Get the free NJ-1080C - state nj

Show details

This document is used to file a composite income tax return for non-resident individuals participating in a New Jersey electing S corporation or partnership for the tax year 2006.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nj-1080c - state nj

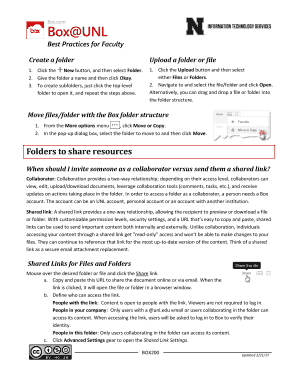

Edit your nj-1080c - state nj form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nj-1080c - state nj form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nj-1080c - state nj online

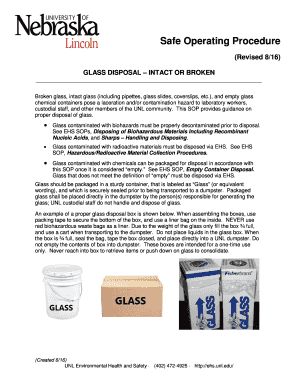

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nj-1080c - state nj. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nj-1080c - state nj

How to fill out NJ-1080C

01

Obtain Form NJ-1080C from the New Jersey Division of Taxation website or your local tax office.

02

Begin by entering your personal information, including your name, address, and Social Security number at the top of the form.

03

Provide information about your income sources, including wages, interest, and dividends, in the relevant sections.

04

Report any deductions you are eligible for to determine your taxable income.

05

Fill out the sections regarding credits to see if you qualify for any tax credits.

06

Calculate your total tax liability based on the information you provided.

07

Review your completed form for accuracy before submitting.

08

Submit Form NJ-1080C by the deadline, either electronically or by mailing it to the appropriate address.

Who needs NJ-1080C?

01

Individuals who have income earned in New Jersey and need to report it for tax purposes.

02

Residents of New Jersey who are required to file a New Jersey income tax return.

03

Taxpayers who are eligible for certain deductions and credits available on the NJ-1080C form.

Fill

form

: Try Risk Free

People Also Ask about

What is form nj 1080 c?

Amended Returns An amended Form NJ-1080-C must be filed if an amended federal return is filed for any filing entity, or if the Internal Revenue Service changes or corrects any item of income, gain, or loss previously reported.

How do I become a high school English teacher in New Jersey?

Education Requirements for Becoming an English Teacher in New Jersey Complete Your Education. The first step in teacher preparation is completion of an accredited teacher degree and preparation program. Pass Teaching Exams. Apply for a Teaching License. Continuing Education.

What is the income tax rate for seniors in New Jersey?

New Jersey is moderately tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 1.75%.

What is the minimum tax for a C Corp in NJ?

The minimum Corporation Business Tax is based on New Jersey gross receipts. It ranges from $500 for a corporation with gross receipts less than $100,000, to $2,000 for a corporation with gross receipts of $1 million or more. (p) Plus a Corporate Stocks Tax of 0.1875% for tax years 2022 & 2023.

Who must file a NJ corporate tax return?

Any corporation which incorporates, qualifies, or otherwise acquires a taxable status (nexus) in New Jersey must file a Corporation Business Tax (CBT) return. In general, this includes all domestic corporations.

How much do English teachers make in NJ?

The average salary for English teachers in New Jersey is around $70,000 per year, but it can vary based on experience and location. Some districts pay even more, especially in urban areas where the cost of living is higher. Speaking of the cost of living, New Jersey is known for being on the pricier side.

How much taxes does an LLC pay in NJ?

The profits generated by an LLC aren't taxed at the business level the way they are in C Corporations. Instead, taxes are as follows: Owners pay self-employment tax on business profits. Owners pay federal income tax on any profits, less allowances and deductions.

Do I need to file a NJ nonresident tax return?

You have to pay New Jersey tax on the income that you earn while you are working in New Jersey. It doesn't matter where your employer is located or where your permanent home is. You have to file a New Jersey nonresident tax return and pay NJ tax on the income that you earned while you worked in NJ.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NJ-1080C?

NJ-1080C is a New Jersey state tax form used by certain taxpayers to report income and calculate their New Jersey gross income tax.

Who is required to file NJ-1080C?

Taxpayers who are nonresidents or part-year residents of New Jersey and have income sourced from New Jersey are required to file NJ-1080C.

How to fill out NJ-1080C?

To fill out NJ-1080C, taxpayers should gather their income information, report their New Jersey-sourced income, deductions, and credits, then follow the instructions provided on the form.

What is the purpose of NJ-1080C?

The purpose of NJ-1080C is to enable nonresidents or part-year residents to report income earned in New Jersey and determine their tax liability.

What information must be reported on NJ-1080C?

NJ-1080C requires reporting of various types of income, including wages, business income, rental income, and other income, as well as any deductions and credits applicable.

Fill out your nj-1080c - state nj online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nj-1080c - State Nj is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.