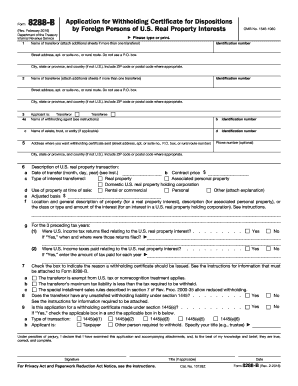

IRS 8288-B 2006 free printable template

Instructions and Help about IRS 8288-B

How to edit IRS 8288-B

How to fill out IRS 8288-B

About IRS 8288-B 2006 previous version

What is IRS 8288-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8288-B

What should I do if I made a mistake on my form 8288 b 2006 after submission?

If you realize there is an error on your form 8288 b 2006 after it has been submitted, you must file an amended form. Clearly indicate the corrections, and be sure to include a brief explanation of the changes. Always keep a copy for your records, as this helps maintain accurate documentation.

How can I verify the status of my form 8288 b 2006 after filing?

To verify the status of your form 8288 b 2006, you can contact the appropriate IRS office or check online if you e-filed. Keep your confirmation number and submission details handy as these are needed for tracking. Be aware that processing times can vary, so patience may be required.

What are common errors to avoid when filing form 8288 b 2006?

Some common errors when filing form 8288 b 2006 include incorrect taxpayer identification numbers, mismatched names, and missing signatures. Double-checking all entries can help mitigate these issues, and utilizing software that highlights potential discrepancies may enhance accuracy.

Are there any specific privacy considerations when submitting the form 8288 b 2006?

When submitting form 8288 b 2006, ensure that sensitive information is shared securely to maintain privacy. If e-filing, use trusted software that complies with data security standards. Additionally, retain your records securely in a protected location to prevent unauthorized access.

See what our users say