Get the free Response to No-Action Request Regarding Shareholder Proposal - sec

Show details

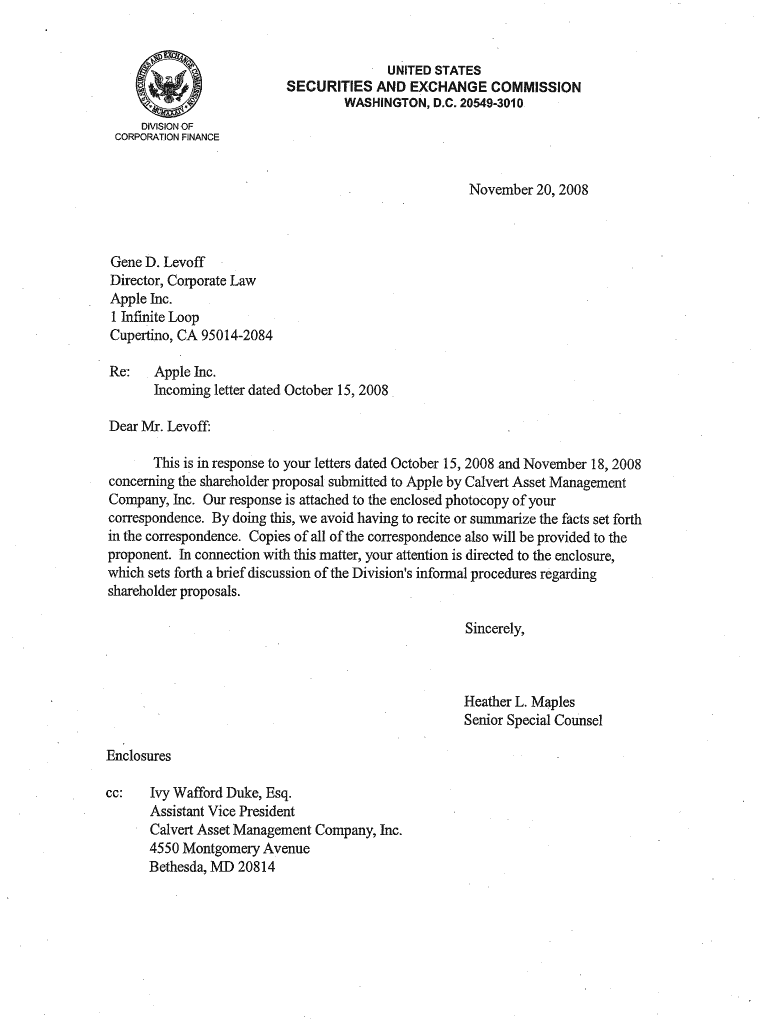

This document is a response from the Securities and Exchange Commission regarding a shareholder proposal submitted to Apple Inc. The proposal requests the company to prepare a sustainability report

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign response to no-action request

Edit your response to no-action request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your response to no-action request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit response to no-action request online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit response to no-action request. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out response to no-action request

How to fill out Response to No-Action Request Regarding Shareholder Proposal

01

Begin by reviewing the shareholder proposal in question.

02

Gather all relevant documentation related to the proposal.

03

Identify the regulatory framework that governs no-action requests.

04

Draft a clear and concise summary of the reasons for the no-action request.

05

Provide supporting arguments and evidence to justify the request.

06

Include a statement addressing the specific regulatory citations.

07

Format the response according to the required guidelines (e.g., length, structure).

08

Review the response for clarity and completeness.

09

Submit the response to the appropriate regulatory body within the designated timeframe.

Who needs Response to No-Action Request Regarding Shareholder Proposal?

01

Companies facing shareholder proposals that believe the proposal does not comply with regulatory requirements.

02

Corporate legal teams seeking to protect the company's interests.

03

Shareholders wanting to understand the rationale behind a no-action request.

Fill

form

: Try Risk Free

People Also Ask about

What is the right to cure shareholder proposal?

Right to Cure proposals focus on the need of shareholders to be timely noticed of defects contained in a notice of nomination, allowing them to cure such defects before proxies are distributed.

What is the rule 14a-8 no action request?

Since 1947, no-action letters under Securities and Exchange Commission (SEC) Rule 14a-8 have allowed SEC staff members to regulate shareholder voice upon management's request, acting as intermediaries between shareholders and management on matters related to shareholder proposals.

Can shareholder proposals hurt shareholders evidence from securities and Exchange Commission no action letter decisions?

Taken together, the evidence suggests that managers may be serving shareholder interests in opposing some proposals and that the no-action-letter process may be helping shareholders by weeding out value-reducing proposals.

What is the rule of three no-action letter?

This no-action letter has given rise to what practitioners refer to as the “rule of three,” which provides that, where voting and investment decisions regarding an entity's portfolio are made by three or more persons and a majority of those persons must agree with respect to voting and investment decisions, then none

What is the SEC no action process?

Most no-action letters describe the request, analyze the particular facts and circumstances involved, discuss applicable laws and rules, and, if the staff grants the request for no action, concludes that the SEC staff would not recommend that the Commission take enforcement action against the requester based on the

What is the no-action letter process?

Through the No-Action Letter (NAL) process, established by Commission order on November 18, 2005, persons may obtain written advice as to whether staff would recommend that the Commission take no enforcement action with respect to specific proposed transactions, practices, or situations.

What is the SEC no-action rule?

An individual or entity who is not certain whether a particular product, service, or action would constitute a violation of the federal securities laws may request a "no-action" letter from the SEC staff.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Response to No-Action Request Regarding Shareholder Proposal?

A Response to No-Action Request Regarding Shareholder Proposal is a document submitted by a company to the Securities and Exchange Commission (SEC) in which it outlines its arguments against including a particular shareholder proposal in its proxy materials. The company seeks assurance that the SEC will not take enforcement action if the proposal is omitted.

Who is required to file Response to No-Action Request Regarding Shareholder Proposal?

Typically, the company that is being targeted by the shareholder proposal is required to file the Response to No-Action Request. This includes publicly traded companies that receive proposals from shareholders.

How to fill out Response to No-Action Request Regarding Shareholder Proposal?

To fill out a Response to No-Action Request, the company should clearly articulate the reasons for the request, provide relevant facts, cite applicable regulations or precedents, and submit the completed document to the SEC according to the required guidelines, including any necessary supporting documentation.

What is the purpose of Response to No-Action Request Regarding Shareholder Proposal?

The purpose of a Response to No-Action Request is to seek SEC guidance on whether the company can exclude a shareholder proposal from its proxy statement. This helps companies ensure compliance with SEC rules and avoid potential legal issues related to shareholder proposals.

What information must be reported on Response to No-Action Request Regarding Shareholder Proposal?

The Response must report the company's arguments for excluding the proposal, any legal bases for the exclusion, descriptions of the proposal, the names of the proponent(s), and any supporting materials or evidence that validate the company’s stance.

Fill out your response to no-action request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Response To No-Action Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.