Get the free Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation - sec

Show details

This document is a confirmation agreement detailing the terms and conditions of a swap transaction between Wachovia Bank, N.A. and Deutsche Bank National Trust Company on behalf of the Long Beach

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long beach mortgage loan

Edit your long beach mortgage loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long beach mortgage loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long beach mortgage loan online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit long beach mortgage loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long beach mortgage loan

How to fill out Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation

01

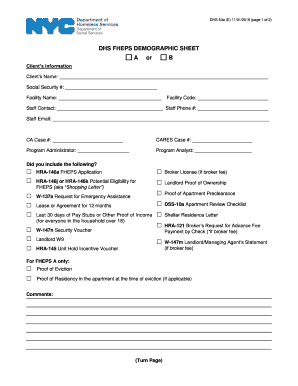

Obtain the Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation form.

02

Fill in the date at the top of the form.

03

Enter your loan number accurately.

04

Provide accurate information about the borrower(s), including name(s) and address(es).

05

Fill in the details of the property associated with the loan, including the address.

06

Specify the interest rates and terms of the mortgage loan.

07

Review all the filled information for accuracy.

08

Sign and date the form at the designated areas.

09

Submit the completed form to the appropriate department or office as instructed.

Who needs Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation?

01

Individuals or entities involved in mortgage transactions that fall under the Long Beach Mortgage Loan Supplemental Interest Trust 2006-7.

02

Borrowers seeking to confirm the details of their mortgage loan.

03

Lenders and financial institutions that require verification of mortgage loan terms.

Fill

form

: Try Risk Free

People Also Ask about

Is Ginnie Mae vs Freddie Mac vs Fannie Mae?

To combat this, in 1970, Ginnie Mae developed the very first mortgage-backed security (MBS), which allowed for many loans to be pooled and used as collateral in a security that could be sold in the secondary market.

How do I verify a mortgage loan officer?

Verify Licensing: The first step in your research should be to check the licensing of your mortgage loan officer. In the United States, loan officers must be registered with the Nationwide Multistate Licensing System & Registry (NMLS).

Who introduced the first security backed by conventional loans in 1971?

28 In 1971, Freddie Mac issued the first conventional loan MBS. Interest Rate Risk: The exposure of an institution's financial condition to adverse movements in interest rates. government owned the preferred stock, and the investors held the non-voting common stock.

What Federal Home Loan mortgage Corporation introduced the first security backed by conventional loans in 1971?

28 In 1971, Freddie Mac issued the first conventional loan MBS. Interest Rate Risk: The exposure of an institution's financial condition to adverse movements in interest rates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

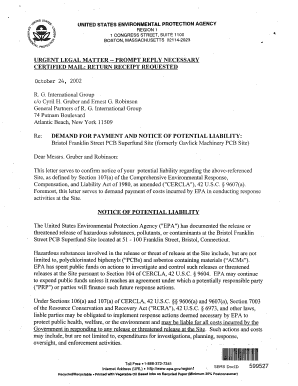

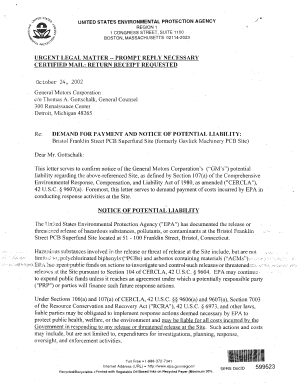

What is Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation?

Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation is a financial document that confirms the details of mortgage-backed securities and their associated interest payments within a specific trust established in 2006.

Who is required to file Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation?

Entities involved in the management and servicing of the mortgage-backed securities within the Long Beach Mortgage Loan Supplemental Interest Trust 2006-7, including trustees and servicers, are typically required to file this confirmation.

How to fill out Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation?

To fill out the Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation, one must provide details such as trust identification, the date of confirmation, interest payment amounts, and any relevant loan information as specified in the form's guidelines.

What is the purpose of Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation?

The purpose of the Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation is to officially document and verify the interest payments to investors and to ensure accurate reporting of the trust's financial performance.

What information must be reported on Long Beach Mortgage Loan Supplemental Interest Trust 2006-7 Confirmation?

Information that must be reported includes the trust name, loan identifiers, interest payment amounts, payment dates, and any changes or discrepancies related to the mortgage loans held in the trust.

Fill out your long beach mortgage loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Beach Mortgage Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.