Get the free Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation - edgar sec

Show details

This document confirms the terms and conditions of a Swap Transaction between ABN AMRO Bank N.V. and Deutsche Bank National Trust Company as Trustee for the Long Beach Mortgage Loan Supplemental Interest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long beach mortgage loan

Edit your long beach mortgage loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long beach mortgage loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit long beach mortgage loan online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit long beach mortgage loan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

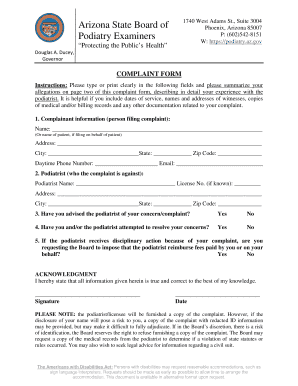

How to fill out long beach mortgage loan

How to fill out Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation

01

Begin by gathering all necessary documents related to your mortgage loan.

02

Download the Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation form from the official website or obtain it from your lender.

03

Fill out your personal identification information at the top of the form, including your name, address, and contact details.

04

Provide the loan details, including the loan number, origination date, and any other relevant information requested on the form.

05

Indicate your income and employment details as required.

06

Review the form for accuracy and completeness.

07

Sign and date the confirmation to validate the information provided.

08

Submit the completed form to the specified address or through the indicated submission method.

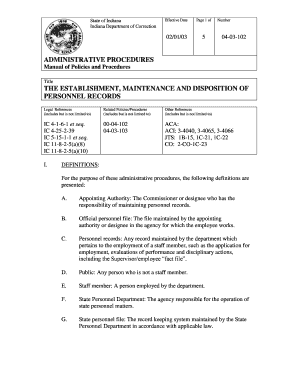

Who needs Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation?

01

Homeowners who have a mortgage loan with Long Beach Mortgage.

02

Investors involved with the Long Beach Mortgage Loan Supplemental Interest Trust.

03

Financial institutions requiring confirmation of loan details for auditing purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the home loan toolkit booklet?

Buying a home is exciting and, let's face it, complicated. This booklet provides "step-by-step" instructions to help you make wise choices along your path to owning a home. Sold in packages of 100.

What Federal Home Loan mortgage Corporation introduced the first security backed by conventional loans in 1971?

28 In 1971, Freddie Mac issued the first conventional loan MBS. Interest Rate Risk: The exposure of an institution's financial condition to adverse movements in interest rates.

What is the term of my mortgage?

The mortgage term is the time your mortgage contract is in effect. Terms may range from a few months to 5 years or more. At the end of each term, you'll need to renew your mortgage. You'll likely need multiple terms to repay your mortgage.

How do I verify a mortgage loan officer?

Verify Licensing: The first step in your research should be to check the licensing of your mortgage loan officer. In the United States, loan officers must be registered with the Nationwide Multistate Licensing System & Registry (NMLS).

Which law requires that the special information booklet be given to borrowers?

12 CFR § 1024.6 - Special information booklet at time of loan application. Electronic Code of Federal Regulations (e-CFR) | US Law | LII / Legal Information Institute.

Where do I find the terms of my mortgage?

If you need to obtain a copy of your mortgage agreement, you will need to do so at the office where the mortgage is filed.

What is the booklet required to be given to borrowers who are contemplating an adjustable rate loan?

ARM Handbook: The Consumer Handbook to Adjustable-Rate Mortgages ("CHARM"; booklet) must be presented to the consumer within three days of applying for an ARM loan (in addition to the ARM disclosure referenced above).

What is the current name of the special information booklet that mortgage lenders are obligated to deliver to would be borrowers?

The RESPA-required Special Information Booklet, Your Home Loan Toolkit, is published by the: - Local state banking regulatory agency.

Where can I find my mortgage agreement?

Where can I obtain a copy of my Mortgage Agreement? If you need to obtain a copy of your mortgage agreement, you will need to do so at the office where the mortgage is filed.

What is the name of the special information booklet required by RESPA?

“Your Home Loan Toolkit” is a resource we revised to help make the mortgage process more understandable. Congress required us to revise an existing booklet, called the Settlement Costs Booklet or the Special Information Booklet, to include some additional information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation?

The Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation is a document that confirms the details of mortgage-backed securities associated with this specific trust. It includes information about the security's interest payments and details about the underlying mortgage loans.

Who is required to file Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation?

The parties involved in the issuance and management of the mortgage-backed securities, including the trust administrator, servicers, and financial institutions involved with the trust, are required to file the Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation.

How to fill out Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation?

To fill out the Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation, you should enter the relevant details such as the trust's name, loan information, payment amounts, interest rates, and any other required financial data as per the guidelines provided by the overseeing regulatory body.

What is the purpose of Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation?

The purpose of the Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation is to provide transparency and assurance to investors and regulatory bodies regarding the mortgage-backed securities, detailing the financial performance and operational status of the underlying loans.

What information must be reported on Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation?

The information that must be reported on the Long Beach Mortgage Loan Supplemental Interest Trust 2006-5 Confirmation includes loan identifiers, interest payment amounts, applicable interest rates, payment dates, and any changes in loan status such as delinquencies or defaults.

Fill out your long beach mortgage loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Beach Mortgage Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.