TN DoR INC 250 2013 free printable template

Show details

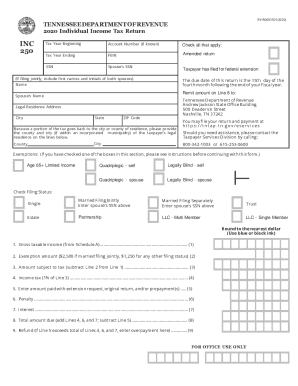

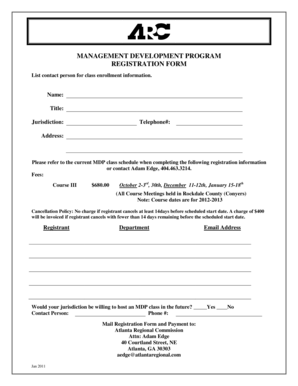

TENNESSEE DEPARTMENT OF REVENUE INDIVIDUAL INCOME TAX RETURN Beginning: ACCOUNT NUMBER INC 250 Taxable Year Ending: Taxpayers filing on a calendar year basis must file their return by April 15 of

pdfFiller is not affiliated with any government organization

Instructions and Help about TN DoR INC 250

How to edit TN DoR INC 250

How to fill out TN DoR INC 250

Instructions and Help about TN DoR INC 250

How to edit TN DoR INC 250

To edit the TN DoR INC 250, utilize pdfFiller to amend text fields directly on the form. You can add or change information seamlessly, ensuring all details are accurate before submission. Make sure you save frequently to avoid any data loss during the editing process.

How to fill out TN DoR INC 250

Filling out the TN DoR INC 250 involves gathering necessary information and entering it correctly into specific sections of the form. Begin by identifying the entity’s details, including its name, Type, and Tax Identification Number (TIN). It’s essential to review the instructions carefully to ensure compliance with the Tennessee Department of Revenue requirements.

01

Gather financial records relevant to the tax reporting period.

02

Complete each section of the form clearly and accurately.

03

Review the form for any errors or omissions.

04

Submit the completed form by the deadline specified.

About TN DoR INC previous version

What is TN DoR INC 250?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About TN DoR INC previous version

What is TN DoR INC 250?

TN DoR INC 250 is a tax form used by corporations operating in Tennessee for reporting income, deductions, and credits while calculating their franchise tax liability. This form helps the state assess the tax owed based on net earnings and provides transparency regarding corporate financial activities.

What is the purpose of this form?

The purpose of the TN DoR INC 250 is to facilitate the accurate reporting of corporate income and associated tax obligations. It enables the Tennessee Department of Revenue to monitor compliance and assess taxes correctly, ensuring that all businesses contribute fairly to state revenues.

Who needs the form?

The TN DoR INC 250 must be filed by all corporations and limited liability companies (LLCs) conducting business in Tennessee. Additionally, entities that are organized or taxed as corporations under state tax law are required to submit this form annually to maintain compliance.

When am I exempt from filling out this form?

Exemptions from filing the TN DoR INC 250 may apply to certain nonprofit organizations that are recognized as tax-exempt under IRS regulations. Additionally, if your business has no taxable transactions in the reporting period, you may not be required to file this form. Always confirm your status with state guidelines to avoid penalties.

Components of the form

The TN DoR INC 250 includes several key components, such as informational fields to input the taxpayer's identification details, income data, deductions, and credits. It also requires calculations of the franchise tax owed based on the corporation's financial information for the reporting year.

Due date

The TN DoR INC 250 is typically due on the 15th day of the fourth month after the close of the corporation’s fiscal year. Corporations should maintain awareness of this deadline to avoid incurring penalties or interest on unpaid taxes.

What are the penalties for not issuing the form?

Failure to issue the TN DoR INC 250 can result in penalties imposed by the Tennessee Department of Revenue. Penalties may include fines, interest on unpaid taxes, and possible legal action. It is crucial to file the form on time to avoid these repercussions.

What information do you need when you file the form?

When filing the TN DoR INC 250, be prepared to provide detailed information, including but not limited to: the corporation’s legal name, TIN, total revenue, deductions claimed, and any applicable credits. Ensure that all figures are accurate and supported by documentation.

Is the form accompanied by other forms?

The TN DoR INC 250 may need to be accompanied by additional forms, such as schedules for specific deductions or credits. Check the instructions for the form to determine if there are complementary forms that should also be submitted for comprehensive reporting.

Where do I send the form?

The completed TN DoR INC 250 should be sent to the Tennessee Department of Revenue. Ensure you send it to the correct address as specified in the form's instructions to guarantee that your filing is processed in a timely manner.

See what our users say