to the BIR.

What information must be reported on NIRC FORM 241?

The information that must be reported on NIRC FORM 241 includes the employer's details, employee's TIN and name, gross compensation income, total tax withheld, and any applicable exemptions or deductions.

Fill out your nirc form 241 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nirc Form 241 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.