Get the free Verification of 2007 and 2008 Property Taxes - state nj

Show details

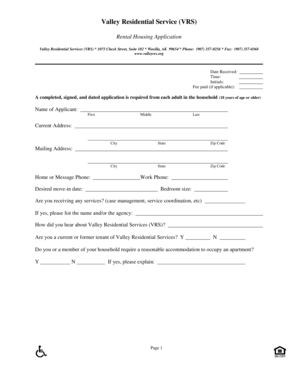

This form is used by homeowners to verify their property taxes for the years 2007 and 2008, including deductions and credits related to senior citizen status and veteran status.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verification of 2007 and

Edit your verification of 2007 and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verification of 2007 and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing verification of 2007 and online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit verification of 2007 and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out verification of 2007 and

How to fill out Verification of 2007 and 2008 Property Taxes

01

Gather all necessary documents, including your property tax statements for 2007 and 2008.

02

Locate the Verification form for 2007 and 2008 Property Taxes, which can usually be found on your local tax authority's website.

03

Fill in your personal information at the top of the form, including your name, address, and any identification numbers required.

04

Provide detailed information about the property, such as the property address and tax identification number.

05

Refer to your tax statements for 2007 and 2008 to accurately fill in the amounts of property taxes paid for each year.

06

Double-check all entries for accuracy to avoid any discrepancies.

07

Sign and date the form at the bottom, certifying that the information provided is true to the best of your knowledge.

08

Submit the completed form to the appropriate tax authority, either by mail or via their online submission portal.

Who needs Verification of 2007 and 2008 Property Taxes?

01

Homeowners who have paid property taxes on their property in the years 2007 and 2008.

02

Individuals applying for tax relief programs or seeking to verify property tax payments for those years.

03

Anyone involved in financial audits or assessments relating to property ownership during the specified years.

Fill

form

: Try Risk Free

People Also Ask about

At what age do you stop paying property taxes in the USA?

Most senior property tax exemption programs require applicants to be at least 65 years old. However, some jurisdictions offer benefits to those as young as 61, while others may require applicants to be 67 or older.

Do any states have no property tax for seniors?

Alabama is the only state that offers total property tax exemption to seniors 65 and up.

Are property taxes public record in Kansas?

Can others access my property tax records? ing to Kansas law, all property tax records are open public information.

What year did the local property tax start?

The Local Property Tax replaced the Household Charge which was abolished from 1 January 2013. Household Charge arrears that were not paid by 1 July 2013 were converted into LPT and are now collected by Revenue through the LPT system.

At what point do seniors stop paying taxes?

Taxes aren't determined by age, so you will never age out of paying taxes. People who are 65 or older at the end of 2025 have to file a return for that tax year (which is due in 2026) if their gross income is $16,550 or higher. If you're married filing jointly and both 65 or older, that amount is $32,300.

What year did property tax start in the USA?

Property taxes in the United States originated during colonial times. By 1796, state and local governments in fourteen of the fifteen states taxed land, but only four taxed inventory (stock in trade).

Who is exempt from paying property taxes in USA?

Common property tax exemptions include Veteran, Disabled Veteran, Homestead, Over 65 and more. Depending on where you live, you may be able to claim multiple property tax exemptions. Not all Veterans or homeowners qualify for these exemptions. Exemptions can vary by county and state.

Do property taxes go down after age 65?

A senior property tax exemption reduces the amount seniors 65 years of age or older have to pay in taxes on properties they own. Property taxes are quite possibly the most widely unpopular taxes in the U.S. And for retirees, they create a unique problem — as property taxes increase over time but incomes may not.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Verification of 2007 and 2008 Property Taxes?

Verification of 2007 and 2008 Property Taxes is a process by which property owners confirm the accuracy of the property tax assessments made during those years, ensuring that the property taxes owed are calculated correctly.

Who is required to file Verification of 2007 and 2008 Property Taxes?

Property owners who wish to contest or confirm their property tax assessments for the years 2007 and 2008 are required to file this verification.

How to fill out Verification of 2007 and 2008 Property Taxes?

To fill out the Verification, property owners need to provide their property details, including address, tax identification number, and any supporting documents that substantiate their claims about the tax assessments.

What is the purpose of Verification of 2007 and 2008 Property Taxes?

The purpose is to ensure that property taxes are assessed accurately and fairly, and to provide a means for property owners to dispute any discrepancies in their tax assessments.

What information must be reported on Verification of 2007 and 2008 Property Taxes?

The information that must be reported includes the property owner's name, property address, tax identification number, the amount of property tax assessed, and any relevant documentation that supports the claim for a verification.

Fill out your verification of 2007 and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verification Of 2007 And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.