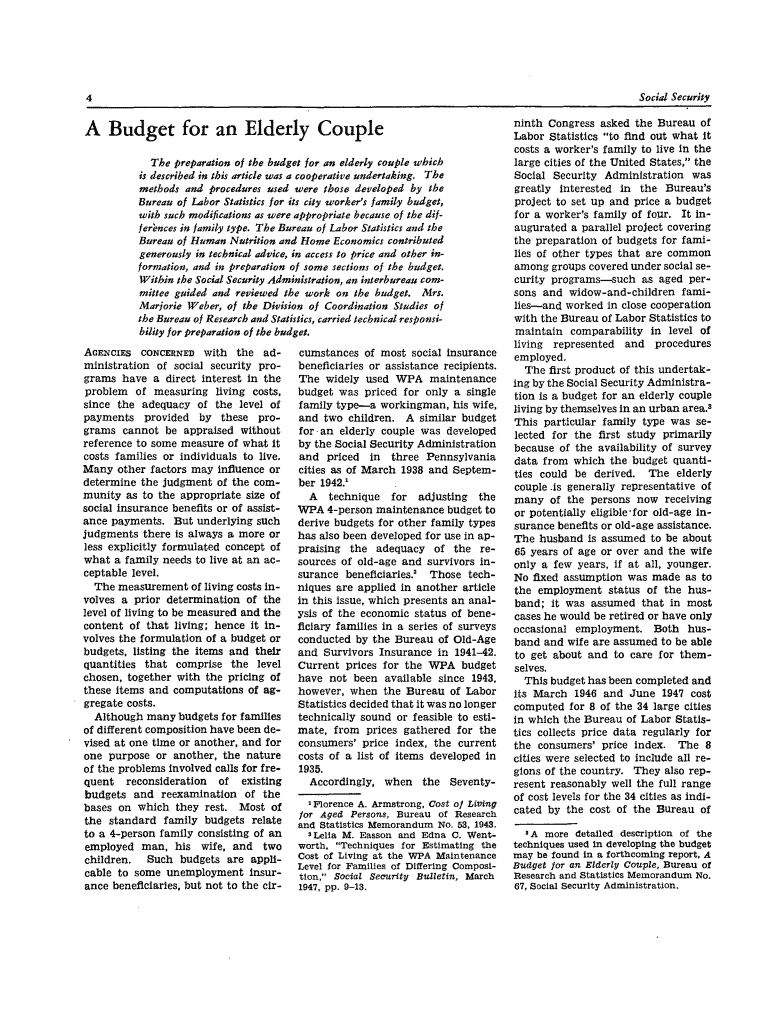

Get the free A Budget for an Elderly Couple

Show details

A detailed budget preparation for elderly couples, outlining living costs including food, housing, medical care, and personal expenses, evaluated for multiple urban locations by the Bureau of Labor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a budget for an

Edit your a budget for an form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a budget for an form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a budget for an online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit a budget for an. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a budget for an

How to fill out A Budget for an Elderly Couple

01

Gather all sources of income, including pensions, Social Security, and any savings.

02

List monthly expenses such as housing, utilities, groceries, transportation, and medical care.

03

Prioritize essential expenses over non-essential ones.

04

Include a category for unexpected expenses or emergencies.

05

Review and adjust expenses to ensure they do not exceed income.

06

Consider seeking advice from a financial planner if needed.

Who needs A Budget for an Elderly Couple?

01

Elderly couples looking to manage their finances effectively.

02

Those approaching retirement and want to plan for fixed income.

03

Family members assisting elderly couples in financial planning.

04

Healthcare providers or social workers helping elderly clients.

Fill

form

: Try Risk Free

People Also Ask about

What is a reasonable budget for a couple?

80/20 Rule This strategy might work well for you if you're new to budgeting as a couple. For your joint income, you can spend 80% on needs and wants and commit 20% to savings. This 20% could go toward emergency funds, college savings, retirement savings or debt reduction.

How to budget for a 2 person household?

Add up your total household income. Then calculate the percentage of that total each individual partner / spouse makes. Now add up your total monthly shared expenses (rent / mortgage, utilities, groceries, joint investing or saving goals, etc).

How to write a household budget?

Five simple steps to create and use a budget Step 1: Estimate your monthly income. Step 2: Identify and estimate your monthly expenses. Step 3: Compare your total estimated income and expenses, and consider your priorities and goals. Step 4: Track your spending, and at the end of month, see if you spent what you planned.

What is the 50 30 20 rule for couples?

If you follow the 50-30-20 rule (50 percent of your income goes to ``needs,'' 30 percent goes to ``wants,'' and 20 percent goes to savings), then keeping that 30 percent in your own account for now may smooth over some of your relationship's rough spots.

How do you create a budget for a couple?

Create Your Budget 50/30/20 budgeting rule: Couples who use this method designate 50% of their take-home pay to essentials, 30% to discretionary items and 20% to pay down debt and save. Depending on your income, spending habits and financial goals, you may decide to adjust these allocations.

What are the three types of family budgets?

Here are five types of budgets to choose from. 50/30/20 budget. The numbers represent how to divide your income after taxes. Cash jar or envelope system. Once funds go into the envelope or jar, you can't spend the money or use it for another purpose. Zero-sum budget. Reverse budgeting. Kakeibo method.

What is a reasonable budget for a couple?

80/20 Rule This strategy might work well for you if you're new to budgeting as a couple. For your joint income, you can spend 80% on needs and wants and commit 20% to savings. This 20% could go toward emergency funds, college savings, retirement savings or debt reduction.

How to create a couple's budget?

Create Your Budget 50/30/20 budgeting rule: Couples who use this method designate 50% of their take-home pay to essentials, 30% to discretionary items and 20% to pay down debt and save. Depending on your income, spending habits and financial goals, you may decide to adjust these allocations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is A Budget for an Elderly Couple?

A budget for an elderly couple is a financial plan that outlines expected income and expenses to manage their finances effectively, ensuring they can cover necessities like housing, food, healthcare, and leisure activities.

Who is required to file A Budget for an Elderly Couple?

Typically, an elderly couple is encouraged, but not necessarily required, to create a budget. However, those receiving certain benefits or financial aid may need to submit a budget to demonstrate their financial situation.

How to fill out A Budget for an Elderly Couple?

To fill out a budget, elderly couples should list all sources of income, such as pensions or Social Security. Next, they should document monthly expenses, including housing, utilities, food, healthcare, and transportation, and compare totals to assess their financial standing.

What is the purpose of A Budget for an Elderly Couple?

The purpose of a budget for an elderly couple is to ensure financial security by tracking income and expenses, preventing overspending, and helping to plan for future financial needs or emergencies.

What information must be reported on A Budget for an Elderly Couple?

A budget for an elderly couple must report all sources of income, fixed and variable expenses, savings, and any debts. This information helps create a clear picture of their financial health.

Fill out your a budget for an online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Budget For An is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.