Get the free Life Events and Your Retirement and Insurance Benefits (For Annuitants) - opm

Show details

This document provides information for annuitants under the Civil Service Retirement System (CSRS) and the Federal Employees Retirement System (FERS) regarding life events that may affect their retirement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life events and your

Edit your life events and your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life events and your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life events and your online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit life events and your. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life events and your

How to fill out Life Events and Your Retirement and Insurance Benefits (For Annuitants)

01

Gather necessary documents related to your retirement and insurance benefits.

02

Identify your life events such as marriage, divorce, the birth of a child, or death of a spouse.

03

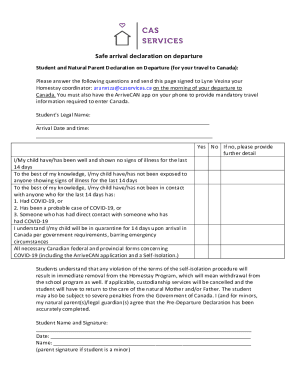

Access the Life Events form and read the instructions carefully.

04

Fill out your personal information, including your name, address, and Social Security number.

05

List the relevant life events that have occurred since your retirement.

06

Provide any required documentation to support the life events reported.

07

Review all the information for accuracy.

08

Submit the completed form as instructed, either online or via mail.

Who needs Life Events and Your Retirement and Insurance Benefits (For Annuitants)?

01

Retirees who have received an annuity from a retirement system.

02

Individuals who have experienced significant life changes affecting their benefits.

03

Family members or beneficiaries dealing with changes in status related to annuity and insurance benefits.

Fill

form

: Try Risk Free

People Also Ask about

What happens to the OPM annuity after death?

If a retiree dies, a lump-sum benefit equal to the annuity due the deceased but not paid before death may be payable. If no survivor annuity is payable based on the retiree's death, the balance of any retirement deductions remaining to the deceased retiree's credit in the Fund, plus any applicable interest, is payable.

What is the 5 year coverage rule for FEHB and FEGLI?

Under FERS, an employee who meets one of the following age and service requirements is entitled to an immediate retirement benefit: age 62 with five years of service, 60 with 20, minimum retirement age (MRA) with 30 or MRA with 10 (but with reduced benefits).

What is a retiree life insurance benefit?

Retiree life insurance is an option that enables you to obtain similar Group Life Insurance coverage after you terminate your current employment. Under the Retiree Life Insurance, the terms and conditions may differ from your employer's group coverage. Some of these differences are highlighted below.

What is the 5 year rule for OPM?

You need to be enrolled in FEHB for five years before you retire, or for the entire time for which you were eligible to be enrolled, and retire on an immediate annuity to be eligible to continue coverage into retirement.

Do retired annuitants pay Social Security?

Rehired annuitants not in positions covered by a Section 218 Agreement are excluded from mandatory Social Security coverage under FICA. However, all retirees hired after March 31, 1986, are covered for Medicare.

Can I retire after 5 years of federal service if I?

You need to be enrolled in FEHB for five years before you retire, or for the entire time for which you were eligible to be enrolled, and retire on an immediate annuity to be eligible to continue coverage into retirement.

What is the 5 year rule for federal employees?

As a rule, you can only continue your FEHB and/or FEGLI coverage into retirement if you are 1) currently enrolled, 2) have been enrolled for at least five years or from your earliest opportunity to enroll, and 3) are retiring on an immediate annuity (including disability).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Life Events and Your Retirement and Insurance Benefits (For Annuitants)?

Life Events and Your Retirement and Insurance Benefits provides information regarding how personal life changes affect retirement and insurance benefits for individuals who are annuitants.

Who is required to file Life Events and Your Retirement and Insurance Benefits (For Annuitants)?

Annuitants who experience significant life changes such as marriage, divorce, death of a spouse, or other qualifying events are required to file Life Events and Your Retirement and Insurance Benefits.

How to fill out Life Events and Your Retirement and Insurance Benefits (For Annuitants)?

To fill out the form, you should gather relevant documentation related to your life event, complete all required fields accurately, and submit the form to the appropriate benefits office.

What is the purpose of Life Events and Your Retirement and Insurance Benefits (For Annuitants)?

The purpose is to ensure that annuitants' retirement and insurance benefits are updated to reflect any changes in their personal circumstances that could affect their eligibility or the extent of their benefits.

What information must be reported on Life Events and Your Retirement and Insurance Benefits (For Annuitants)?

Information that must be reported includes details of the life event, personal identification information, specific changes in beneficiary designations, and any required supporting documentation.

Fill out your life events and your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Events And Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.