Get the free New Jersey Corporate Business Tax MeF Developers Handbook - state nj

Show details

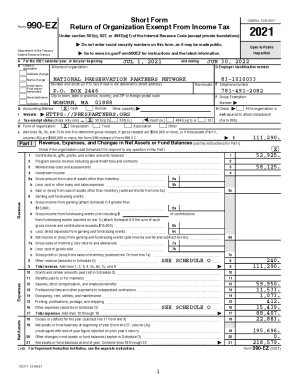

This handbook is intended to assist software developers in creating software solutions for filing New Jersey Corporate Business Tax returns electronically through the Federal/State Modernized e-File

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new jersey corporate business

Edit your new jersey corporate business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new jersey corporate business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new jersey corporate business online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new jersey corporate business. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new jersey corporate business

How to fill out New Jersey Corporate Business Tax MeF Developers Handbook

01

Download the New Jersey Corporate Business Tax MeF Developers Handbook from the official state website.

02

Familiarize yourself with the structure of the document and its sections.

03

Identify the specific forms and APIs you will need to implement.

04

Follow the provided guidelines for data formatting and transmission standards.

05

Complete any application forms included in the handbook for registration.

06

Develop your software solution based on the specifications outlined in the handbook.

07

Test your implementation thoroughly to ensure compliance with state requirements.

08

Submit your application for approval if required, and wait for feedback.

09

Incorporate any necessary adjustments based on the feedback received.

10

Finalize your setup and prepare for ongoing maintenance and updates.

Who needs New Jersey Corporate Business Tax MeF Developers Handbook?

01

Software developers working on tax filing solutions for New Jersey businesses.

02

Corporations that need to file Corporate Business Tax electronically.

03

Tax consultants and advisors assisting clients with Corporate Business Tax compliance.

04

Government agencies overseeing tax compliance and electronic filing processes.

05

Businesses looking to integrate with the New Jersey tax filing system.

Fill

form

: Try Risk Free

People Also Ask about

How much tax does an LLC pay in New Jersey?

By default, LLCs don't pay taxes. Instead, the LLC Members are responsible for reporting the income (or losses) on their personal 1040 tax return. The Members pay taxes on any LLC profits.

What is the tax rate for an LLC in New Jersey?

The State's tax rate is 9% based upon the entire net income or the portion of the entire net income allocated to New Jersey. Taxes for multi-state corporations are apportioned using a three-factor formula of sales, property, and payroll.

Is corporate tax 21%?

The 2017 Tax Cuts and Jobs Act (TCJA) included the largest corporate tax cut in U.S. history, bringing the top marginal rate on corporate income falling from 35 percent down to 21 percent. While the reduction brought the U.S. rate in line with peer countries, it was also costly to the fiscal bottom line.

What is the tax rate for S Corp in NJ?

S corporations in New Jersey are taxed on their entire net income at a rate of 9%, and shareholders are taxed on their pro rata share of the corporation's income under the Gross Income Tax. This is important to consider for tax planning.

What is the perfection period for e files in NJ?

When a transmitted electronic business return is rejected in Processing Year 2020, there is a 10-day Transmission Perfection Period to perfect that return for electronic re-transmission.

Can you paper file NJ corporate tax return?

In general, all Corporation Business Tax (CBT) returns and payments, whether self-prepared or prepared by a tax professional, must be submitted electronically. This includes returns, estimated payments, extensions, and vouchers.

What is the corporate business tax rate in New Jersey?

New Jersey corporation business tax Although this tax is often called a franchise tax or privilege tax, \ it's known as the corporation business tax (CBT), in New Jersey. In 2023, New Jersey's corporate business tax rate ranges from 6.5% to 9% of a corporation's business income.

What is the corporate tax rate in New Jersey 2025?

New Mexico increased its graduated corporate tax rate to 5.9% in 2025 and New Jersey has added a 2.5% surtax to its top 9% Corporation Business Tax (CBT) that raised the top marginal CBT rate to 11.5% – the highest corporate tax rate in the nation by far.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New Jersey Corporate Business Tax MeF Developers Handbook?

The New Jersey Corporate Business Tax MeF Developers Handbook is a guide for developers that provides detailed instructions and specifications for the electronic filing of Corporate Business Tax returns in New Jersey. It serves as a reference for ensuring compliance with the state's tax regulations.

Who is required to file New Jersey Corporate Business Tax MeF Developers Handbook?

Businesses operating in New Jersey that generate income or have a physical presence in the state are required to file the Corporate Business Tax and must adhere to the guidelines outlined in the MeF Developers Handbook for electronic submission.

How to fill out New Jersey Corporate Business Tax MeF Developers Handbook?

Filling out the New Jersey Corporate Business Tax MeF requires following the prescribed format and using the specified XML schema as detailed in the Developers Handbook. It involves inputting accurate financial data, ensuring compliance with tax laws, and validating the submission according to state requirements.

What is the purpose of New Jersey Corporate Business Tax MeF Developers Handbook?

The purpose of the MeF Developers Handbook is to facilitate the electronic filing process for Corporate Business Tax returns, ensuring that developers have the necessary resources and guidelines to create compliant e-filing applications that streamline tax submission for corporations.

What information must be reported on New Jersey Corporate Business Tax MeF Developers Handbook?

The information that must be reported includes corporate income, deductions, credits, and any other financial details relevant to the Corporate Business Tax. It also requires reporting on the entity's structure, jurisdiction, and compliance data as outlined in the guidelines of the Handbook.

Fill out your new jersey corporate business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Jersey Corporate Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.