Get the free 2012-112 - occ

Show details

This document outlines the agreement between LifeStore Bank and the Comptroller of the Currency to ensure the bank operates safely and soundly, complying with applicable laws and regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012-112 - occ

Edit your 2012-112 - occ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012-112 - occ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012-112 - occ online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2012-112 - occ. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012-112 - occ

How to fill out 2012-112

01

Start by downloading the 2012-112 form from the official website.

02

Carefully read the instructions provided at the top of the form.

03

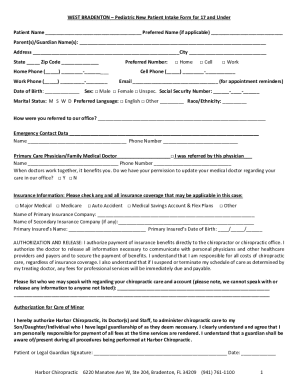

Fill out your personal information such as name, address, and Social Security number in the designated fields.

04

Provide detailed information regarding your income for the relevant tax year.

05

Report any deductions or credits you are eligible for in the appropriate sections.

06

Double-check all entered information for accuracy before submitting.

07

Sign and date the form at the bottom.

08

Submit the completed form to the indicated address or electronically if permitted.

Who needs 2012-112?

01

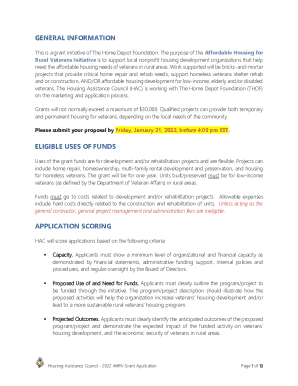

Individuals or businesses required to report specific income or deductions for tax purposes.

02

Taxpayers looking to claim certain credits or benefits related to tax filers from the year 2012.

03

Financial institutions or other entities that need to fulfill regulatory reporting requirements.

Fill

form

: Try Risk Free

People Also Ask about

Does 112 speak English in France?

With this number, non-French speakers will have no problem communicating their issues thanks to interpreters' assistance! The #112 interpreters will put the local French SAMU, fire brigade or police on the line and will provide a comprehensive explanation/interpretation either in your mother tongue or in English.

What's the difference between 112 and 911?

In many countries, dialing either 112 (used in Europe and parts of Asia, Africa and South America) or 911 (used mostly in the Americas) will connect callers to emergency services. For individual countries, see the list of emergency telephone numbers.

Does 112 speak English?

ing to the information provided by Member States to the European Commission, this is currently possible in 17 countries: 112 emergency call centres can normally handle English-language calls in 16 countries (Austria, Bulgaria, the Czech Republic, Denmark, Germany, Estonia, Finland, France, Greece, Hungary,

What happens if you call 112 in the USA?

In the United States and Canada, calling 911 for an emergency is always the best practice. Due to concerns, most places in the United States will “roll-over” 112 calls to 911, however, this is time-consuming and in an emergency every second counts.

Do they speak English at 112?

The operator will either deal with the request directly or transfer the call to the most appropriate emergency service depending on the national organisation of emergency services. Operators in many countries can answer the calls not only in their national language, but also in English or French.

Does 112 speak English?

ing to the information provided by Member States to the European Commission, this is currently possible in 17 countries: 112 emergency call centres can normally handle English-language calls in 16 countries (Austria, Bulgaria, the Czech Republic, Denmark, Germany, Estonia, Finland, France, Greece, Hungary,

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012-112?

2012-112 is a tax form used in the United States for reporting specific income and deductions for certain types of taxpayers.

Who is required to file 2012-112?

Individuals or entities that meet specific eligibility criteria set by the IRS, typically those with certain types of income or deductions.

How to fill out 2012-112?

To fill out 2012-112, gather all required financial documents, provide accurate information regarding income and deductions, and follow the instructions provided with the form.

What is the purpose of 2012-112?

The purpose of 2012-112 is to ensure that specific income and deductions are accurately reported for tax assessment and compliance.

What information must be reported on 2012-112?

Information that must be reported on 2012-112 includes total income, allowable deductions, and any relevant tax credits.

Fill out your 2012-112 - occ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012-112 - Occ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.