Get the free 3106— Land trust agreement, 7-06

Show details

Este contrato de fideicomiso se establece entre el fideicomisario y los beneficiarios para la gestión y conservación de la propiedad fideicomisaria. Detalla los derechos y deberes de las partes

We are not affiliated with any brand or entity on this form

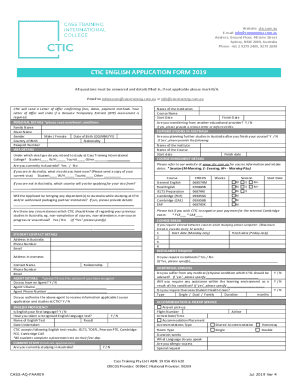

Get, Create, Make and Sign 3106 land trust agreement

Edit your 3106 land trust agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3106 land trust agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 3106 land trust agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 3106 land trust agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

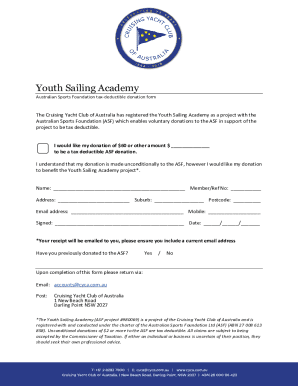

How to fill out 3106 land trust agreement

How to fill out 3106— Land trust agreement, 7-06

01

Begin with the title section and enter '3106— Land Trust Agreement, 7-06'.

02

Fill in the names and addresses of the parties involved, including the trustee and the beneficiaries.

03

Specify the legal description of the property that is subject to the trust.

04

Detail the purpose of the trust and the terms under which it operates.

05

Indicate the powers and responsibilities of the trustee.

06

Outline the distribution terms for the beneficiaries.

07

Provide spaces for signatures and dates at the bottom of the agreement.

08

Review the document for completeness and ensure all required fields are filled.

09

Consider obtaining legal advice to ensure compliance with local laws.

10

Make copies of the completed agreement for all parties involved.

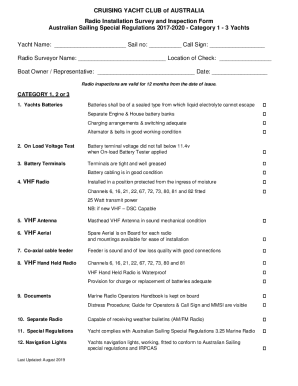

Who needs 3106— Land trust agreement, 7-06?

01

Real estate investors looking to protect their property assets.

02

Individual property owners seeking to manage property through a trust.

03

Beneficiaries who wish to clarify their rights in a land trust.

04

Estate planners who want to structure property ownership efficiently.

Fill

form

: Try Risk Free

People Also Ask about

How do you read a trust agreement?

A land trust is a pass-through entity with essentially no affect on taxes. The IRS regards land trusts as disregarded entities and does not assign them tax ID numbers. Any income the land trust generates is treated as personal income and therefore reported on your personal tax return.

How does a beneficiary receive money from a trust?

As a trustee, you can obtain bank statements from the date of death, look at the bank balance, and appraise the cash. For real property, stocks, or assets with fluctuating values, you'll want to get a licensed appraiser involved to protect you from possible claims made by the beneficiaries.

Who pays taxes on a land trust?

A land trust is primarily used for privacy, while an LLC offers liability protection. Land trusts are not entities and do not require state filings, whereas LLCs require filings and have public ownership records. LLCs are better for long-term holdings, while land trusts provide quick, private transactions.

How do you determine the value of a trust?

A trustee holds the authority to manage and distribute trust assets as outlined in the trust document. This includes making investments, paying bills, and making distributions to beneficiaries. However, these powers are subject to local laws and any specific court orders.

What are the downsides of a land trust?

Potential Pitfalls of a Land Trust While there are some advantages of a land trust, there are also some pitfalls that you need to be aware of. If you buy property under a land trust, you will not have redemption rights. This means that you would lose the right to reclaim the property in foreclosure.

How to read a trust account statement?

How to read your trust account billing statement A = Invoice Number. C = Financial Responsibility Party. D = Invoice Period. E = Customer # and Trust Account. F = Total Net Deposits. G = Total Net Charges. H = Beginning Balance. I = Net Deposits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

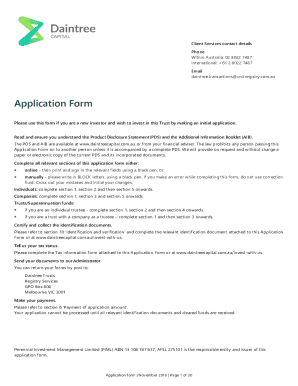

What is 3106— Land trust agreement, 7-06?

3106— Land trust agreement, 7-06 is a legal document that outlines the terms and conditions under which a land trust is created, managed, and operated, typically to hold title to real estate for the benefit of specific beneficiaries.

Who is required to file 3106— Land trust agreement, 7-06?

Individuals or entities that establish a land trust for the management of property are required to file 3106— Land trust agreement, 7-06 to ensure compliance with relevant laws and regulations.

How to fill out 3106— Land trust agreement, 7-06?

To fill out 3106— Land trust agreement, 7-06, provide detailed information about the trust, including the name of the trust, the trustee's information, the beneficiaries, and any specified terms or conditions related to the management of the property.

What is the purpose of 3106— Land trust agreement, 7-06?

The purpose of 3106— Land trust agreement, 7-06 is to legally formalize the arrangement between the trustee and beneficiaries, outlining their rights and responsibilities while providing a framework for property management and usage.

What information must be reported on 3106— Land trust agreement, 7-06?

The information that must be reported on 3106— Land trust agreement, 7-06 includes the names of the trust, trustee, and beneficiaries, property details, terms of the trust, and any specific instructions for property management.

Fill out your 3106 land trust agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

3106 Land Trust Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.