Get the free Conversion of Bank or Credit Union to a Federal Charter

Show details

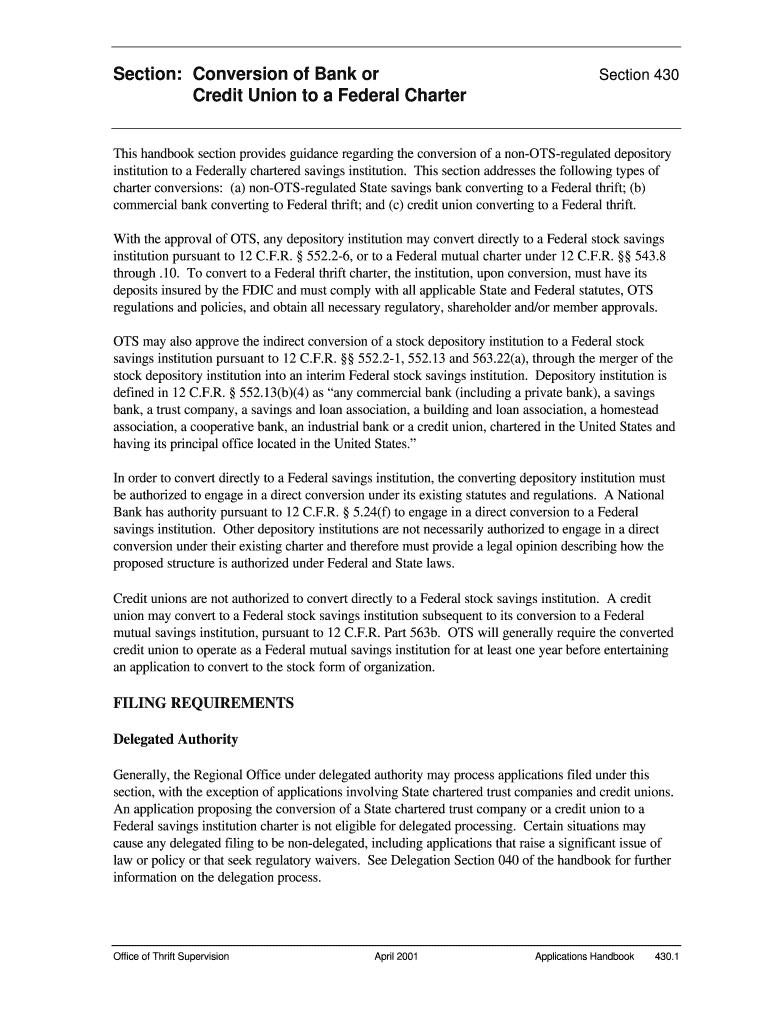

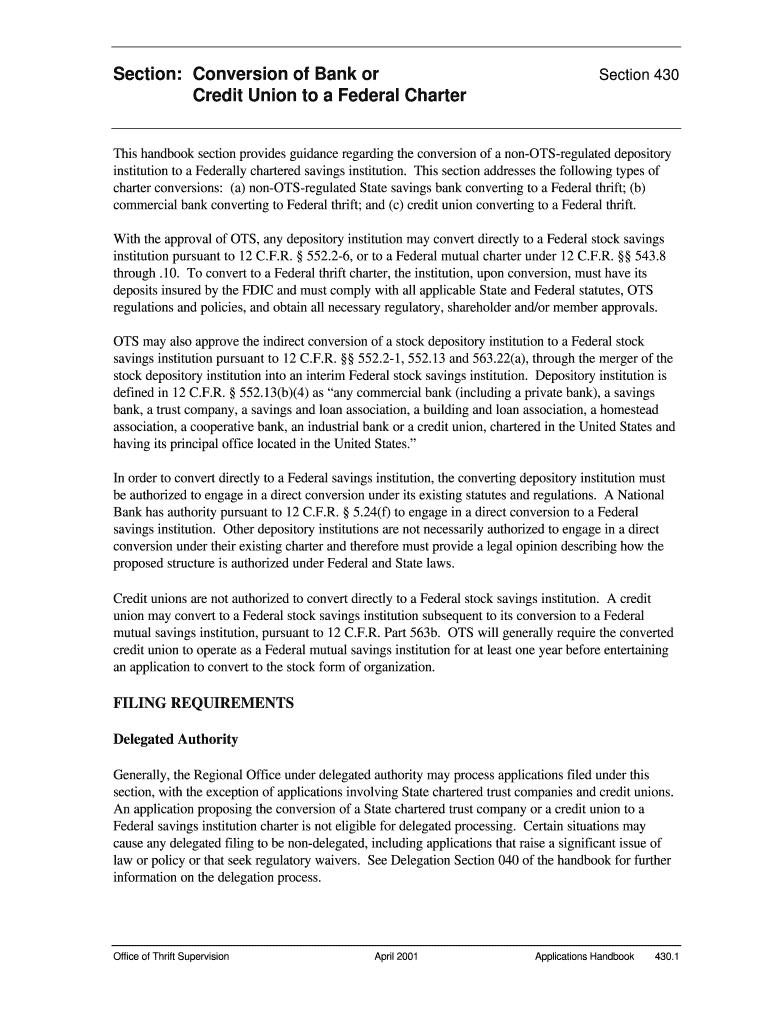

This document provides comprehensive guidance on the procedures and requirements for converting a non-OTS-regulated depository institution to a federally chartered savings institution, detailing charter

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conversion of bank or

Edit your conversion of bank or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conversion of bank or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing conversion of bank or online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit conversion of bank or. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conversion of bank or

How to fill out Conversion of Bank or Credit Union to a Federal Charter

01

Gather necessary documents such as bank financials, governance structure, and regulatory compliance records.

02

Consult with a legal expert in banking regulations to understand all requirements.

03

Prepare the formal application for conversion including all relevant details and disclosures.

04

Submit the application to the appropriate federal regulatory agency, such as the Office of the Comptroller of the Currency (OCC).

05

Await feedback or request for additional information from the regulatory agency.

06

Respond to any inquiries or requests for clarification promptly.

07

Attend any required hearings or meetings with regulatory officials.

08

Once approved, implement the necessary changes in governance and operations to comply with federal regulations.

Who needs Conversion of Bank or Credit Union to a Federal Charter?

01

State-chartered banks or credit unions seeking to operate under federal regulations.

02

Financial institutions wishing to expand their reach and services at the federal level.

03

Organizations looking to gain access to broader resources and regulatory benefits provided by federal charters.

04

Entities aiming to enhance their credibility and stability in the financial market.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a state chartered credit union and a federally chartered credit union?

The main difference is whether the permit to do business as a credit union was granted by the state government or the federal government. Whenever a new credit union is established, the organizers apply for either a state or national (federal) credit union charter.

What is a federal credit union charter?

A federally charted credit union has a charter from the federal government granting it the ability to operate. Federally charted credit unions follow federal regulations, sometimes more strict than state regulations.

How to tell if a credit union is federally chartered?

If your bank or lender is a credit union, find out if it is federally chartered or state chartered. To do so, find it in the National Credit Union Administration's Find Credit Unions web page and check the "Charter State" field. If that field says "N/A", the credit union is federally chartered.

What does it mean to be a federally chartered bank?

If your bank or lender is a credit union, find out if it is federally chartered or state chartered. To do so, find it in the National Credit Union Administration's Find Credit Unions web page and check the "Charter State" field. If that field says "N/A", the credit union is federally chartered.

How do I know if my credit union is federally chartered?

The main difference is whether the permit to do business as a credit union was granted by the state government or the federal government. Whenever a new credit union is established, the organizers apply for either a state or national (federal) credit union charter.

What's the difference between FDIC and NCUA?

A federal credit union (FCU) is a credit union that is chartered under the Federal Credit Union Act and governed by the National Credit Union Association (NCUA). The NCUA is a federal agency that was created in response to the Federal Credit Union Act of 1934.

What is a credit union charter?

Federally-chartered banks receive their charters from the federal government and are regulated by the OCC, or Office of the Comptroller of Currency.

Are credit unions federally chartered?

Federally Chartered Credit Unions: An Overview. In the United States, credit unions are divided into two categories: state-chartered and federally chartered. Though they share many characteristics, requirements, and purposes, the difference in charters impacts the regulation and titling of a given credit union.

How do you know if a credit union is federally insured?

Federally insured credit unions must prominently display the official NCUA insurance sign is shown at each teller station and where insured account deposits are normally received in its principal place of business and in any of its branches.

Can a credit union convert to a bank?

NCUA does not oppose a credit union's authority to convert to a savings bank or other non-credit union charter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

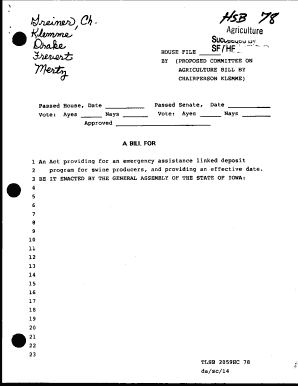

What is Conversion of Bank or Credit Union to a Federal Charter?

The conversion of a bank or credit union to a federal charter is the process by which a state-chartered bank or credit union changes its regulatory framework to operate under federal laws instead of state laws.

Who is required to file Conversion of Bank or Credit Union to a Federal Charter?

Any state-chartered bank or credit union that wishes to operate under a federal charter must file for conversion to a federal charter.

How to fill out Conversion of Bank or Credit Union to a Federal Charter?

To fill out the conversion application, the institution must complete the required federal application forms, provide necessary documentation, and submit the application to the relevant federal regulatory agency.

What is the purpose of Conversion of Bank or Credit Union to a Federal Charter?

The purpose of converting to a federal charter is to gain access to federal insurance for deposits, enhanced regulatory support, and broader operational flexibility under federal law.

What information must be reported on Conversion of Bank or Credit Union to a Federal Charter?

The information that must be reported includes details about the institution's current operations, governance structure, financial statements, proposed business plans, and compliance with federal regulations.

Fill out your conversion of bank or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conversion Of Bank Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.