Get the free Outstanding Loan Information - uscg

Show details

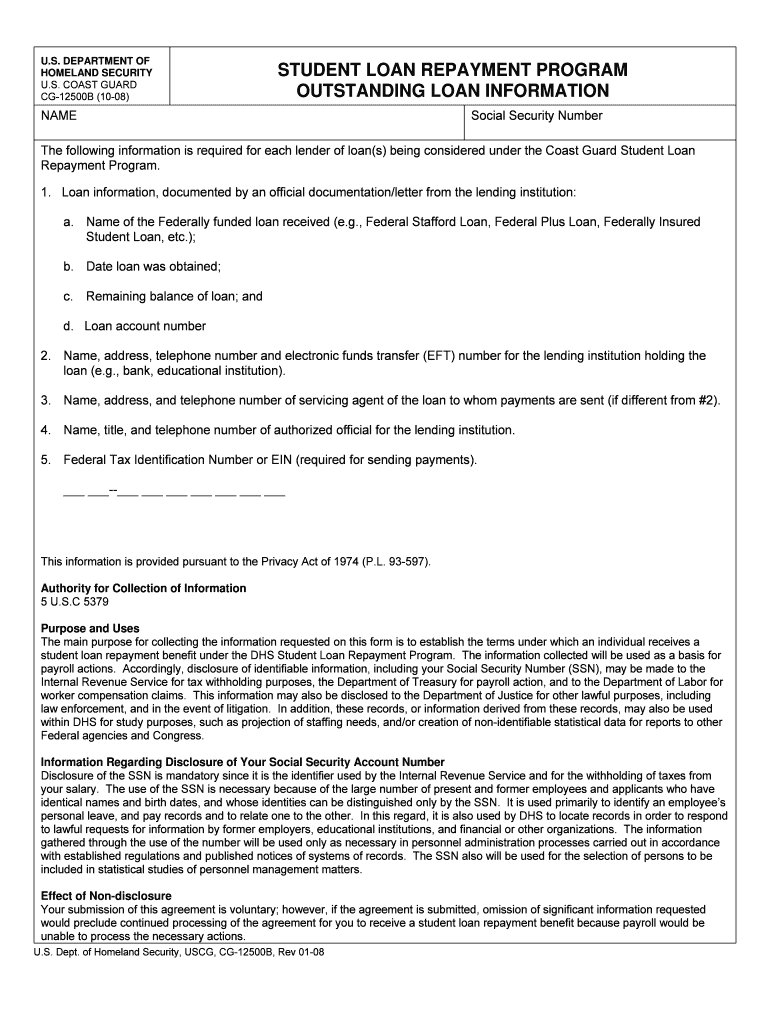

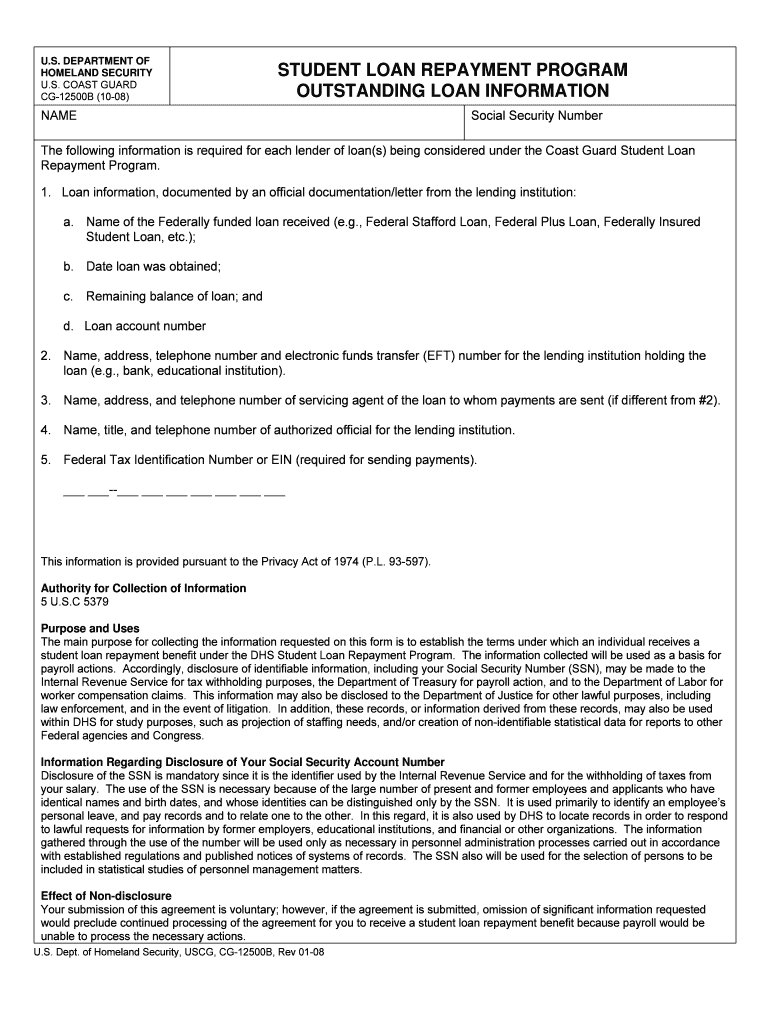

This document collects required loan information for individuals participating in the Coast Guard Student Loan Repayment Program, outlining terms and related lender details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign outstanding loan information

Edit your outstanding loan information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your outstanding loan information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit outstanding loan information online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit outstanding loan information. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out outstanding loan information

How to fill out Outstanding Loan Information

01

Gather your loan details including the original loan amount, current balance, interest rate, and payment terms.

02

Identify the lender's name and contact information.

03

Specify the purpose of the loan and any associated account numbers.

04

Provide any additional details such as payment history or loan status.

05

Review the completed Outstanding Loan Information for accuracy before submission.

Who needs Outstanding Loan Information?

01

Individuals applying for loans who need to provide proof of existing debt.

02

Lenders evaluating an applicant's financial situation.

03

Financial advisors assessing a client's overall debt management.

04

Individuals looking to consolidate or refinance existing loans.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of total loans outstanding?

Total Outstanding Loans means, as of any date of determination, the unpaid principal amount of all Loans outstanding hereunder.

What does "outstanding" mean in a loan?

An outstanding balance is the total amount still owed on a loan or credit card. An outstanding principal balance is the principal or original amount of a loan (i.e., the dollar amount initially loaned) that is still due and does not take into account the interest or any fees that are owed on the loan.

What is outstanding loan information?

The outstanding amount or balance on a personal loan refers to the total amount you still owe to the lender, including the remaining principal and any accrued interest, as well as any additional charges such as late fees. This figure represents your current financial obligation on the loan.

What are outstanding student loans?

REPAYING LOANS. Outstanding principal refers to the remaining amount of the original loan, plus any capitalized interest.

What do outstanding student loans mean?

An outstanding balance refers to money due that has not yet been paid. When a customer or debtor fails to settle or settles only part of the payment due, the remainder becomes the outstanding balance. Outstanding balances are recorded in various financial documents including accounts receivable and accounts payable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Outstanding Loan Information?

Outstanding Loan Information refers to the details regarding loans that are currently unpaid or have remaining balances. This information typically includes loan amounts, interest rates, payment schedules, and the status of the loans.

Who is required to file Outstanding Loan Information?

Entities such as financial institutions, organizations extending loans, and sometimes individuals in certain jurisdictions may be required to file Outstanding Loan Information to comply with regulatory requirements.

How to fill out Outstanding Loan Information?

To fill out Outstanding Loan Information, gather the required details about each loan, such as loan amount, lender information, payment history, and current status. Complete the designated form accurately, ensuring all sections are filled out and all required documents are attached.

What is the purpose of Outstanding Loan Information?

The purpose of Outstanding Loan Information is to provide a clear record of current outstanding debts, which is essential for regulatory compliance, financial assessments, and managing risk within financial systems.

What information must be reported on Outstanding Loan Information?

The information that must be reported typically includes the borrower's name, loan type, loan amount, interest rate, original loan date, current balance, payment status, and any relevant notes regarding the loan.

Fill out your outstanding loan information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Outstanding Loan Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.