Get the free URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT AND CREDIT CARRY FORWARD - state nj

Show details

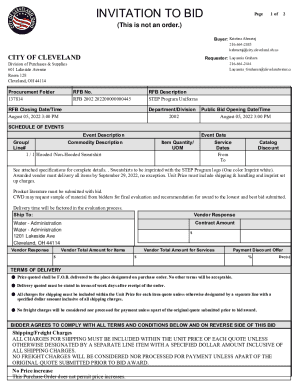

This form is used to claim the Urban Enterprise Zone Investment Tax Credit for qualified businesses in New Jersey, detailing the necessary qualifications and calculations for allowable credits and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign urban enterprise zone investment

Edit your urban enterprise zone investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your urban enterprise zone investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit urban enterprise zone investment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit urban enterprise zone investment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out urban enterprise zone investment

How to fill out URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT AND CREDIT CARRY FORWARD

01

Obtain the URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT application form from the relevant local government or tax authority.

02

Review the eligibility criteria to ensure your business activities qualify for the tax credit.

03

Gather all necessary documentation regarding your business investment in the urban enterprise zone, including receipts, contracts, and any proof of expenditures.

04

Complete the application form accurately, filling in all required fields such as business information, investment details, and any applicable financial data.

05

Calculate the amount of tax credit you are eligible for based on your qualified investments and the guidelines provided.

06

Submit the completed application along with all supporting documents to the appropriate authority before the specified deadline.

07

Keep a copy of the submitted application and any correspondence for your records.

08

If applicable, follow up on the status of your application to ensure it has been processed.

Who needs URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT AND CREDIT CARRY FORWARD?

01

Businesses operating within designated urban enterprise zones that are making qualified investments.

02

Entrepreneurs looking to reduce their tax liabilities through investment in revitalization and development activities in urban areas.

03

Companies aiming to enhance economic growth and job creation in underserved communities.

Fill

form

: Try Risk Free

People Also Ask about

What is the enterprise zone investment tax credit in Illinois?

What is the enterprise zone investment tax credit? The Illinois Income Tax Act 35 ILCS 5/201, as amended allows a . 5 percent credit against the state income tax for investments in qualified property, which is placed in service in an enterprise zone.

How do I claim my Colorado enterprise zone credit?

File Colorado income taxes and include certification documents. Once the certification application is approved by the local enterprise zone administrator, you will receive via email a tax credit certificate that you need to submit with your Colorado income tax return.

How do I carry forward my energy tax credit?

You can carry forward any excess unused credit, though, and apply it to reduce the tax you owe in future years. Do not include interest paid including loan origination fees. The credit has no annual or lifetime dollar limit except for credit limits for fuel cell property.

How to claim Colorado Enterprise Zone tax credit?

How to qualify for and claim this credit Complete the pre-certification application on the OEDIT application portal(opens in new window). Complete the certification application on the OEDIT application portal(opens in new window). File Colorado income taxes and include certification documents.

What is the Colorado enterprise zone contribution credit?

The Enterprise Zone Contribution Tax Credit provides a tax credit to Colorado taxpayers that contribute to targeted enterprise zone (EZ) projects. When taxpayers make a certified contribution, they can claim: 25% of a cash donation as a state income tax credit. 12.5% of an in-kind donation as a state income tax credit.

What does it mean to carry forward a tax credit?

A carryforward credit is the application of a tax credit to a future tax year. This provision exists so that businesses can take advantage of tax credits that were unused because of operating losses or IRS imposed limits on how much can be claimed in a single year.

How do I claim my EV credit in Colorado?

To claim the Colorado Innovative Vehicle Tax Credit, fill out Form DR-0617 and file it with your income tax return forms. The Electric Vehicle Tax Benefits webpage from the Department of Revenue explains both state and federal clean vehicle tax credits.

How does Colorado tax credit work?

The Colorado Earned Income Tax Credit (COEITC) is a state tax credit that gives people who earn lower incomes money back. Many people who earn lower incomes that do not file their taxes miss out on this credit, so it is important to file a state tax return to get the money you may be eligible for.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT AND CREDIT CARRY FORWARD?

The Urban Enterprise Zone Investment Tax Credit is a financial incentive provided to businesses that invest in economically disadvantaged urban areas. It allows qualifying businesses to receive a credit against their state tax liabilities based on their capital investments in designated urban enterprise zones. The credit can be carried forward to future tax years if it exceeds the tax liability for the year in which it was generated.

Who is required to file URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT AND CREDIT CARRY FORWARD?

Businesses that have made qualified investments in an urban enterprise zone and wish to claim the tax credit must file for the Urban Enterprise Zone Investment Tax Credit. This typically includes corporations, partnerships, and sole proprietors operating within the designated zones.

How to fill out URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT AND CREDIT CARRY FORWARD?

To fill out the Urban Enterprise Zone Investment Tax Credit form, businesses must provide detailed information about their investments, including the type of investment, the location, and the amount invested. Documentation can include proof of the investment, tax identification numbers, and any pertinent financial statements. It is advisable to follow the specific guidelines provided by the state's revenue department.

What is the purpose of URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT AND CREDIT CARRY FORWARD?

The purpose of the Urban Enterprise Zone Investment Tax Credit is to stimulate economic development in underprivileged urban areas, attract new businesses, promote job creation, and encourage investments in communities that may otherwise struggle to attract capital.

What information must be reported on URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT AND CREDIT CARRY FORWARD?

Information that must be reported includes the business name and tax identification number, details of the investment made (including date, amount, and type), the specific urban enterprise zone location, and any supporting documentation that validates the investment and eligibility for the credit.

Fill out your urban enterprise zone investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Urban Enterprise Zone Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.