Get the free Appendix A: Letters of Credit - occ

Show details

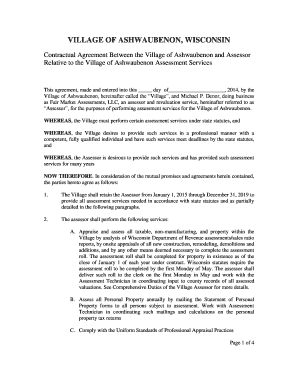

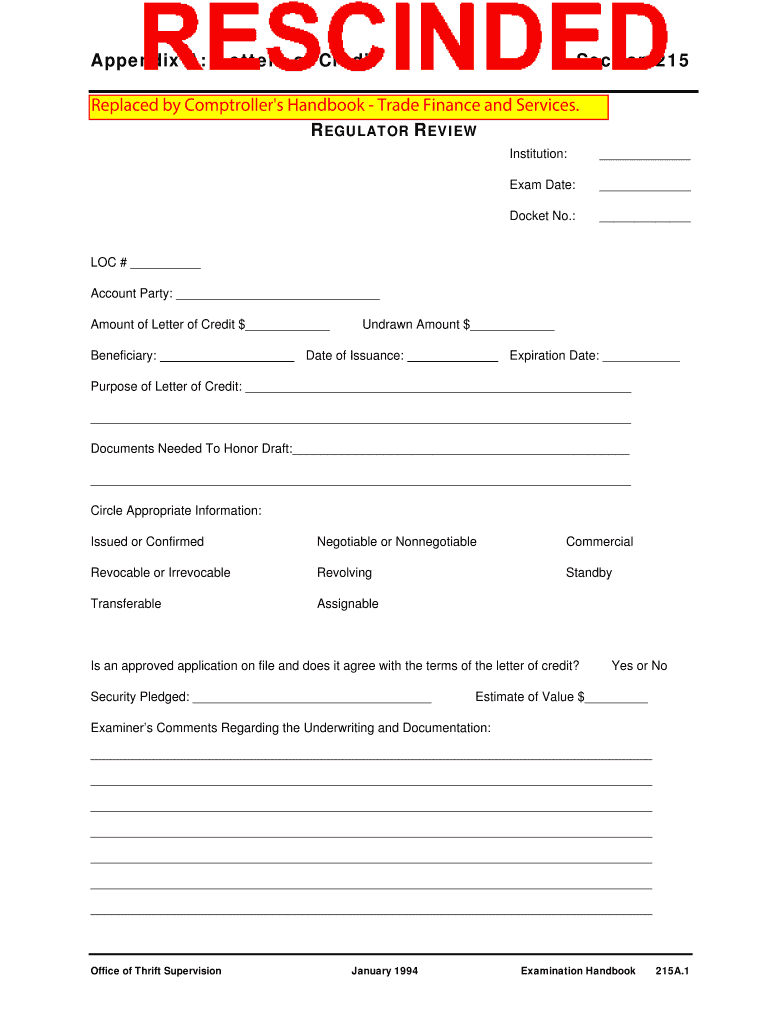

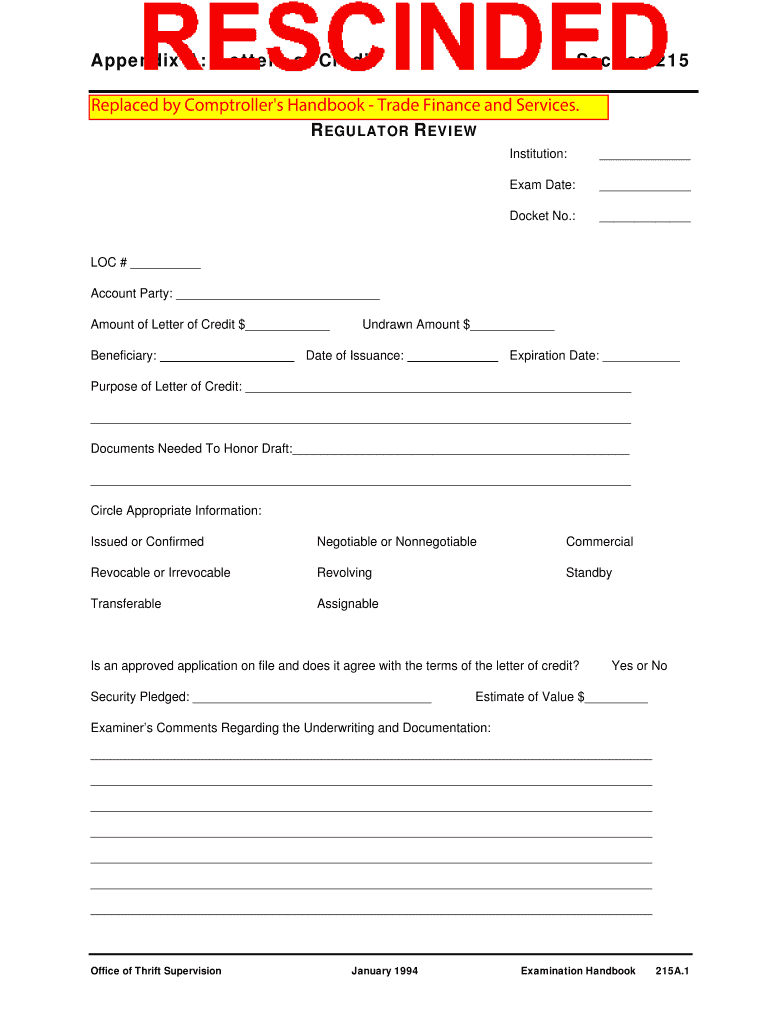

This document serves as a template for Letters of Credit used in trade finance, detailing essential information such as the account party, beneficiary, amounts, issuance and expiration dates, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appendix a letters of

Edit your appendix a letters of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appendix a letters of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit appendix a letters of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit appendix a letters of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out appendix a letters of

How to fill out Appendix A: Letters of Credit

01

Gather necessary information: Collect details about the transaction, involved parties, and specific requirements for the letter of credit.

02

Identify the applicant: Clearly state the name and address of the party requesting the letter of credit.

03

Define the beneficiary: Indicate the person or entity entitled to receive the letter of credit.

04

Specify the amount: Clearly outline the monetary amount covered by the letter of credit.

05

State the expiration date: Indicate the date by which the letter of credit must be utilized.

06

Describe the terms and conditions: Detail all necessary conditions that must be met for the letter of credit to be honored.

07

Include required documents: List all documents that need to be submitted to draw on the letter of credit.

08

Review legal requirements: Ensure compliance with any legal regulations pertaining to international trade and finance.

09

Sign and date the document: Provide space for authorized signatures and the date to validate the letter of credit.

Who needs Appendix A: Letters of Credit?

01

Businesses engaged in international trade who require secured payment methods.

02

Exporters needing assurance of payment from foreign buyers.

03

Financial institutions issuing letters of credit as part of trade financing services.

04

Importers wishing to provide a guarantee to foreign suppliers for their goods.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules of LC?

The LC will be confirmed by another bank with prior arrangement, only when it is advised to do so by the opening bank. Confirmation can be added only to irrevocable credits and not to revocable credits. When a bank acts as an advising bank, it has the only responsibility to verify the genuineness of the credit.

What is the difference between a letter of guarantee and a letter of credit?

A letter of credit is a financial instrument that a bank issues for a buyer (the bank client) guaranteeing that a seller will be paid. A banker's acceptance, on the other hand, guarantees that the bank will pay for a future transaction, rather than the individual account holder.

What is LC with an example?

A Letter of Credit (LC) is a financial instrument used in international trade to provide payment security. It guarantees that the seller will receive payment from the buyer, as long as the seller fulfils the agreed-upon terms and conditions.

What is an LC and how does it work?

A letter of credit is essentially a financial contract between a bank, a bank's customer and a beneficiary. Generally issued by an importer's bank, the letter of credit guarantees the beneficiary will be paid once the conditions of the letter of credit have been met.

What is the difference between LC and BG?

Unlike an LC, which ensures timely payment upon fulfilling specific terms and conditions, a BG serves as a safety net, covering financial losses due to non-payment of invoices. In such cases, the issuing bank becomes liable to make the whole payment to the seller or exporter.

What is the main difference between LC and BG?

Nature of guarantee: A bank guarantee provides a safety net for losses, whereas a letter of credit assures payment upon fulfilling specific conditions. Usage: Bank guarantees are often used in contracts as a performance safety, whereas letters of credit are primarily used in trade finance to ensure payment for goods.

What is the difference between LC and BC?

1. LC is one of the payment mode used in the International Trade between importer and exporter to cover third-party credit risk. Meaning if the importer defaults, his bank will have to pay on his behalf. Whereas, Buyers credit is a funding mechanism used by importer to funds his transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Appendix A: Letters of Credit?

Appendix A: Letters of Credit is a section in regulatory or financial documents that outlines the guidelines and requirements for issuing and managing letters of credit, which are financial instruments used to ensure payment between parties.

Who is required to file Appendix A: Letters of Credit?

Entities that issue letters of credit, such as banks and financial institutions, are generally required to file Appendix A: Letters of Credit as part of compliance with regulatory requirements.

How to fill out Appendix A: Letters of Credit?

To fill out Appendix A: Letters of Credit, one must provide specific details such as the identity of the issuer, beneficiary, terms of the letter, and any conditions that must be met for payment.

What is the purpose of Appendix A: Letters of Credit?

The purpose of Appendix A: Letters of Credit is to standardize the information provided about letters of credit to ensure transparency and compliance with financial regulations.

What information must be reported on Appendix A: Letters of Credit?

Information that must be reported on Appendix A: Letters of Credit includes the issuing bank's name, the beneficiary's details, the amount, the expiration date, and any terms and conditions related to the letter of credit.

Fill out your appendix a letters of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appendix A Letters Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.