Get the free RETIREE TAX CERTIFICATION FOR CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT - stat...

Show details

This form certifies that a retiree's civil union partner or domestic partner qualifies as a tax dependent for health coverage purposes, ensuring benefits can remain non-taxable. It details the requirements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retiree tax certification for

Edit your retiree tax certification for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retiree tax certification for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retiree tax certification for online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit retiree tax certification for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

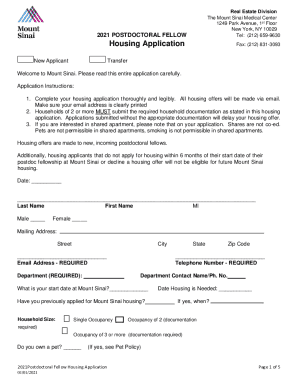

How to fill out retiree tax certification for

How to fill out RETIREE TAX CERTIFICATION FOR CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT

01

Obtain the RETIREE TAX CERTIFICATION form from your HR department or online portal.

02

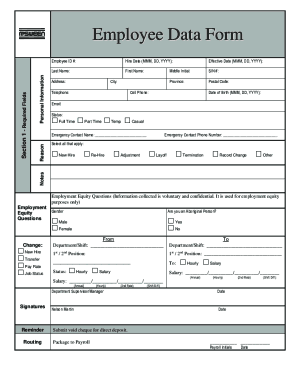

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide information about your civil union partner or domestic partner, including their full name and relationship to you.

04

Indicate the type of benefits you or your partner is requesting.

05

Complete any required tax identification sections accurately.

06

Review the form for any additional documentation that may be required, such as proof of your partnership.

07

Sign and date the form at the bottom to certify the information is correct.

08

Submit the completed form to the appropriate department as instructed on the form.

Who needs RETIREE TAX CERTIFICATION FOR CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT?

01

Retired employees who have civil union partners or domestic partners and wish to ensure that their benefits are recognized for tax purposes.

02

Individuals seeking tax benefits related to their civil union or domestic partnership.

03

Retirees who want to secure tax certification to ensure compliance with tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a civil union partner and a domestic partner?

TAXATION - DOMESTIC PARTNERSHIP BENEFIT Internal Revenue Service guidelines establish that adding a domestic partner to your benefits will result in taxable income to the employee for Federal tax purposes only. The state of California no longer taxes the imputed value of domestic partner health related benefits.

What are the disadvantages of a civil union?

While civil unions provide legal recognition at the state level, they are not recognized federally. This means that couples in civil unions may not be entitled to certain federal benefits and protections that married couples enjoy, such as access to federal tax benefits and immigration benefits.

Is a girlfriend a domestic partner?

A girlfriend can be considered a domestic partner if both individuals live together and share a domestic life similar to that of a married couple, but this designation can vary based on legal definitions and individual circumstances.

Is a domestic partner the same as a civil union?

A domestic partnership is a civil union effectively a marriage by another name. The term was used to describe same sex ``marriages'' before they were legally recognized (during the days when same sex marriages weren't legal). Couples would have a ceremony like a wedding.

What are the disadvantages of a domestic partnership?

Unlike married couples, domestic partners can't legally claim each other as “family.” This means they may not be able to claim the same familial rights as married couples, including the ability to adopt, depending on the state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RETIREE TAX CERTIFICATION FOR CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT?

RETIREE TAX CERTIFICATION FOR CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT is a document that verifies the eligibility of a retiree's civil union partner or domestic partner for tax purposes, particularly in relation to benefits provided by the retiree.

Who is required to file RETIREE TAX CERTIFICATION FOR CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT?

Retirees who wish to claim benefits for their civil union partner or domestic partner are required to file the RETIREE TAX CERTIFICATION.

How to fill out RETIREE TAX CERTIFICATION FOR CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT?

To fill out the RETIREE TAX CERTIFICATION, retirees must provide personal information, details about their civil union or domestic partnership, and any relevant financial or tax information according to the form's instructions.

What is the purpose of RETIREE TAX CERTIFICATION FOR CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT?

The purpose of the certification is to ensure that the benefits conferred to civil union partners or domestic partners of retirees are recognized for tax purposes, allowing for appropriate tax treatment.

What information must be reported on RETIREE TAX CERTIFICATION FOR CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT?

The information that must be reported includes the retiree's identification details, the civil union or domestic partner's information, the nature of the partnership, and any applicable benefits being claimed.

Fill out your retiree tax certification for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retiree Tax Certification For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.