Get the free United States Senate Financial Disclosure Report - ethics senate

Show details

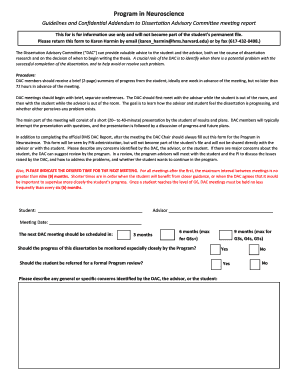

This document is a financial disclosure report required for members, candidates, and certain staff of the U.S. Senate to report their financial interests and transactions to ensure transparency and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign united states senate financial

Edit your united states senate financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your united states senate financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing united states senate financial online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit united states senate financial. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out united states senate financial

How to fill out United States Senate Financial Disclosure Report

01

Obtain the correct form for the United States Senate Financial Disclosure Report from the Senate website.

02

Fill in your personal information, including your name, address, and the position you hold.

03

List all the sources of income, including salaries, dividends, and any other Form 1099 income.

04

Report all assets, including stocks, bonds, real estate, and other investments, along with their estimated values.

05

Disclose any liabilities, such as loans or mortgages, and provide the creditor's name and the amount owed.

06

Include any positions held outside the Senate, such as directorships, advisory roles, or affiliations with organizations.

07

Review the reporting requirements for gifts and travel and disclose any received gifts or travel expenses paid by third parties.

08

Sign and date the report to certify that the information provided is accurate and complete.

09

Submit the report by the deadline, typically by May 15 each year.

Who needs United States Senate Financial Disclosure Report?

01

Members of the United States Senate are required to file a Financial Disclosure Report.

02

Anyone running for a Senate seat must also submit this report as part of the election process.

03

Certain Senate staff members and officials may also be required to file depending on their roles.

Fill

form

: Try Risk Free

People Also Ask about

What does financial disclosure mean in USAJobs?

Some jobs require federal employees to disclose information about assets, income, employment agreements, liabilities, outside activities and gifts. Agencies use this information to identify and resolve real or perceived conflicts of interest.

What are the financial disclosure requirements for the Senate?

Senate employees must file Financial Disclosure Reports if their rate of pay is at or above the “filing threshold.” The term “filing threshold” is defined as 120% of the basic rate of pay in effect for GS-15 of the General Schedule. For calendar year 2024, the filing threshold was $147,649.

What does financial disclosure mean on USAJobs?

Some jobs require federal employees to disclose information about assets, income, employment agreements, liabilities, outside activities and gifts. Agencies use this information to identify and resolve real or perceived conflicts of interest.

What does financial disclosure mean?

In the financial world, disclosure refers to making all relevant information about a business available to the public or internally to those that work at a company.

What is disclosure of financial status?

Financial disclosures, otherwise known as financial reports, are carefully-curated documents that present information about, you guessed it, a company's finances. These disclosures are shared with the government, the public, and a company's stakeholders such as investors, shareholders, and employees.

What is the financial disclosure report?

What are Financial Disclosure Reports? Financial Disclosure Reports include information about the source, type, amount, or value of the incomes of Members, officers, certain employees of the U.S. House of Representatives and related offices, and candidates for the U.S. House of Representatives.

What is a financial disclosure statement for a job?

Financial disclosure reports are used to identify potential or actual conflicts of interest. If the person charged with reviewing an employee's report finds a conflict, he should impose a remedy immediately.

Do senators have to disclose tax returns?

Section 6103 of the Internal Revenue Code establishes that federal tax returns and return information are confidential unless a statute expressly authorizes disclosure. Congress has established some exceptions to this general proscription.

What is a financial disclosure filing status?

Sharing information about your finances with your spouse (or domestic partner) is a requirement for getting a divorce or legal separation. This is called disclosure or financial disclosure. The financial documents don't get filed with the court. You just share them with your spouse.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is United States Senate Financial Disclosure Report?

The United States Senate Financial Disclosure Report is a document that provides transparency regarding the financial interests of U.S. Senators, including their income, investments, assets, and liabilities.

Who is required to file United States Senate Financial Disclosure Report?

All U.S. Senators are required to file the United States Senate Financial Disclosure Report annually, as well as any candidates running for the Senate.

How to fill out United States Senate Financial Disclosure Report?

To fill out the United States Senate Financial Disclosure Report, Senators and candidates must gather relevant financial information, complete the designated forms accurately, and submit them to the Senate's Select Committee on Ethics according to the prescribed deadlines.

What is the purpose of United States Senate Financial Disclosure Report?

The purpose of the United States Senate Financial Disclosure Report is to promote transparency and inform the public about potential conflicts of interest and the financial holdings of elected officials.

What information must be reported on United States Senate Financial Disclosure Report?

The report must include information about sources of income, investments, real estate holdings, liabilities, gifts, and any other financial interests that could potentially influence an official's decision-making.

Fill out your united states senate financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

United States Senate Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.