Get the free Disclosure of Travel Expenses - ethics senate

Show details

This form is used by Senators and Officers to disclose travel expenses that have been or will be reimbursed or paid for them, as required by Senate rules. It includes information on the source of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign disclosure of travel expenses

Edit your disclosure of travel expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disclosure of travel expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit disclosure of travel expenses online

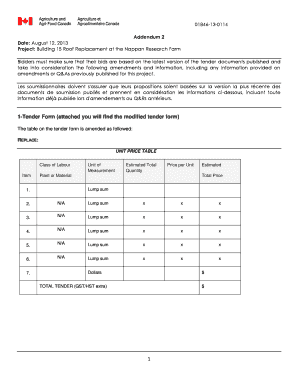

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit disclosure of travel expenses. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out disclosure of travel expenses

How to fill out Disclosure of Travel Expenses

01

Obtain the Disclosure of Travel Expenses form from your organization's finance department or website.

02

Fill in your personal information at the top of the form, including your name, position, and department.

03

Specify the purpose of travel and the destinations visited.

04

List all travel expenses incurred, breaking them down into categories such as transportation, accommodation, meals, and incidentals.

05

Provide dates for each travel segment and document the total amount spent for each category.

06

Attach receipts for all expenses being claimed, ensuring they are organized according to each category.

07

Review the completed form for accuracy and completeness before submission.

08

Submit the form to your supervisor or designated person for approval.

Who needs Disclosure of Travel Expenses?

01

Employees who incur travel expenses for business purposes are required to fill out the Disclosure of Travel Expenses.

02

Individuals seeking reimbursement for travel-related costs must complete this form to provide transparency and accountability.

03

All managers or supervisors who approve travel expenses should be familiar with the form.

Fill

form

: Try Risk Free

People Also Ask about

What is the legal definition of expenses?

expense n. : financial burden or outlay. ;specif. : an item of business outlay chargeable against revenue for a specific period.

How to record travel expenses?

How do you record travel expenses? Record travel expenses by documenting all costs related to travel, such as transportation, lodging, and meals. Use receipts and a travel expense form to track and categorize these expenses in your accounting system.

What are considered travel expenses?

Travel by airplane, train, bus or car between your home and your business destination. Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location. Shipping of baggage and sample or display material between regular and temporary work locations.

What is the legal definition of travel expenses?

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job.

What is not considered a travel expense?

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes.

What is travelling expenses in English?

Meaning of travel expense in English one of the costs for flights, hotels, meals, etc. for an organization's employees when they travel on business: Staff travel expenses are provided throughout the project.

What is an expense report travel expense report?

Travel and expense reports are physical or digital documents that include all of the relevant details for a travel-related expense, including the amount of the purchase, the date, and expense category.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Disclosure of Travel Expenses?

Disclosure of Travel Expenses is a process through which individuals or organizations report the costs associated with travel undertaken for business purposes. This may include transportation, lodging, meals, and other related expenditures.

Who is required to file Disclosure of Travel Expenses?

Typically, individuals who incur travel expenses on behalf of a company, government entity, or organization are required to file a Disclosure of Travel Expenses. This usually includes employees, executives, and possibly contractors or board members.

How to fill out Disclosure of Travel Expenses?

To fill out a Disclosure of Travel Expenses, you need to gather all receipts and documentation related to your travel costs, complete the required form provided by your organization or governing body, detail each expense, and submit it along with any supporting documents as required.

What is the purpose of Disclosure of Travel Expenses?

The purpose of Disclosure of Travel Expenses is to maintain transparency and accountability regarding the use of funds for travel-related activities. It ensures that all expenses are documented, justified, and comply with relevant policies and regulations.

What information must be reported on Disclosure of Travel Expenses?

The information that must typically be reported includes the date of travel, purpose of the travel, destination, individual(s) traveling, itemized list of expenses (transportation, lodging, meals, etc.), and any receipts or documentation supporting those expenses.

Fill out your disclosure of travel expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Disclosure Of Travel Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.