Get the free NEW JERSEY CORPORATION BUSINESS TAX RESEARCH AND DEVELOPMENT TAX CREDIT - state nj

Show details

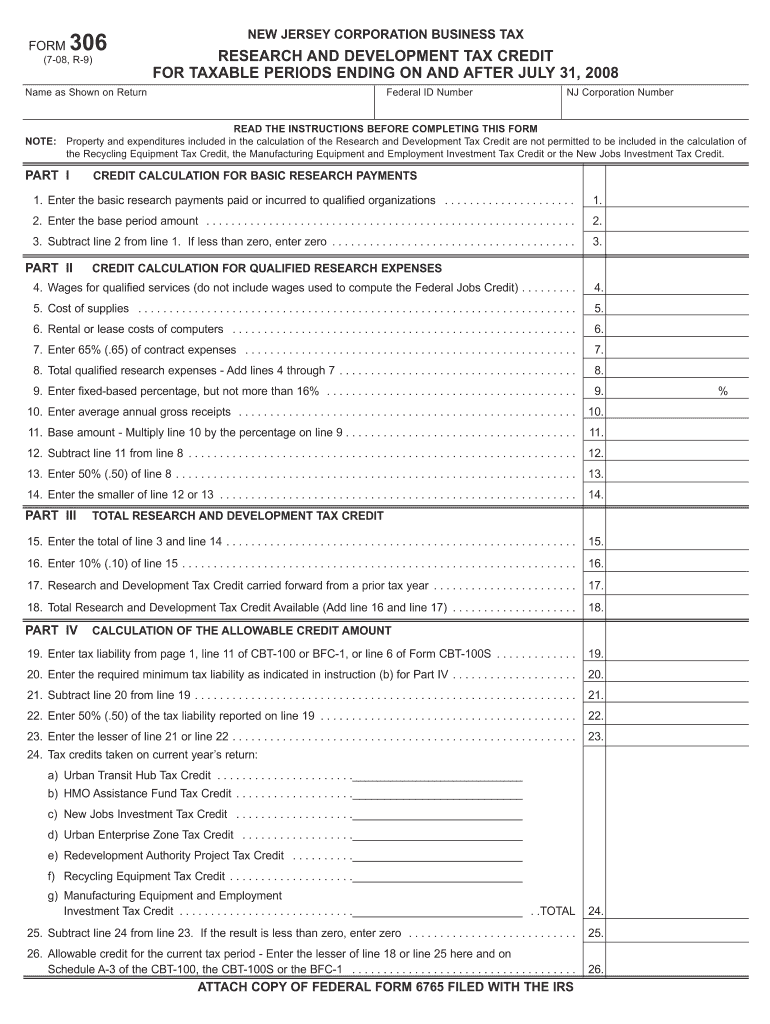

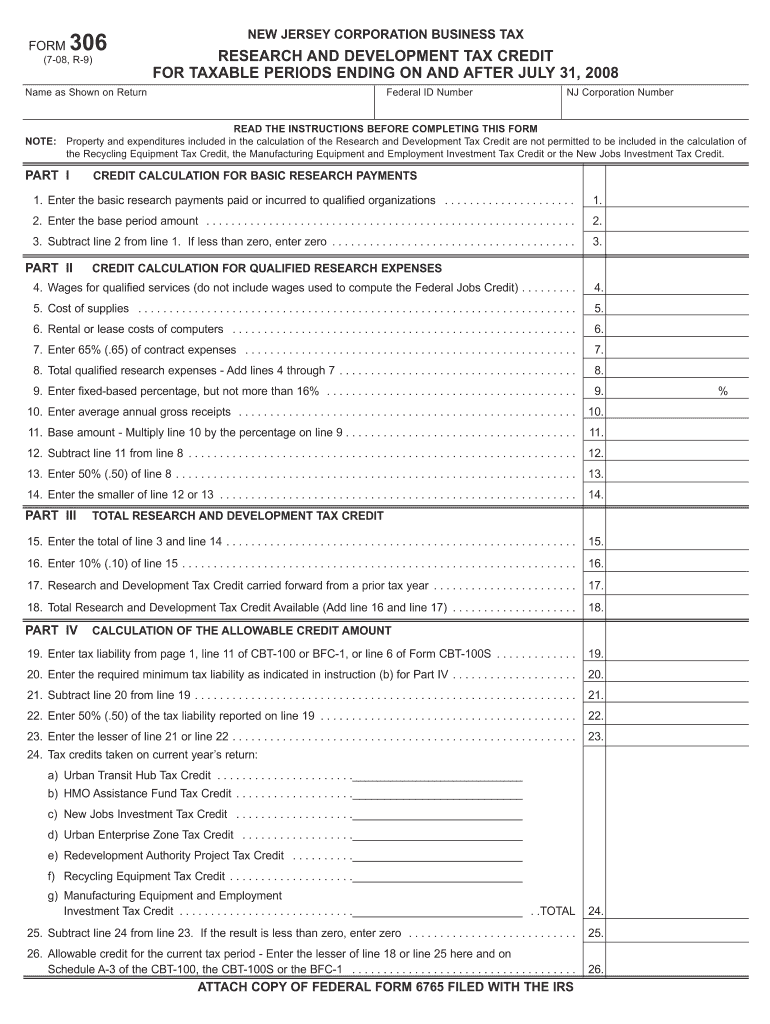

This form is used to calculate and claim the Research and Development Tax Credit for corporations in New Jersey for taxable periods ending on or after July 31, 2008.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new jersey corporation business

Edit your new jersey corporation business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new jersey corporation business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new jersey corporation business online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new jersey corporation business. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new jersey corporation business

How to fill out NEW JERSEY CORPORATION BUSINESS TAX RESEARCH AND DEVELOPMENT TAX CREDIT

01

Gather necessary documentation such as financial statements and R&D expense reports.

02

Ensure your business is eligible by confirming that your activities qualify as research and development under New Jersey tax guidelines.

03

Complete the appropriate forms provided by the New Jersey Division of Taxation for the R&D tax credit.

04

Calculate your qualified research expenses based on wages, supplies, and contract research costs.

05

Determine the allowable credit based on the percentage of your qualified research expenses.

06

Review and verify all information is accurate to avoid any processing delays.

07

Submit the completed forms and documentation to the New Jersey Division of Taxation by the required deadline.

Who needs NEW JERSEY CORPORATION BUSINESS TAX RESEARCH AND DEVELOPMENT TAX CREDIT?

01

Businesses engaged in qualified research and development activities in New Jersey.

02

Corporations looking to reduce their tax liability through R&D tax credits.

03

Companies investing in innovation and product development within the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the 80% rule for R&D credit?

Wages: The 80% Rule for Qualified Employees Under this rule, if an employee spends 80% or more of their time performing qualified R&D activities, the business can take 100% of that employee's wages as a qualified research expense (QRE) for R&D credit purposes.

How do I book my R&D tax credit?

Recording the R&D tax credit using cash basis accounting. If your company uses cash basis accounting, the process is relatively simple: Deposit the tax credit refund into your bank account. Record the refund as a reduction in payroll tax expenses on your income statement.

What are the new rules for R&D credit?

Key Changes Impacting R&D Tax Credit Claims for 2024 Businesses electing special tax treatments (such as the reduced credit under Section 280C) must make specific disclosures. Starting in 2025, detailed project-level reporting is mandatory for businesses with over $1.5 million in Qualified Research Expenses (QREs).

What is the 80 rule for R&D tax credit?

Wages: The 80% Rule for Qualified Employees Under this rule, if an employee spends 80% or more of their time performing qualified R&D activities, the business can take 100% of that employee's wages as a qualified research expense (QRE) for R&D credit purposes.

What is the substantially all rule for research credits?

The “Substantially All” rule under Section 41 necessitates that the majority of a project's activities must qualify as research activities to be eligible for the R&D Tax Credit. This provision encourages extensive R&D endeavors, offering taxpayers the chance to claim credits for a wide array of qualifying activities.

What is the 25 25 rule for R&D credit?

Yes, under the TCJA, the "25/25 limitation" restricts C-corporations with over $25,000 in regular tax liability from offsetting more than 75% of their tax liability using the R&D tax credit.

What qualifies for research and development tax credit?

Who qualifies for the R&D credit? Any company engaged in activities to develop or improve products, processes, software, formulas, techniques or inventions in a way that required some level of technical experimentation to determine the most accurate and appropriate design may qualify for the R&D credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NEW JERSEY CORPORATION BUSINESS TAX RESEARCH AND DEVELOPMENT TAX CREDIT?

The New Jersey Corporation Business Tax Research and Development Tax Credit is a tax incentive program designed to encourage businesses to invest in research and development activities within the state. This credit allows corporations to claim a percentage of their qualified research expenses against their corporation business tax liability.

Who is required to file NEW JERSEY CORPORATION BUSINESS TAX RESEARCH AND DEVELOPMENT TAX CREDIT?

Corporations that engage in qualified research activities and have incurred eligible expenses in New Jersey are required to file for the Research and Development Tax Credit. This includes businesses that conduct research aimed at developing or improving products, processes, or software.

How to fill out NEW JERSEY CORPORATION BUSINESS TAX RESEARCH AND DEVELOPMENT TAX CREDIT?

To fill out the New Jersey Corporation Business Tax Research and Development Tax Credit, corporations must complete the relevant forms provided by the New Jersey Division of Taxation. This includes documenting eligible research expenses and providing necessary financial information to support their credit claim.

What is the purpose of NEW JERSEY CORPORATION BUSINESS TAX RESEARCH AND DEVELOPMENT TAX CREDIT?

The purpose of the New Jersey Corporation Business Tax Research and Development Tax Credit is to promote innovation and technological advancement within the state by reducing the tax burden on companies engaging in research and development activities, ultimately stimulating economic growth.

What information must be reported on NEW JERSEY CORPORATION BUSINESS TAX RESEARCH AND DEVELOPMENT TAX CREDIT?

Corporations must report information regarding their qualified research expenses, including wages paid to staff involved in R&D, costs of supplies used in the research process, and any contractor expenses related to the research activities. Detailed documentation supporting these claims is also required.

Fill out your new jersey corporation business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Jersey Corporation Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.