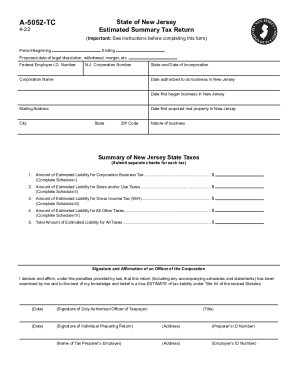

NJ A-5052-TC 2011 free printable template

Show details

A-5052-TC 5-11 R-15 STATE OF NEW JERSEY ESTIMATED SUMMARY TAX RETURN IMPORTANT See General Instructions on page 3 before completing this form Period Beginning Ending Proposed date of legal dissolution withdrawal merger etc. Federal Employer I. Other Taxes/Fees UI/DI etc.. TOTAL Estimated Fees and Other Taxes. Carry to Page 1 Line 4. Page 3 INSTRUCTIONS FOR COMPLETING FORM A-5052 This form must be filed with the Application for Tax Clearance Certi...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nj form a 5052

Edit your nj form a 5052 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nj form a 5052 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nj form a 5052 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nj form a 5052. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ A-5052-TC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nj form a 5052

How to fill out NJ A-5052-TC

01

Obtain the NJ A-5052-TC form from the New Jersey Division of Taxation website or your local tax office.

02

Enter your name and address at the top of the form.

03

Provide your Social Security Number or Tax Identification Number in the designated field.

04

Fill in the tax year you are reporting for.

05

Complete the income sections by reporting all applicable income sources.

06

Deduct any allowable expenses according to the instructions provided.

07

Calculate your total tax due or refund amount as instructed on the form.

08

Review your entries for accuracy.

09

Sign and date the form before submitting it.

10

Keep a copy of the completed form for your records.

Who needs NJ A-5052-TC?

01

Individuals who are required to report their income tax liability for New Jersey.

02

Taxpayers seeking to claim deductions or credits related to New Jersey taxes.

03

Residents and non-residents who earn income in New Jersey and need to file taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is alternative business income in New Jersey?

“Alternative business income or loss” is the sum (i) of the sum of the four categories of New Jersey business income and loss computed with intercategory loss netting plus (ii) any allowable loss carryforward. “Loss carryforward” is an alternative business loss to the extent it is not utilized in the current tax year.

Do I need to attach federal return to NJ return?

You must attach a copy of your Federal income tax return or a statement to that effect if you did not file a Federal return. NOTE: If you derived any income while a resident of New Jersey, it may also be necessary to file a New Jersey resident return.

Does New Jersey require you to file a tax return?

NJ Taxation Even minors (including students) and senior citizens must file if they meet the income filing requirements. Part-year residents are subject to tax and must file a return if their income for the entire year was more than the filing threshold amount for their filing status.

What is pass-through businesses tax?

What Is a Pass-through Business? A pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

Where can I get NJ state tax forms?

In Person – Visit the Regional Information Center nearest to you to pick up a copy of the forms and instructions. You must make an appointment as no walk-ins are allowed. Appointment times are 9:00 a.m. to 4:00 p.m. See link above to schedule an appointment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nj form a 5052 for eSignature?

To distribute your nj form a 5052, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find nj form a 5052?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific nj form a 5052 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit nj form a 5052 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign nj form a 5052 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is NJ A-5052-TC?

NJ A-5052-TC is a Tax Certification form used in New Jersey for reporting certain tax-related information, typically pertaining to credits or deductions.

Who is required to file NJ A-5052-TC?

Individuals or entities who claim specific tax credits or deductions in New Jersey are required to file NJ A-5052-TC.

How to fill out NJ A-5052-TC?

To fill out NJ A-5052-TC, taxpayers must provide their personal identification information, identify the applicable tax credits or deductions, and include any necessary supporting documentation.

What is the purpose of NJ A-5052-TC?

The purpose of NJ A-5052-TC is to formalize and certify claims for certain tax credits or deductions, ensuring compliance with state tax regulations.

What information must be reported on NJ A-5052-TC?

The information that must be reported on NJ A-5052-TC includes taxpayer identification details, the specific tax credits or deductions being claimed, and any relevant financial data or supporting documentation.

Fill out your nj form a 5052 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nj Form A 5052 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.