Get the free NEW JERSEY CORPORATION BUSINESS TAX RECYCLING EQUIPMENT TAX CREDIT - state nj

Show details

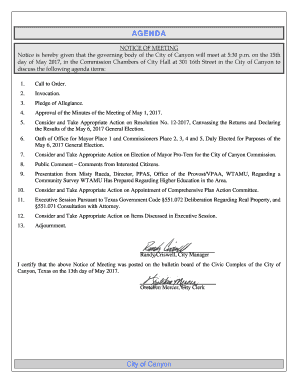

This form is used by businesses in New Jersey to claim a tax credit for recycling equipment, requiring certification from the Department of Environmental Protection and demonstrating eligibility based

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new jersey corporation business

Edit your new jersey corporation business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new jersey corporation business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new jersey corporation business online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new jersey corporation business. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new jersey corporation business

How to fill out NEW JERSEY CORPORATION BUSINESS TAX RECYCLING EQUIPMENT TAX CREDIT

01

Gather all necessary documentation regarding your business and recycling equipment.

02

Determine the eligibility criteria for the Recycling Equipment Tax Credit in New Jersey.

03

Complete the tax credit application form provided by the New Jersey Division of Taxation.

04

Include detailed information about the recycling equipment, such as purchase date, costs, and types of equipment.

05

Calculate the amount of tax credit you are entitled to based on the eligible expenses.

06

Attach any supporting documents, receipts, and proof of purchase to your application.

07

Submit the completed application form and all attachments to the relevant state department by the designated deadline.

Who needs NEW JERSEY CORPORATION BUSINESS TAX RECYCLING EQUIPMENT TAX CREDIT?

01

Businesses in New Jersey that invest in recycling equipment to enhance their operational efficiency and reduce environmental impact.

02

Corporations looking to lower their tax liability by taking advantage of available tax credits for recycling initiatives.

03

Any eligible entities engaged in the business of recycling or processing recyclable materials.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for the NJ rebate?

Who is eligible: Homeowners and tenants who paid property taxes on their principal residence in New Jersey either directly or through rent during the year.

What is the $1500 tax credit in NJ?

Homeowners with household incomes below $150,000 will receive a $1,500 property tax rebate, and homeowners with a household income between $150,000 and $250,000 will receive a $1,000 rebate.

What is the New Jersey production tax credit?

30-35% TAX CREDIT, +2% or 4% DIVERSITY BONUS The New Jersey Film & Digital Media Tax Credit Program provides a transferable credit against the corporation business tax and the gross income tax for certain expenses incurred for the production of certain films and digital media content in New Jersey.

Who qualifies for a New Jersey earned income tax credit?

You can claim the NJEITC if you are married, not filing a joint return, had a qualifying child who lived with you for more than half of 2024, and you lived apart from your spouse for the last 6 months of 2024. You are eligible for an NJEITC only if you claim and are allowed a federal EITC.

What does it mean when you get a tax credit?

A tax credit is a dollar-for-dollar amount taxpayers claim on their tax return to reduce the income tax they owe. Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund.

What is the New Jersey tax credit?

Official Site of The State of New Jersey The amount of your NJEITC is a percentage of your federal Earned Income Tax Credit. For 2024, the NJEITC amount is 40% of the federal credit amount. The federal maximum amounts are available on the IRS website.

Do you get a tax credit for recycling?

Many states focus on recycling as an industry, giving tax exemptions or credits to manufacturers with the intent of increasing commerce or jobs. For this reason, many states have made tax credits dependent on the number of jobs created or the amount of capitol invested.

What is NJ tax credit?

NJ Taxation The amount of your NJEITC is a percentage of your federal Earned Income Tax Credit. For 2024, the NJEITC amount is 40% of the federal credit amount. The federal maximum amounts are available on the IRS website.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NEW JERSEY CORPORATION BUSINESS TAX RECYCLING EQUIPMENT TAX CREDIT?

The New Jersey Corporation Business Tax Recycling Equipment Tax Credit is a tax incentive that allows businesses to receive a credit against their corporation business tax liability for the purchase of certain recycling equipment.

Who is required to file NEW JERSEY CORPORATION BUSINESS TAX RECYCLING EQUIPMENT TAX CREDIT?

Businesses that have purchased eligible recycling equipment and are subject to New Jersey's Corporation Business Tax are required to file for the New Jersey Corporation Business Tax Recycling Equipment Tax Credit.

How to fill out NEW JERSEY CORPORATION BUSINESS TAX RECYCLING EQUIPMENT TAX CREDIT?

To fill out the New Jersey Corporation Business Tax Recycling Equipment Tax Credit, businesses must complete the appropriate tax forms provided by the New Jersey Division of Taxation and include details of the recycling equipment purchased along with any necessary supporting documentation.

What is the purpose of NEW JERSEY CORPORATION BUSINESS TAX RECYCLING EQUIPMENT TAX CREDIT?

The purpose of the New Jersey Corporation Business Tax Recycling Equipment Tax Credit is to encourage businesses to invest in recycling equipment by providing a financial incentive that reduces their overall tax liability, thus promoting environmentally sustainable practices.

What information must be reported on NEW JERSEY CORPORATION BUSINESS TAX RECYCLING EQUIPMENT TAX CREDIT?

Businesses must report information such as the type of recycling equipment purchased, the amount of the credit being claimed, and any relevant certifications or documentation to prove eligibility when filing for the New Jersey Corporation Business Tax Recycling Equipment Tax Credit.

Fill out your new jersey corporation business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Jersey Corporation Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.