Get the free Order Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order P...

Show details

This document includes a ruling by the SEC against Scott E. DeSano related to violations of the Investment Advisers Act and the Investment Company Act, detailing findings, sanctions, and required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign order making findings and

Edit your order making findings and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your order making findings and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

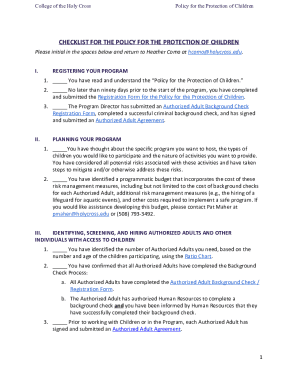

Editing order making findings and online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit order making findings and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out order making findings and

How to fill out Order Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order Pursuant to Sections 203(f) and 203(k) of the Investment Advisers Act of 1940 and Sections 9(b) and 9(f) of the Investment Company Act of 1940 as to Scott E. DeSano

01

Gather all relevant documents and evidence related to the case against Scott E. DeSano.

02

Review Sections 203(f) and 203(k) of the Investment Advisers Act of 1940 and Sections 9(b) and 9(f) of the Investment Company Act of 1940 to understand the legal framework.

03

Draft the Order Making Findings, clearly stating the violations committed by Scott E. DeSano.

04

Outline the proposed remedial sanctions, ensuring they are appropriate and proportionate to the violations.

05

Include the terms of the Cease-and-Desist Order, specifying the actions Scott E. DeSano must refrain from.

06

Ensure all findings and legal citations are clearly presented and supported by the evidence.

07

Review the document for accuracy and compliance with statutory requirements.

08

Submit the completed Order to the appropriate regulatory body for review and enforcement.

Who needs Order Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order Pursuant to Sections 203(f) and 203(k) of the Investment Advisers Act of 1940 and Sections 9(b) and 9(f) of the Investment Company Act of 1940 as to Scott E. DeSano?

01

Regulatory bodies overseeing investment advisers and companies.

02

Legal professionals involved in securities law and regulatory compliance.

03

Investors and stakeholders affected by Scott E. DeSano's actions.

Fill

form

: Try Risk Free

People Also Ask about

What is section 203 of the Investment Advisers Act?

Section 203. (a) Except as provided in subsection (b) and Section 203A, it shall be unlawful for any investment adviser, unless registered under this section, to make use of the mails or any means or instrumentality of interstate commerce in connection with his or its business as an investment adviser.

What is Section 203 of the Investment Advisers Act?

Section 203. (a) Except as provided in subsection (b) and Section 203A, it shall be unlawful for any investment adviser, unless registered under this section, to make use of the mails or any means or instrumentality of interstate commerce in connection with his or its business as an investment adviser.

What is Section 203 L or M of the Advisers Act?

Section 203(l) generally provides an exemption from SEC registration for investment advisers that provide advice solely with respect to “venture capital funds.” Section 203(m) generally provides an exemption from SEC registration for investment advisers that provide advice solely to private funds and have less than

What is Section 203 L or M of the United States Investment Advisers Act of 1940?

The private fund adviser exemption in Advisers Act section 203(m) directs the Commission to provide an exemption from registration to any investment adviser who solely advises private funds and has assets under management in the United States of less than $150 million.

What is Section 202 A of the Investment Advisers Act of 1940?

Section 202(a)(11) of the Act defines an investment adviser as any person or firm that: for compensation; is engaged in the business of; providing advice to others or issuing reports or analyses regarding securities.

What is Section 204 A of the Investment Advisers Act of 1940?

Section 204A of the Act requires that investment advisers maintain and enforce written policies reasonably designed to prevent the misuse of material nonpublic information by the investment adviser or any person associated with the investment adviser.

What is Section 203A of the Federal Investment Advisers Act of 1940?

Section 203A of the Investment Advisers Act of 1940 (the "Advisers Act") generally prohibits an investment adviser from registering with the Commission unless that adviser has more than $25 million of assets under management or is an adviser to a registered investment company.

What is Section 203 A of the Investment Advisers Act of 1940?

Section 203. (a) Except as provided in subsection (b) and Section 203A, it shall be unlawful for any investment adviser, unless registered under this section, to make use of the mails or any means or instrumentality of interstate commerce in connection with his or its business as an investment adviser.

What is the SEC rule 202a?

[4] Section 202(a)(11)(C) of the Advisers Act generally excludes from the investment adviser definition any broker or dealer who performs investment advisory services (i.e., who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of

What is Section 203A of the Federal Investment Advisers Act of 1940?

Section 203A of the Investment Advisers Act of 1940 (the "Advisers Act") generally prohibits an investment adviser from registering with the Commission unless that adviser has more than $25 million of assets under management or is an adviser to a registered investment company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Order Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order Pursuant to Sections 203(f) and 203(k) of the Investment Advisers Act of 1940 and Sections 9(b) and 9(f) of the Investment Company Act of 1940 as to Scott E. DeSano?

It is a regulatory action issued by financial authorities to investigate Scott E. DeSano's conduct and to impose sanctions, including a cease-and-desist order, that prevents him from engaging in certain investment advisory practices deemed harmful or illegal under the related laws.

Who is required to file Order Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order Pursuant to Sections 203(f) and 203(k) of the Investment Advisers Act of 1940 and Sections 9(b) and 9(f) of the Investment Company Act of 1940 as to Scott E. DeSano?

Typically, the regulatory agency overseeing investment advisers, such as the Securities and Exchange Commission (SEC), is required to file this order against Scott E. DeSano when there is sufficient evidence of violation of investment laws.

How to fill out Order Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order Pursuant to Sections 203(f) and 203(k) of the Investment Advisers Act of 1940 and Sections 9(b) and 9(f) of the Investment Company Act of 1940 as to Scott E. DeSano?

To fill out this order, one needs to provide detailed information regarding the violations committed by Scott E. DeSano, the related laws, the findings of fact, and the recommended remedial sanctions. It must also include the jurisdiction and the basis for the order.

What is the purpose of Order Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order Pursuant to Sections 203(f) and 203(k) of the Investment Advisers Act of 1940 and Sections 9(b) and 9(f) of the Investment Company Act of 1940 as to Scott E. DeSano?

The purpose is to protect investors and uphold market integrity by addressing and rectifying any unlawful behavior by Scott E. DeSano in his role as an investment adviser, thereby preventing further violations.

What information must be reported on Order Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order Pursuant to Sections 203(f) and 203(k) of the Investment Advisers Act of 1940 and Sections 9(b) and 9(f) of the Investment Company Act of 1940 as to Scott E. DeSano?

Essential information includes the identity of Scott E. DeSano, a summary of the findings related to his actions, the specific legal provisions he violated, any evidence collected, and the recommended sanctions and remedial actions.

Fill out your order making findings and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Order Making Findings And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.