Get the free Form of Stock Option and Restricted Stock Agreement - sec

Show details

This document outlines the grant of restricted stock and non-qualified stock options, detailing the terms, conditions, vesting, and exercise rights associated with the granted stock and options.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form of stock option

Edit your form of stock option form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form of stock option form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form of stock option online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form of stock option. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form of stock option

How to fill out Form of Stock Option and Restricted Stock Agreement

01

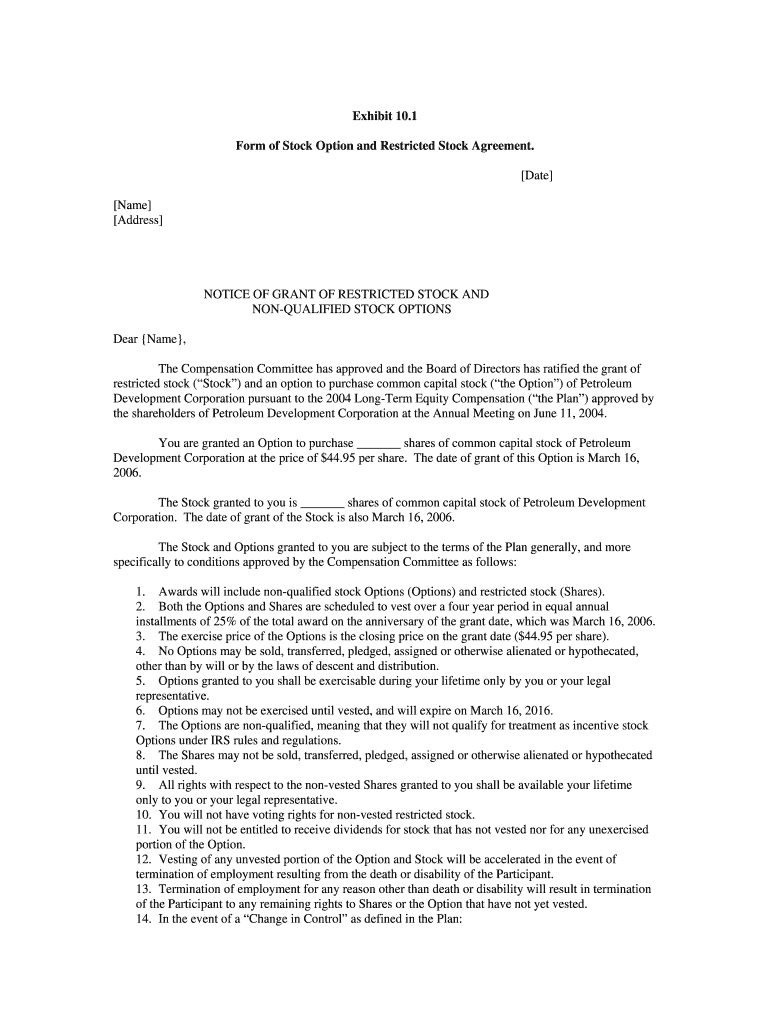

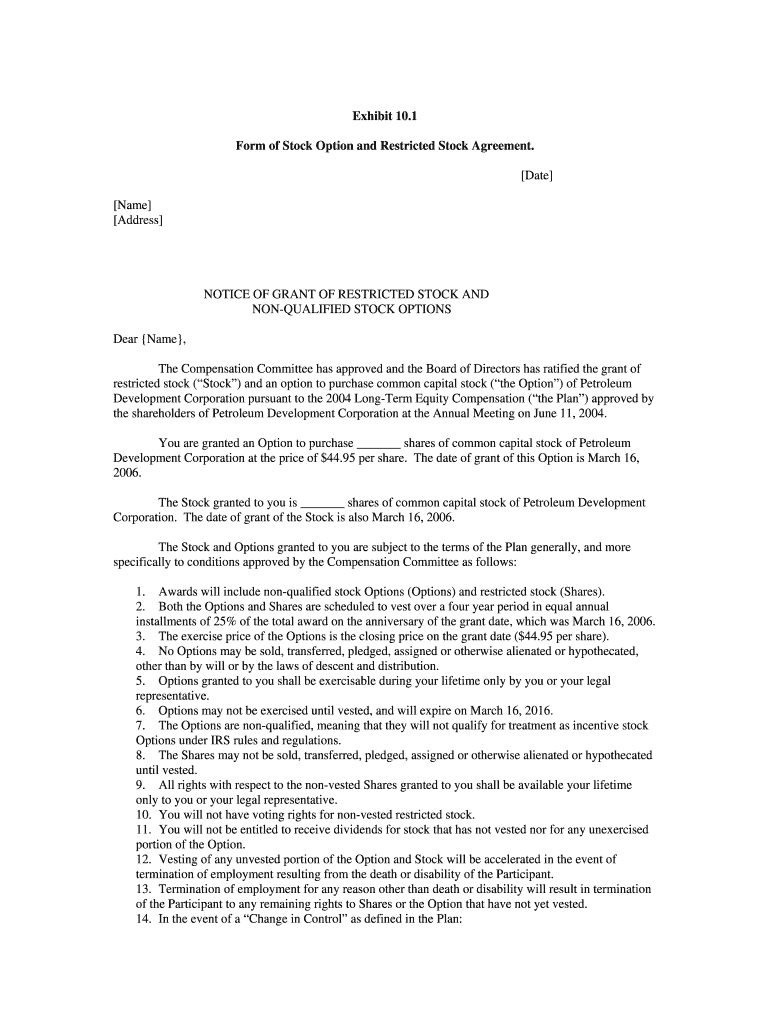

Begin by entering your name and address at the top of the form.

02

Specify the type of agreement (Stock Option or Restricted Stock) you are filling out.

03

Fill in the date of the agreement.

04

Indicate the number of shares being offered in the stock option or restricted stock.

05

Include the exercise price per share (for stock options).

06

Specify the vesting schedule for the shares.

07

Outline the terms and conditions of the agreement, including any performance milestones.

08

Sign and date the agreement at the bottom.

09

Provide a witness signature if required by your company policies.

10

Make a copy for your records before submitting it to your employer.

Who needs Form of Stock Option and Restricted Stock Agreement?

01

Employees of companies offering stock options or restricted stock as part of their compensation package.

02

Executive-level staff who are being incentivized with equity.

03

Investors looking to understand their rights and obligations regarding stock options or restricted stock.

04

HR professionals managing employee compensation and equity agreements.

Fill

form

: Try Risk Free

People Also Ask about

Why do companies switch from options to RSUs?

Comments Section RSUs tend to have a multi-year vesting schedule. So the firm gets benefits of having the compensation being deferred. Probably the biggest benefit is that it increases switching costs for the employee, reducing the incentive to switch firms for a better salary.

What is a stock restriction agreement?

A form of restricted stock unit (RSU) agreement to be used to grant stock-settled RSUs to non-employee directors under an RSU or other equity incentive plan. This Standard Document has integrated drafting notes with important explanations and drafting tips.

What is the difference between a stock option and a restricted stock?

Stock Restriction Agreements restrict the stockholder's right to sell, transfer, pledge, convert or assign all or some of its shares. Generally, the shareholder is not permitted to transfer any shares except with permission by the company.

Should I sell RSU or options first?

A rule of thumb - if the company is growing, go for options, if revenues/profits are declining go for rsus.

What is better, restricted stock or options?

Options provide huge upside and help attract risk-taking employees looking to share in big rewards. RSUs reduce risk and are better for retention since they have immediate value. The choice depends on if you want employees betting on the company's success or sticking around for the long haul.

What is a form of restricted stock unit?

A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.

What are the disadvantages of restricted stock?

Some potential disadvantages to restricted stock include the following: Unless a recipient elects early taxation through an 83(b) election, the value of the shares when the restrictions lapse is taxed as ordinary income, rather than as a capital gain. Early taxation does not protect the shares from forfeiture.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form of Stock Option and Restricted Stock Agreement?

The Form of Stock Option and Restricted Stock Agreement is a legal document that outlines the terms and conditions under which stock options and restricted stock are granted to employees or directors as part of their compensation.

Who is required to file Form of Stock Option and Restricted Stock Agreement?

Companies that grant stock options or restricted stock to their employees or executives are typically required to file this form with relevant regulatory agencies, such as the SEC in the United States.

How to fill out Form of Stock Option and Restricted Stock Agreement?

To fill out the form, one must provide detailed information regarding the terms of the stock option or restricted stock grant, including the number of shares, exercise price, vesting schedule, and any performance conditions.

What is the purpose of Form of Stock Option and Restricted Stock Agreement?

The purpose of the form is to ensure transparency and compliance with securities regulations, to document the rights and obligations of both the grantor and the grantee, and to establish clear guidelines for the grant of stock options and restricted stock.

What information must be reported on Form of Stock Option and Restricted Stock Agreement?

The form must report information such as the names of the parties involved, the type and number of shares granted, the exercise price, the vesting schedule, the expiration date of the options, and any performance criteria associated with the grants.

Fill out your form of stock option online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Of Stock Option is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.