Get the free Morgan Stanley Waiver Request of Ineligible Issuer Status - sec

Show details

This document is a response from the Securities and Exchange Commission regarding a waiver request made by Morgan Stanley Investment Management related to ineligible issuer status under the Securities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign morgan stanley waiver request

Edit your morgan stanley waiver request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your morgan stanley waiver request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit morgan stanley waiver request online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit morgan stanley waiver request. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

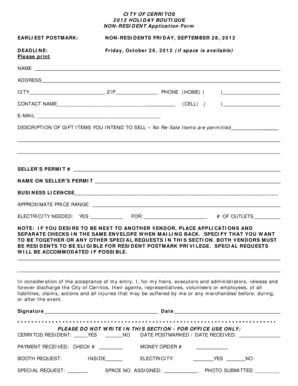

How to fill out morgan stanley waiver request

How to fill out Morgan Stanley Waiver Request of Ineligible Issuer Status

01

Obtain the Morgan Stanley Waiver Request form from the official website or designated department.

02

Carefully read the instructions provided on the form.

03

Fill out your personal details, such as name, address, and contact information.

04

Provide details about the issuer that is ineligible, including their name and reason for ineligibility.

05

Clearly explain the rationale for requesting the waiver, including any supporting evidence or documentation.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form according to the provided submission guidelines, either electronically or by mail.

Who needs Morgan Stanley Waiver Request of Ineligible Issuer Status?

01

Entities or individuals seeking to conduct transactions or investments related to an issuer that is currently considered ineligible by Morgan Stanley.

02

Investment managers or advisors who wish to request exceptions for specific issuers to facilitate investment processes.

03

Clients who have specific circumstances that warrant a waiver for an ineligible issuer status.

Fill

form

: Try Risk Free

People Also Ask about

Who is an ineligible issuer under the Securities Act?

In order to qualify as a WKSI, an issuer may not be an “ineligible issuer.” Rule 405 of the Securities Act defines an “ineligible issuer” to be, among other things, an issuer that has been convicted of a felony or misdemeanor specified in certain enumerated provisions under Section 15 of the Exchange Act or an issuer

Who is considered an issuer?

An issuer is a legal entity that develops, registers and sells securities to finance its operations. Issuers may be corporations, investment trusts, or domestic or foreign governments. Issuers make available securities such as equity shares, bonds, and warrants.

What was Morgan Stanley accused of doing?

Morgan Stanley Faces $24M Lawsuit Over Alleged Recruiting Misrepresentation. A Los Angeles-based Morgan Stanley broker, Rodney Dean Halvorson, has filed a lawsuit against the firm, seeking at least $24 million in damages.

What is the Morgan Stanley controversy?

In November 2019, Morgan Stanley fired or placed on leave four traders for suspected securities mismarking. The firm suspected that $100–140 million in losses were concealed by the mismarking of the value of the securities.

What is an ineligible issuer?

Pursuant to Rule 405 under the Securities Act, an issuer will be an ineligible issuer if it (or its subsidiary) has been convicted of specified felo- nies or misdemeanors under Section 15 of the Securities Exchange Act of 1934, or has violated the anti-fraud provisions of the federal securities laws.

What is the difference between issuer and non-issuer?

Issuer: Public companies that issue securities and file with the SEC. Non-issuer: Private companies that don't issue securities or file with the SEC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Morgan Stanley Waiver Request of Ineligible Issuer Status?

The Morgan Stanley Waiver Request of Ineligible Issuer Status is a formal request submitted to obtain a waiver that allows an issuer, which does not meet specific eligibility criteria, to participate in offerings under certain regulations.

Who is required to file Morgan Stanley Waiver Request of Ineligible Issuer Status?

Issuers that do not meet the eligibility requirements to register securities offerings under specific regulatory frameworks are required to file the Morgan Stanley Waiver Request of Ineligible Issuer Status.

How to fill out Morgan Stanley Waiver Request of Ineligible Issuer Status?

To fill out the Morgan Stanley Waiver Request, the issuer must complete the provided forms accurately, providing all necessary information about their financials, compliance status, and the reasons for the waiver request.

What is the purpose of Morgan Stanley Waiver Request of Ineligible Issuer Status?

The purpose of the Morgan Stanley Waiver Request is to seek approval for a waiver from the regulatory requirements that prevent an issuer from participating in securities offerings, thus allowing access to capital markets.

What information must be reported on Morgan Stanley Waiver Request of Ineligible Issuer Status?

The information required includes details about the issuer’s financial condition, compliance history, specific eligibility criteria being addressed, and the rationale for the waiver request.

Fill out your morgan stanley waiver request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Morgan Stanley Waiver Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.