Get the free Business Allocation Schedule - state nj

Show details

This form is used to report business locations and calculate the business allocation percentage for tax purposes for businesses operating inside and outside of New Jersey.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business allocation schedule

Edit your business allocation schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business allocation schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

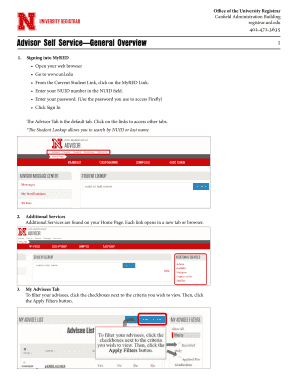

Editing business allocation schedule online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business allocation schedule. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

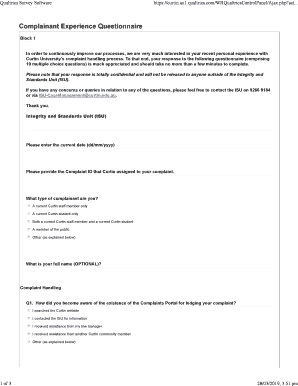

How to fill out business allocation schedule

How to fill out Business Allocation Schedule

01

Begin by gathering all necessary financial data related to your business operations.

02

Identify the different business activities and their respective income sources.

03

Allocate income and expenses to each business activity based on percentage or proportionate share.

04

Fill in the schedule form by entering the allocated amounts for each activity.

05

Ensure all figures are accurate and consistent with your accounting records.

06

Review the completed schedule for any errors or omissions.

07

Submit the Business Allocation Schedule as required by your tax authorities.

Who needs Business Allocation Schedule?

01

Businesses that are required to demonstrate the allocation of income and expenses across different activities.

02

Tax professionals who prepare tax returns or allocate resources for companies.

03

Compliance officers needing to ensure adherence to tax regulations.

04

Accountants managing multiple business units within a single organization.

Fill

form

: Try Risk Free

People Also Ask about

Is New Jersey a single factor apportionment?

Many years ago, the CBT apportionment formula (New Jersey calls it “allocation”) was an equally weighted three-factor formula of property, payroll, and sales ratios. The CBT has since moved, legislatively, to a hyper-weighted sales factor and then to a single sales factor.

What is the business allocation factor in New Jersey?

The allocation factor uses market-based sourcing, not cost of performance, to determine the portion of the business income sourced to New Jersey. The allocation factor is calculated using a single sales factor formula rather than a three-factor formula. See N.J.A.C. 18:7-7.1 through N.J.A.C.

What is New York's income allocation?

This means if you earned money from an employer and that income is not taxable to New York, you will need to manually allocate the New York income on your tax return to avoid being taxed on the same income in more than one state.

What is the business tax in New Jersey?

Although this tax is often called a franchise tax or privilege tax, \ it's known as the corporation business tax (CBT), in New Jersey. In 2023, New Jersey's corporate business tax rate ranges from 6.5% to 9% of a corporation's business income.

How to calculate NJ CBT tax?

NJ Taxation The Corporation Business Tax rate is 9% on adjusted entire net income or on the portion allocable to New Jersey. The rate is 7.5% for all corporations with entire net income of $100,000 or less. The rate is 6.5% for all corporations with entire net income of $50,000 or less.

What is the Ptet rate in New Jersey?

Pass-Through Business Alternative Income Tax Act Pass-Through Entity IncomeTax Rate First $250,000 5.675% Amount between $250,000 and $1 million 6.52% Amount between $1 million and $5 million 9.12% Amount over $5 million 10.9%

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Allocation Schedule?

Business Allocation Schedule is a form used by businesses to report the allocation of income, expenses, and other financial data among different locations or divisions for tax purposes.

Who is required to file Business Allocation Schedule?

Businesses that operate in multiple jurisdictions and need to allocate their income and expenses to determine the taxable income in each area are required to file the Business Allocation Schedule.

How to fill out Business Allocation Schedule?

To fill out the Business Allocation Schedule, a business must gather relevant financial information, report income and expenses by category, and allocate them according to the established criteria based on where the business activities occur.

What is the purpose of Business Allocation Schedule?

The purpose of the Business Allocation Schedule is to ensure that businesses accurately report their income and expenses, comply with tax regulations, and properly allocate amounts to the appropriate jurisdictions for tax analysis.

What information must be reported on Business Allocation Schedule?

The Business Allocation Schedule must report information such as total income, expenses, net profit or loss, allocation of income and expenses by jurisdiction, and any other necessary financial details required by tax authorities.

Fill out your business allocation schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Allocation Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.