Get the free Motor Home Insurance Application

Show details

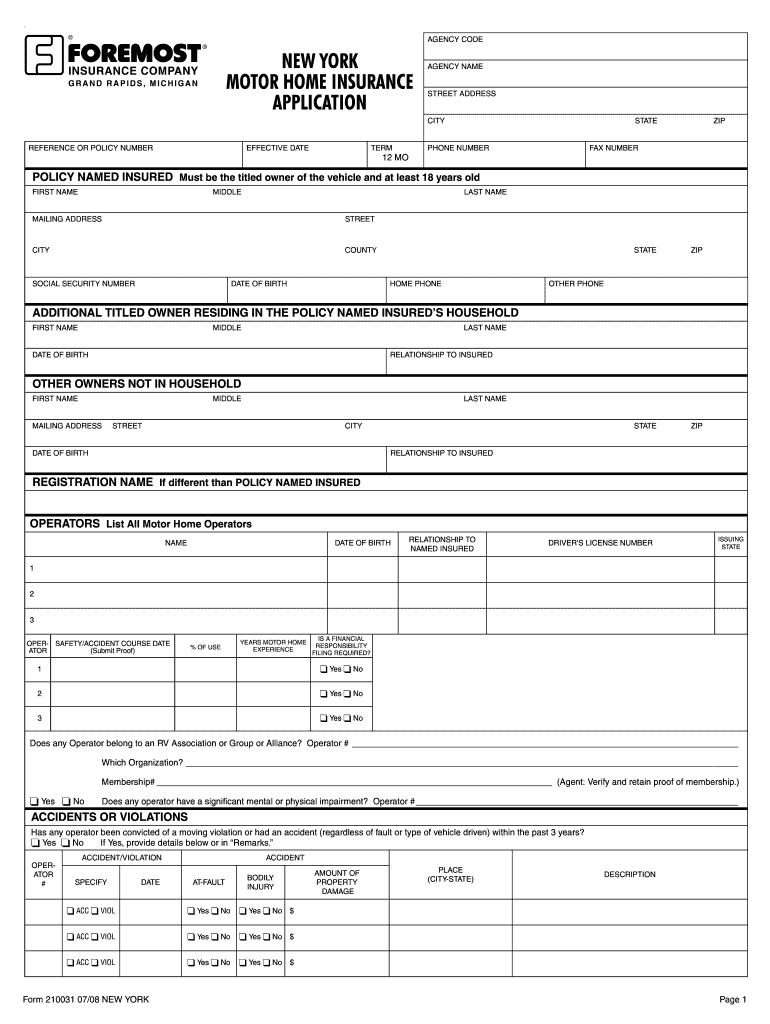

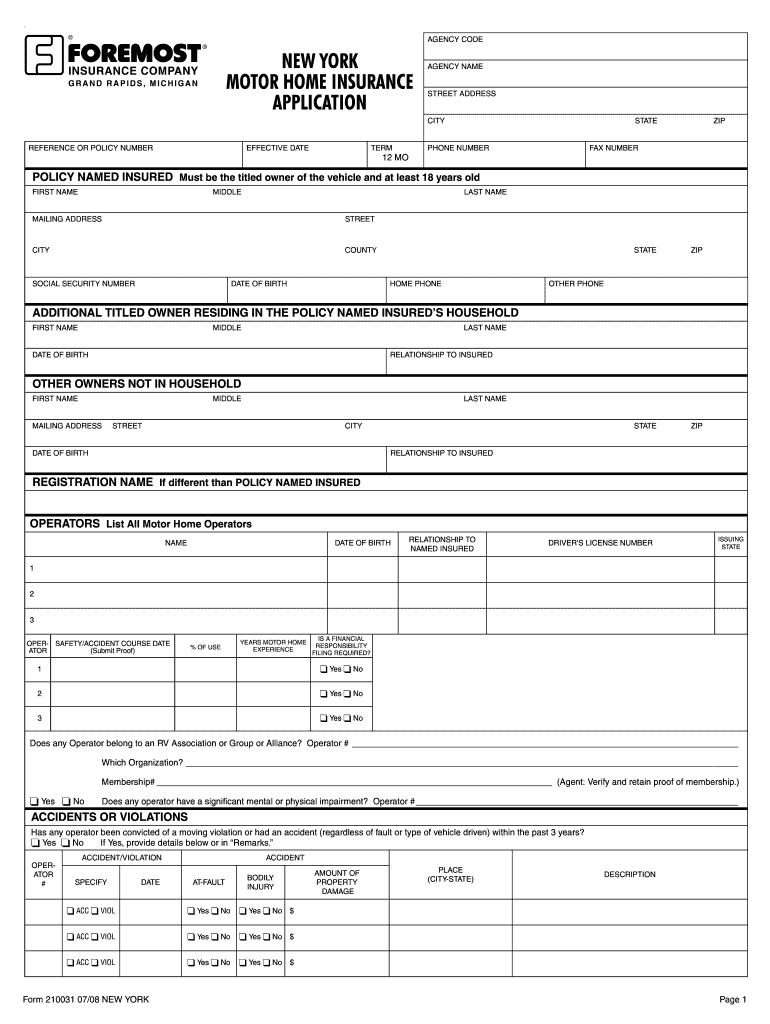

This application form is used to apply for motor home insurance in New York. It gathers personal details of the applicants, vehicle information, operator details, and coverage selections. It also

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor home insurance application

Edit your motor home insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor home insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit motor home insurance application online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit motor home insurance application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor home insurance application

How to fill out Motor Home Insurance Application

01

Gather necessary documents: Ensure you have your driver's license, vehicle title, and any previous insurance information.

02

Provide personal details: Fill in your name, address, and contact information on the application form.

03

Describe the motor home: Include the make, model, year, and Vehicle Identification Number (VIN) of your motor home.

04

Indicate usage: Specify how you plan to use the motor home (e.g., full-time living, vacation travel, etc.).

05

Select coverage options: Choose the type of coverage you want (e.g., liability, comprehensive, collision).

06

Provide additional information: Answer any questions regarding previous claims, driving history, and safety features.

07

Review the application: Double-check for any errors or missing information.

08

Submit the application: Send the completed application to your insurance provider.

Who needs Motor Home Insurance Application?

01

Individuals who own a motor home and want to protect their investment.

02

People who use their motor home for full-time living or extended travel.

03

Families who go on vacations and need coverage for their recreational vehicle.

04

Anyone looking to meet state insurance requirements for motor homes.

Fill

form

: Try Risk Free

People Also Ask about

Does AARP cover RV insurance?

AARP® Auto Insurance from The Hartford offers specialized protection for your RV, motorhome or trailer. No-cost, no-obligation quotes are available. You can customize your RV insurance policy with specialized coverages that will protect your home away from home.

How much is insurance for a Class A motorhome per month?

Average RV insurance cost RV insurance costs $500 to $1,500 per year on average, depending on the size, type, usage, and level of coverage you choose. The average RV insurance cost per month is $15 to $50 for a travel trailer, while insuring a self-propelled, Class A, luxury motorhome averages $50 to $200 per month.

Does State Farm offer motorhome insurance?

With the State Farm Personal Price Plan®, it doesn't matter if you're a newbie or full timer headed to California; whether in a motorhome, camper van or travel trailer – State Farm and Stephanie Canessa can help build a policy that works for you.

Can you get motorhome insurance?

It is a legal requirement to insure your motorhome – much like any other vehicle on the road – but standard car or van insurance won't cover it. You need a specialist motorhome insurance policy to cover a motorhome if you haven't declared it off the road.

What kind of insurance do you put on an RV?

Since nearly all states require liability coverage on a motor vehicle, you need RV bodily injury and property damage liability coverage before you can get behind the wheel of your motorhome.

Who has the best insurance for motorhomes?

Progressive RV insurance Progressive's RV insurance is a good fit for a number of vehicle and trailer-style recreational vehicles, including fifth-wheel, pop-ups, truck campers and Class A, B and C motorhomes. It also offers a large number of discounts for customers to save on their RV coverage.

Who is the best company for RV insurance?

Best RV insurance companies Best for affordability: Progressive. Best for part-time RVers: Good Sam. Best for discounts: Nationwide. Best for full-time RVers: Roamly. Best for total loss replacement: . Best for motorhomes: Allstate.

What does it cost to insure a motorhome?

RV insurance can cost about $125 per month on average depending on your RV and situation. Motorhome insurance for full-timers is typically more expensive than standard policies and can be as expensive as $3,000 per year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Motor Home Insurance Application?

A Motor Home Insurance Application is a document used to apply for insurance coverage specifically for motor homes, which are vehicles designed for living and traveling.

Who is required to file Motor Home Insurance Application?

Anyone who owns a motor home and wishes to obtain insurance coverage for it is required to file a Motor Home Insurance Application.

How to fill out Motor Home Insurance Application?

To fill out a Motor Home Insurance Application, gather necessary information such as personal details, motor home specifications, and coverage preferences. Complete the application form accurately and submit it to the insurance provider.

What is the purpose of Motor Home Insurance Application?

The purpose of the Motor Home Insurance Application is to provide insurance companies with the necessary information to assess the risk and determine the appropriate coverage and premiums for insuring the motor home.

What information must be reported on Motor Home Insurance Application?

The information that must be reported includes the owner's personal details, details about the motor home (make, model, year, VIN), usage information, coverage preferences, and any previous insurance claims.

Fill out your motor home insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Home Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.