Get the free RECORD OF AUDIT – PARK ATTENDANT/CARETAKER - corpslakes usace army

Show details

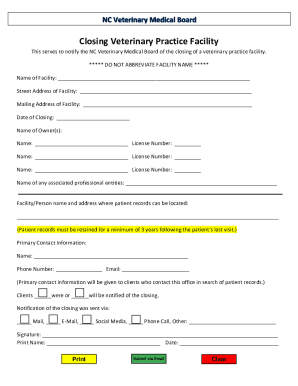

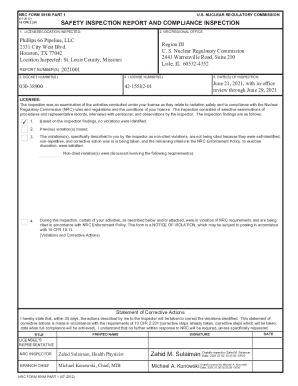

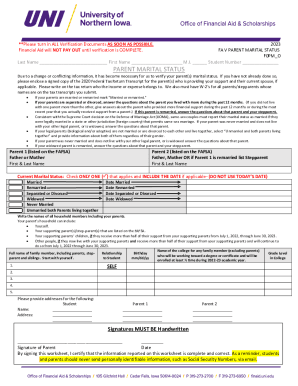

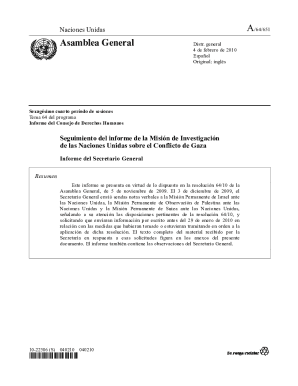

This document is used to conduct an audit of park attendants and caretakers, ensuring compliance with registration records, fees, and cleanliness, among other operational checks.

We are not affiliated with any brand or entity on this form

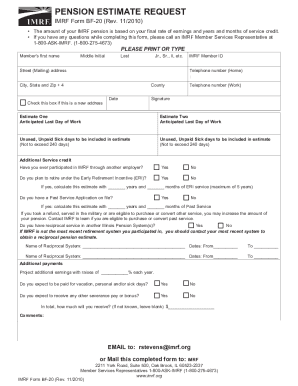

Get, Create, Make and Sign record of audit park

Edit your record of audit park form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your record of audit park form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing record of audit park online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit record of audit park. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out record of audit park

How to fill out RECORD OF AUDIT – PARK ATTENDANT/CARETAKER

01

Start with the date of the audit at the top of the record.

02

Fill in the name of the park or location being audited.

03

List the name of the park attendant/caretaker responsible for that period.

04

Define the time period of the audit (e.g., weekly, monthly).

05

Document specific tasks performed by the park attendant/caretaker during the audit period, such as maintenance, visitor assistance, and cleanup.

06

Include observations related to park conditions, such as cleanliness, safety issues, and visitor feedback.

07

Note any incidents or irregularities that occurred during the audit period.

08

Gather signatures from the park attendant/caretaker and the supervisor to validate the audit.

Who needs RECORD OF AUDIT – PARK ATTENDANT/CARETAKER?

01

Park management teams for monitoring and evaluation.

02

Local government agencies for compliance and reporting.

03

Environmental organizations to ensure park standards are met.

04

Park attendants/caretakers for personal accountability.

Fill

form

: Try Risk Free

People Also Ask about

What does IRS look for in audit?

An IRS audit is a review/examination of an organization's or individual's books, accounts and financial records to ensure information reported on their tax return is reported correctly ing to the tax laws and to verify the reported amount of tax is correct.

What triggers an audit from the IRS?

Not reporting all of your income is an easy-to-avoid red flag that can lead to an audit. Taking excessive business tax deductions and mixing business and personal expenses can lead to an audit. The IRS mostly audits tax returns of those earning more than $200,000 and corporations with more than $10 million in assets.

What happens if you are audited and found guilty?

If you are audited and found guilty of tax evasion or tax avoidance, you may face a fine of up to $100,000 and be guilty of a felony as provided under Section 7201 of the tax code.

What might cause you to get IRS audited?

Not reporting all of your income is an easy-to-avoid red flag that can lead to an audit. Taking excessive business tax deductions and mixing business and personal expenses can lead to an audit. The IRS mostly audits tax returns of those earning more than $200,000 and corporations with more than $10 million in assets.

What amount triggers an IRS audit?

Who Gets Audited the Most? Adjusted Gross IncomeAudit Rate $200,000-$500,000 0.1% $500,000-$1,000,000 0.3% 1,000,000-$5,000,000 0.5% $5,000,000-$10,000,000 1.4%7 more rows

Does the IRS look at your bank account during an audit?

The Short Answer: Yes. Share: The IRS probably already knows about many of your financial accounts, and the IRS can get information on how much is there. But, in reality, the IRS rarely digs deeper into your bank and financial accounts unless you're being audited or the IRS is collecting back taxes from you.

How to avoid an IRS audit?

How to Reduce Your Audit Risks File electronically and carefully avoid math errors. Include all income reported to you on your return. Carefully consider whether to deduct expenses for businesses that are chronically unprofitable. Keep records to substantiate your deductions.

What does an audit letter from the IRS look like?

An IRS audit letter typically contains the taxpayer's name, tax ID number, contact information, and a request for additional documentation to support claims on the tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RECORD OF AUDIT – PARK ATTENDANT/CARETAKER?

The RECORD OF AUDIT – PARK ATTENDANT/CARETAKER is a formal document used to track and report the activities, duties, and management of park attendants or caretakers in a specified area, ensuring proper oversight and accountability.

Who is required to file RECORD OF AUDIT – PARK ATTENDANT/CARETAKER?

Park attendants and caretakers who are responsible for the maintenance, safety, and operation of parks and recreational areas are required to file the RECORD OF AUDIT – PARK ATTENDANT/CARETAKER.

How to fill out RECORD OF AUDIT – PARK ATTENDANT/CARETAKER?

To fill out the RECORD OF AUDIT – PARK ATTENDANT/CARETAKER, individuals should accurately enter details such as the date, activities performed, hours worked, any incidents or issues encountered, and any maintenance tasks completed.

What is the purpose of RECORD OF AUDIT – PARK ATTENDANT/CARETAKER?

The purpose of the RECORD OF AUDIT – PARK ATTENDANT/CARETAKER is to maintain a comprehensive record of park management activities, ensuring transparency, accountability, and effective resource allocation.

What information must be reported on RECORD OF AUDIT – PARK ATTENDANT/CARETAKER?

Information that must be reported includes the date and time of duties performed, descriptions of tasks completed, incidents reported, maintenance activities conducted, and any observations related to park conditions.

Fill out your record of audit park online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Record Of Audit Park is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.