Get the free Request for Proposal for Delinquent Tax Debt Collection Services

Show details

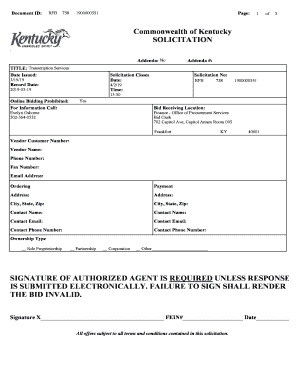

This document is a Request for Proposal issued by the New Jersey Department of the Treasury for the procurement of delinquent tax debt collection services. It outlines the responsibilities of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for proposal for

Edit your request for proposal for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for proposal for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for proposal for online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request for proposal for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for proposal for

How to fill out Request for Proposal for Delinquent Tax Debt Collection Services

01

Begin by reading the instructions carefully to understand the scope and requirements of the RFP.

02

Provide a detailed introduction outlining your organization's background and experience in tax debt collection.

03

Clearly define the services you will offer, including your methodology for collecting delinquent tax debts.

04

Outline your proposed timeline for the project, including significant milestones.

05

Include information about your team, their qualifications, and their roles in the project.

06

Present your pricing model transparently, including any fees, commission structures, and payment terms.

07

Describe any compliance policies and practices you follow to ensure legality and ethics in debt collection.

08

Provide references and case studies from similar projects to demonstrate your effectiveness and reliability.

09

Include any additional resources or support you can offer that may differentiate your proposal.

10

Review your proposal for clarity, grammar, and adherence to the RFP guidelines before submission.

Who needs Request for Proposal for Delinquent Tax Debt Collection Services?

01

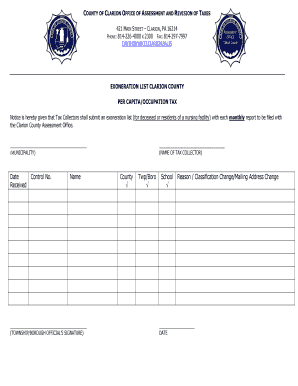

Local government entities that need to recover unpaid property taxes.

02

Municipal agencies responsible for managing tax collection and financial accountability.

03

Public sector organizations looking for professional services to handle delinquent taxes.

04

Tax departments that want to outsource collections to specialized agencies.

Fill

form

: Try Risk Free

People Also Ask about

What should you not say to a debt collector?

8 things you should never say to a credit card debt collector "Yes, I can pay something today." "This debt belongs to me." "I don't have any money." "Take me to court." "The debt is too old to collect." "I'll give you my bank account information." "I'm recording this call without your permission."

How do I write a letter to a debt collection?

Avoid aggressive language that could alienate the debtor. Include Key Components: Effective debt collection letters should contain specific key components, including the debtor's information, a clear statement of the debt, payment options, a call to action, and a deadline for payment.

Can tax debt be sent to collections?

When the IRS sends your case to IRS Collection, it means the IRS has contacted you with notices and a tax bill, but you still haven't paid. The IRS may try to collect the money by taking your assets through liens and levies, or sometimes, the IRS will assign private contractors to collect tax debts.

How to write a letter for debt collection?

Avoid aggressive language that could alienate the debtor. Include Key Components: Effective debt collection letters should contain specific key components, including the debtor's information, a clear statement of the debt, payment options, a call to action, and a deadline for payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Proposal for Delinquent Tax Debt Collection Services?

A Request for Proposal (RFP) for Delinquent Tax Debt Collection Services is a formal document issued by a government agency or organization seeking proposals from qualified vendors to collect unpaid taxes. This process helps identify the most effective and cost-efficient collection methods.

Who is required to file Request for Proposal for Delinquent Tax Debt Collection Services?

Typically, government entities such as municipalities, counties, or state revenue departments that manage delinquent tax collections are required to file an RFP to solicit bids from collection agencies.

How to fill out Request for Proposal for Delinquent Tax Debt Collection Services?

To fill out an RFP for Delinquent Tax Debt Collection Services, you should include detailed specifications such as the scope of services, criteria for evaluation, timeline, budget, and submission guidelines. Ensure clarity and completeness to attract the right vendors.

What is the purpose of Request for Proposal for Delinquent Tax Debt Collection Services?

The purpose of an RFP for Delinquent Tax Debt Collection Services is to seek qualified vendors who can effectively recover overdue tax debts, ensuring compliance with legal requirements, and to promote transparency and competition in the procurement process.

What information must be reported on Request for Proposal for Delinquent Tax Debt Collection Services?

The RFP must report information such as the specific services required, background information about the delinquent debt, performance expectations, evaluation criteria, deadlines for submissions, and terms of compensation.

Fill out your request for proposal for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Proposal For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.