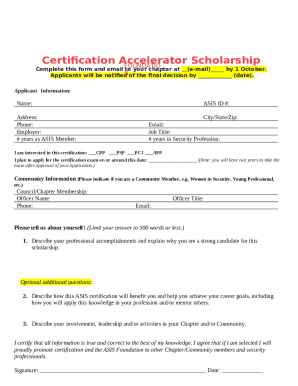

Get the free Meeting the Challenges of BSA/AML Risk Management: A Regulatory Perspective - occ

Show details

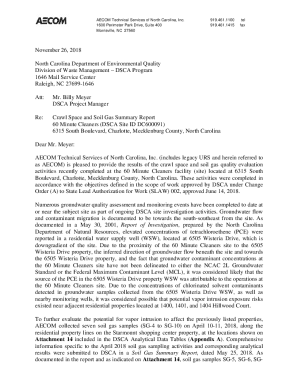

This document details a seminar presented by the Comptroller of the Currency focusing on BSA/AML risk management for national banks, including discussions on compliance, reporting requirements, enforcement,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign meeting form challenges of

Edit your meeting form challenges of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your meeting form challenges of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing meeting form challenges of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit meeting form challenges of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out meeting form challenges of

How to fill out Meeting the Challenges of BSA/AML Risk Management: A Regulatory Perspective

01

Begin by identifying and understanding the key components of BSA/AML risk management.

02

Gather relevant regulations and guidance documents related to BSA/AML compliance.

03

Review existing risk assessment procedures within your organization.

04

Engage with stakeholders to assess current challenges and areas for improvement in your BSA/AML program.

05

Create a plan to address identified challenges while adhering to regulatory expectations.

06

Document all procedures, policies, and risk assessments clearly for audit purposes.

07

Train staff on new guidelines and ensure they understand their roles in compliance.

08

Regularly review and update your BSA/AML risk management practices to adapt to regulatory changes.

Who needs Meeting the Challenges of BSA/AML Risk Management: A Regulatory Perspective?

01

Financial institutions including banks, credit unions, and money services businesses.

02

Compliance officers tasked with ensuring adherence to BSA/AML regulations.

03

Risk management professionals seeking to enhance their understanding of regulatory perspectives.

04

Auditors and regulators who require insights into BSA/AML compliance challenges.

05

Businesses involved in international transactions requiring strong compliance frameworks.

Fill

form

: Try Risk Free

People Also Ask about

What is the $3000 rule for BSA?

for cash of $3,000-$10,000, inclusive, to the same customer in a day, it must keep a record. more to the same customer in a day, regardless of the method of payment, it must keep a record. a record. The Bank Secrecy Act (BSA) was enacted by Congress in 1970 to fight money laundering and other financial crimes.

What is BSA guidelines?

Guidance Documents Our internationally respected BSA documents provide evidence-based guidance to clinicians. They follow a rigorous production process of authoring, internal review, expert peer review and public consultation.

What are the BSA regulations?

Specifically, the regulations implementing the BSA require financial institutions to, among other things, keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax

What are BSA AML regulations?

BSA-AML (Bank Secrecy Act/Anti-Money Laundering) Position Summary. BSA/AML regulations are designed to help identify the source, volume, and movement of currency and other monetary instruments.

What is the BSA AML regulation?

What is BSA/AML Risk Assessment? Step 1: Identify Your Risk Categories. Step 2: Analyze The Information Collected About The Risk Categories. Step 3: Identify Your ML/TF Controls. Step 3: Implement New or Enhanced Controls. Step 5: Create A Residual Risk Assessment Report.

What are the steps in the BSA AML risk based approach?

Factors to consider in AML risk scoring Customer risk factors. These are those factors related to the customer's profile that could increase the risk to the organization. Product and service risk factors. Risk factors related to delivery methods. Geographical risk factors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Meeting the Challenges of BSA/AML Risk Management: A Regulatory Perspective?

Meeting the Challenges of BSA/AML Risk Management: A Regulatory Perspective is a framework and guidance tool designed to help financial institutions comply with Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations. It outlines regulatory expectations and helps institutions assess and manage their risks related to money laundering and terrorist financing.

Who is required to file Meeting the Challenges of BSA/AML Risk Management: A Regulatory Perspective?

Financial institutions that are subject to BSA/AML regulations, including banks, credit unions, securities firms, and other entities involved in financial transactions, are required to implement the principles outlined in Meeting the Challenges of BSA/AML Risk Management.

How to fill out Meeting the Challenges of BSA/AML Risk Management: A Regulatory Perspective?

Filling out the Meeting the Challenges of BSA/AML Risk Management involves assessing the institution's risk profile, documenting existing measures against BSA/AML regulations, identifying areas for improvement, and detailing the action plan for compliance. Institutions must refer to the specific guidelines provided by regulators and ensure all relevant data is accurately reported.

What is the purpose of Meeting the Challenges of BSA/AML Risk Management: A Regulatory Perspective?

The purpose is to enhance the understanding of BSA/AML compliance requirements, improve risk assessment methodologies, and ensure that institutions develop effective controls to deter, detect, and report financial crimes related to money laundering and terrorist financing.

What information must be reported on Meeting the Challenges of BSA/AML Risk Management: A Regulatory Perspective?

Information that must be reported includes the institution's risk assessment outcomes, policies and procedures for BSA/AML compliance, training programs for staff, and details of any identified weaknesses or areas that require improvement in the institution's risk management framework.

Fill out your meeting form challenges of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Meeting Form Challenges Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.