Get the free Russell Choice of Fund Form

Show details

Este formulario permite a los empleados que son elegibles elegir el Russell Private Active Pension para recibir las contribuciones de su empleador. Es necesario completar todos los campos y presentarlo

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign russell choice of fund

Edit your russell choice of fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your russell choice of fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing russell choice of fund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit russell choice of fund. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

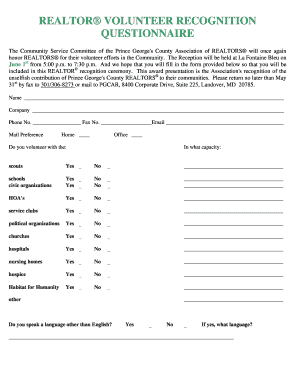

How to fill out russell choice of fund

How to fill out Russell Choice of Fund Form

01

Obtain the Russell Choice of Fund Form from your employer or plan administrator.

02

Read the instructions carefully to understand the fund options available.

03

Fill in your personal details at the top of the form, including your name, address, and account number.

04

Review the list of available funds and select your preferred investment options by marking the appropriate boxes or writing in the fund names.

05

Determine the percentage or dollar amount you wish to allocate to each fund, ensuring the total equals 100%.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to your employer or plan administrator as instructed.

Who needs Russell Choice of Fund Form?

01

Employees participating in a retirement plan that offers a choice of funds.

02

Individuals looking to diversify their investment options in a retirement savings account.

03

Newcomers enrolling in an employer-sponsored retirement plan.

Fill

form

: Try Risk Free

People Also Ask about

Is Russell Investments a good company?

Russell Investments has an employee rating of 3.5 out of 5 stars, based on 494 company reviews on Glassdoor which indicates that most employees have a good working experience there.

What is the difference between a trust and a master trust?

In constitution, a master trust pension is the same as any other trust-based pension scheme. The difference is that it is structured to look after pension savings sponsored by different employers, each with their own section within the master trust. Trustees are generally independent of the master trust provider.

What type of company is Russell Investments?

Since 1936, we have been an innovator in asset management and investment consulting, a pioneer of the multi-manager open platform model and a powerful voice in the retirement field. Every financial journey is different.

What is the Russell benefit payment direction form?

The Russell SuperSolution Benefit Payment Direction Form is a document used to request benefit payments from the Russell SuperSolution Fund. It outlines the procedures for transferring benefits to another superannuation fund, rolling over benefits, or withdrawing cash.

What is a choice of fund form?

Employees. Use this form to advise an employer of your choice of super fund. You must provide the required information so your employer can make contributions to your nominated super fund.

What is Russell Investments Master Trust?

Russell Investments Master Trust is a Public offer Retail fund. Learn more about MySuper funds and the different types of super funds. Russell Investments Master Trust ranks 34 in terms of total member benefits, which are valued at approximately $11.25 billion.

Is Russell Investments a super fund?

The compliance letter is to certify that the Russell Investments Master Trust is a complying resident regulated superannuation fund.

How do I contact Russell Investments super?

Russell Investments and Resource Super members can call 1800 555 667, Nationwide Super members call 1800 025 241, and Salaam Super members call 1300 926 626. No worries, reset your password at Russell Investments, Resource Super, Nationwide Super, and Salaam superannuation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Russell Choice of Fund Form?

The Russell Choice of Fund Form is a document used by individuals to select their investment options within a retirement plan or similar savings plan, specifically those managed by Russell Investments.

Who is required to file Russell Choice of Fund Form?

Individuals participating in retirement plans that offer a choice of investment funds managed by Russell Investments are typically required to fill out the Russell Choice of Fund Form to specify their investment preferences.

How to fill out Russell Choice of Fund Form?

To fill out the Russell Choice of Fund Form, individuals should provide their personal information, review the available investment options, select their preferred funds, and sign the form to confirm their choices.

What is the purpose of Russell Choice of Fund Form?

The purpose of the Russell Choice of Fund Form is to allow individuals to make informed decisions about their investment allocations within a retirement plan, ensuring that their choices align with their financial goals and risk tolerance.

What information must be reported on Russell Choice of Fund Form?

The information that must be reported on the Russell Choice of Fund Form includes personal identification details, the selected investment options, and any specific allocation percentages for each chosen fund.

Fill out your russell choice of fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Russell Choice Of Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.