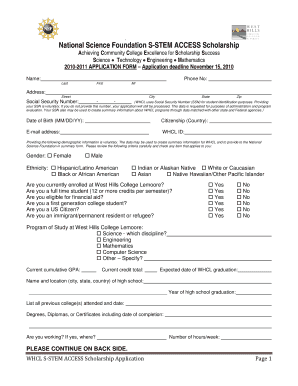

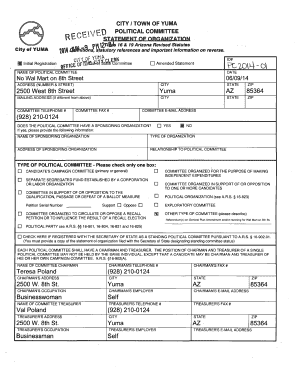

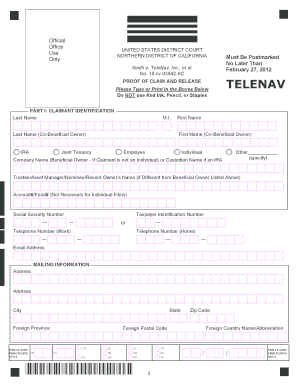

Get the free Maryland Mortgage Lender License Application Checklist - mortgage nationwidelicensin...

Show details

This document includes instructions for completing a new application for a branch under the Maryland Mortgage Lender License. It outlines the necessary requirements, costs, documentation, and submission

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign maryland mortgage lender license

Edit your maryland mortgage lender license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland mortgage lender license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maryland mortgage lender license online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit maryland mortgage lender license. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out maryland mortgage lender license

How to fill out Maryland Mortgage Lender License Application Checklist

01

Gather all necessary personal and business information, including your legal name, business structure, and contact details.

02

Prepare a detailed business plan outlining your lending practices, target market, and business goals.

03

Compile required documentation, such as financial statements, background checks, and credit reports.

04

Complete the Maryland Mortgage Lender License Application form accurately.

05

Submit fingerprints for a criminal background check as per the state requirements.

06

Pay the required application fee as specified in the checklist.

07

Ensure compliance with additional state and federal regulations related to mortgage lending.

08

Review your application for completeness and accuracy before submission.

09

Submit the application and all supporting documents to the Maryland Commissioner of Financial Regulation.

Who needs Maryland Mortgage Lender License Application Checklist?

01

Any individual or business entity wishing to operate as a mortgage lender in Maryland must complete the Maryland Mortgage Lender License Application Checklist.

Fill

form

: Try Risk Free

People Also Ask about

How hard is the mortgage test?

Becoming a successful mortgage loan originator (MLO) requires registering with the National Mortgage Licensing System (NMLS) and passing a difficult national exam that has a pass rate of just 56%. Create an account, provide personal information, and pay fees to register as an MLO candidate.

How do I get my MLO license in Maryland?

In order to become a licensed Mortgage Loan Originator in the state of Maryland, you'll need to complete the following steps. Step 1Request your personal NMLS account. Step 2Complete Your Maryland NMLS Pre-License Education. Step 3Pass the NMLS Mortgage licensing exam. Step 4Apply for your NMLS license.

What is the pass rate for the mortgage license exam?

What Happens If You Fail the NMLS Test? The national exam has a relatively low pass rate of 56%. If you're part of the 44% who don't pass on the first time, that's quite alright — the test is meant to be challenging and it's hardly a reason to give up on your future as a Loan Officer.

What percentage of people pass the NMLS test?

Passing the NMLS test is notoriously difficult. In fact, the first-time pass rate is just over half at 54% and just 46.7% for subsequent attempts, ing to the NMLS SAFE test passing rate. That is why it is important to study as much as possible before you take the test.

Is the mortgage license test hard?

The NMLS exam covers a wide range of mortgage laws, regulations, and industry practices, making it a difficult test to pass without proper preparation.

What not to say to a mortgage lender?

0:07 1:52 Process additionally avoid making statements about your intention to make large purchases. This mayMoreProcess additionally avoid making statements about your intention to make large purchases. This may signal financial instability to lenders refrain from discussing your credit score without evidence.

Why is the MLO test so hard?

There are three factors that tend to make the MLO Test difficult, including: To ensure compliance with the SAFE Act, the test developers designed the test to be challenging. Some test takers don't fully understand or apply the key concepts necessary to pass.

What disqualifies you from being a loan officer?

Personal MLO Requirements Submitting your fingerprints to the FBI and pass a criminal background check ( felonies committed in the past seven years or any financial crimes concerning forgery, fraud, bribery, etc., will disqualify you)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Maryland Mortgage Lender License Application Checklist?

The Maryland Mortgage Lender License Application Checklist is a comprehensive list of requirements and documents that applicants must submit to obtain a mortgage lender license in the state of Maryland.

Who is required to file Maryland Mortgage Lender License Application Checklist?

Any individual or business entity wishing to operate as a mortgage lender in Maryland must file the Maryland Mortgage Lender License Application Checklist.

How to fill out Maryland Mortgage Lender License Application Checklist?

To fill out the Maryland Mortgage Lender License Application Checklist, applicants must gather required documentation, complete the application form thoroughly, and ensure all information is accurate before submission.

What is the purpose of Maryland Mortgage Lender License Application Checklist?

The purpose of the Maryland Mortgage Lender License Application Checklist is to ensure applicants meet all regulatory requirements and to facilitate a thorough review process for licensing.

What information must be reported on Maryland Mortgage Lender License Application Checklist?

The Maryland Mortgage Lender License Application Checklist must report information such as the applicant's business structure, financial statements, business plan, and any relevant criminal or financial disclosures.

Fill out your maryland mortgage lender license online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland Mortgage Lender License is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.