Get the free NEW JERSEY CORPORATION BUSINESS TAX FORM 313 - state nj

Show details

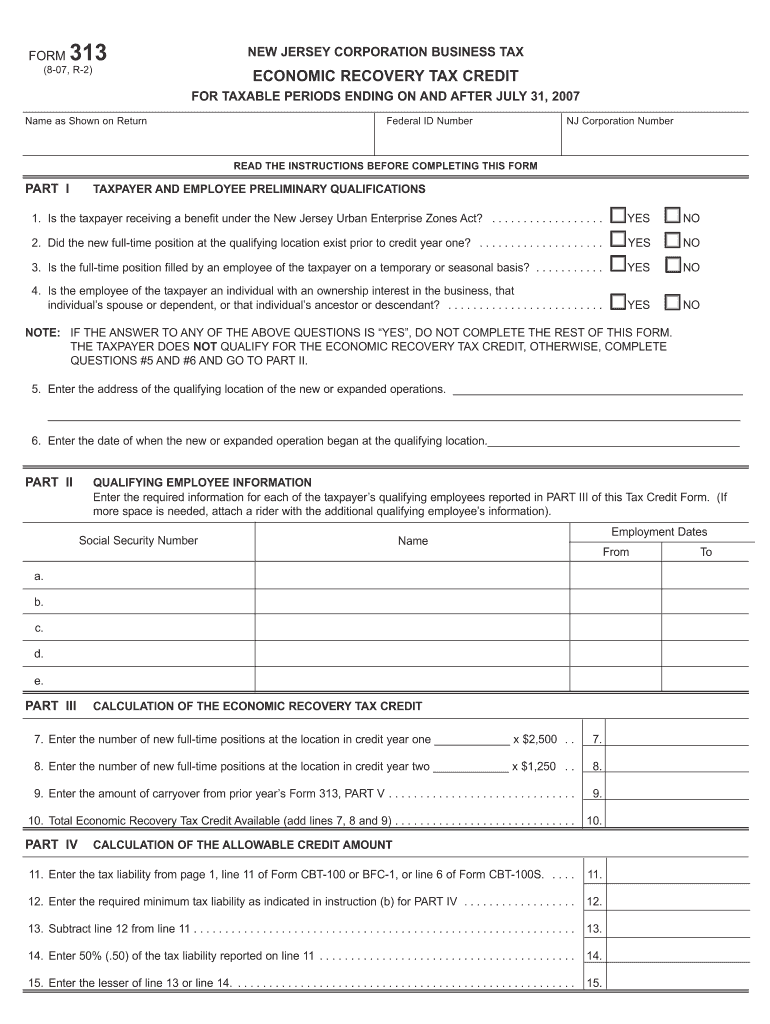

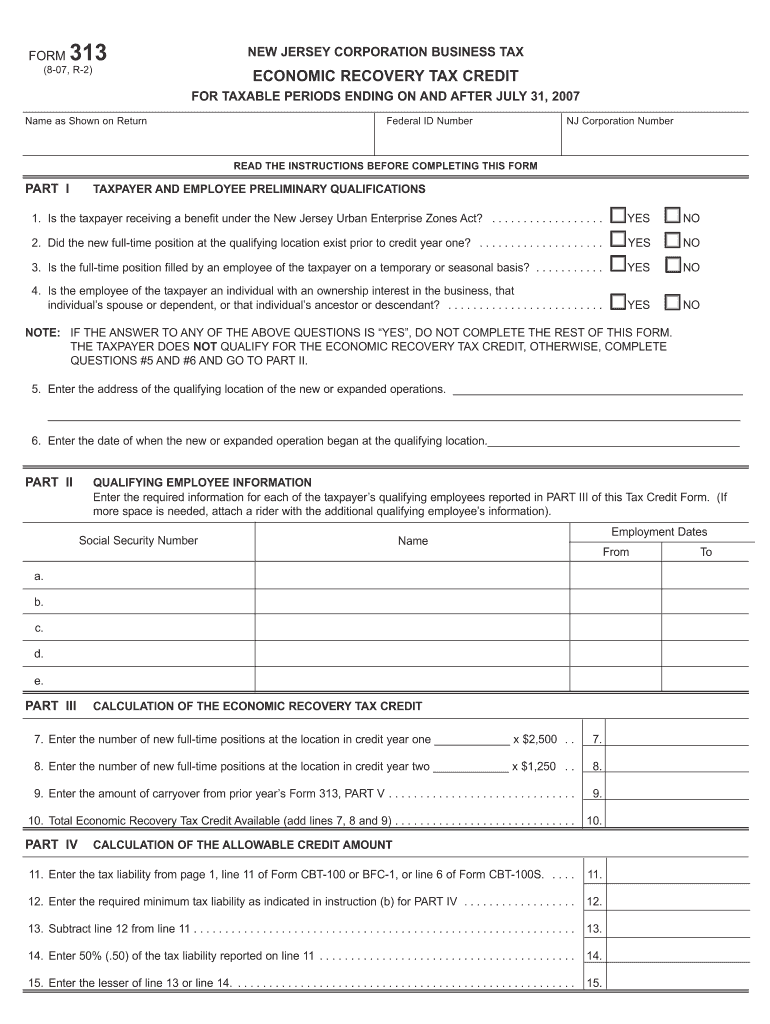

This form is used by New Jersey corporations to apply for the Economic Recovery Tax Credit, which incentivizes business investment and the creation of new full-time positions in qualifying municipalities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new jersey corporation business

Edit your new jersey corporation business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new jersey corporation business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

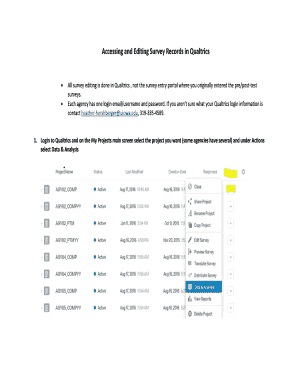

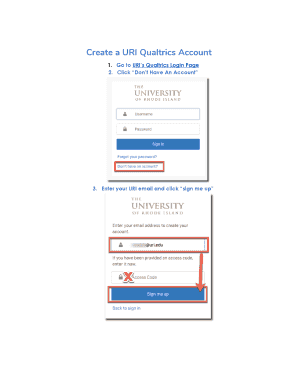

Editing new jersey corporation business online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new jersey corporation business. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

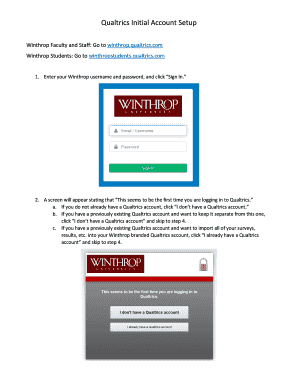

How to fill out new jersey corporation business

How to fill out NEW JERSEY CORPORATION BUSINESS TAX FORM 313

01

Obtain the New Jersey Corporation Business Tax Form 313 from the New Jersey Division of Taxation website.

02

Enter the corporation's name, address, and federal employer identification number (FEIN) at the top of the form.

03

Report total gross receipts by filling in the appropriate line, ensuring all amounts are accurate and well-documented.

04

Calculate the taxable income and enter it on the designated line of the form.

05

Apply any applicable deductions or credits as outlined in the instructions provided with the form.

06

Compute the total tax due based on the corporation's taxable income according to New Jersey tax rates.

07

Complete any additional schedules or attachments as required.

08

Review the entire form for accuracy and completeness before signing.

09

Submit the form electronically or by mail to the appropriate New Jersey tax office by the due date.

Who needs NEW JERSEY CORPORATION BUSINESS TAX FORM 313?

01

Any corporation conducting business in New Jersey that meets the income threshold for taxation must file Form 313.

Fill

form

: Try Risk Free

People Also Ask about

Can I pay NJ tax online?

If you have a balance due, you may pay your taxes online by e-check or credit card (fees apply) and receive immediate confirmation that your return and payment have been received by the State of New Jersey.

Is corporate tax the same as business tax?

The profit of a C corporation — consisting of the revenue it makes in sales minus the cost of doing business — is taxed twice, once as business income at the entity level (corporate income tax) and again at the shareholder level (individual/personal income tax) when distributed as dividends or realized as capital gains

Can I pay my corporate taxes online?

Electronic Federal Tax Payment System. A free way for the public, businesses, and federal agencies to pay their taxes online.

What is the NJ business tax pin?

Your Business Tax PIN is printed on the "Welcome Letter" you received when you first registered your business. Generally, the 4-digit PIN is the same used to submit New Jersey tax payments and returns (e.g., Withholding Tax returns (Forms NJ-927/NJ-500 or Form NJ-927-W) or Sales and Use Tax returns (Forms ST-50/50B)).

What is the corporate business tax rate in New Jersey?

New Jersey, which levied the highest corporate rate in the country of 11.5 percent from 2021-2023, now has the fourth-highest rate (9 percent), as the state's 2.5 percentage-point corporation business tax surcharge expired at the end of 2023.

How do I pay my New Jersey corporation business tax?

You may make a payment by EFT, e-check, or credit card through our online Corporation Business Tax Online Filing and Payments Service. (Combined Filers must submit payments using the Unitary ID number assigned to the Managerial Member.)

How do I pay my Jersey tax?

Pay your personal or company tax bill Payment deadlines. Debit or credit card online. Debit or credit card by telephone. Direct debit. Cheque Telephone and internet banking.

How much is NJ business tax?

C-Corp Businesses Filing Taxes The State's tax rate is 9% based upon the entire net income or the portion of the entire net income allocated to New Jersey. Taxes for multi-state corporations are apportioned using a three-factor formula of sales, property, and payroll.

What is NJ Corporation business tax?

C Corporation Tax Rates: For taxpayers with Entire Net Income greater than $100,000, the tax rate is 9% (. 09) on adjusted entire net income or such portion thereof as may be allocable to New Jersey. For taxpayers with Entire Net Income greater than $50,000 and less than or equal to $100,000, the tax rate is 7.5% (.

What is NJ corporate business tax?

Although this tax is often called a franchise tax or privilege tax, \ it's known as the corporation business tax (CBT), in New Jersey. In 2023, New Jersey's corporate business tax rate ranges from 6.5% to 9% of a corporation's business income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NEW JERSEY CORPORATION BUSINESS TAX FORM 313?

NEW JERSEY CORPORATION BUSINESS TAX FORM 313 is a tax form used by corporations in New Jersey to calculate and report their corporation business taxes to the state.

Who is required to file NEW JERSEY CORPORATION BUSINESS TAX FORM 313?

Corporations doing business in New Jersey, as well as out-of-state corporations with New Jersey gross income of over $100,000 or any corporation with a physical presence in the state, are required to file this form.

How to fill out NEW JERSEY CORPORATION BUSINESS TAX FORM 313?

To fill out FORM 313, corporations must provide their basic information, including gross income, applicable deductions and credits, and the calculated tax liability, following the instructions provided with the form.

What is the purpose of NEW JERSEY CORPORATION BUSINESS TAX FORM 313?

The purpose of FORM 313 is to ensure that corporations report their income and calculate the appropriate tax liability owed to the state of New Jersey, thereby facilitating compliance with state tax laws.

What information must be reported on NEW JERSEY CORPORATION BUSINESS TAX FORM 313?

The form requires reporting of total gross income, deductions, taxable income, applicable tax rates, credits, and the final tax amount due, along with identifying information about the corporation.

Fill out your new jersey corporation business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Jersey Corporation Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.