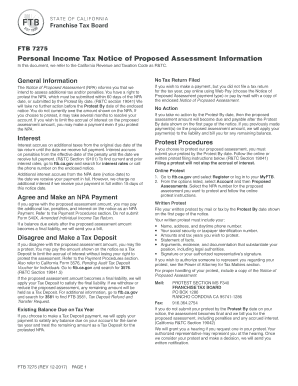

CA FTB 7275 2010 free printable template

Show details

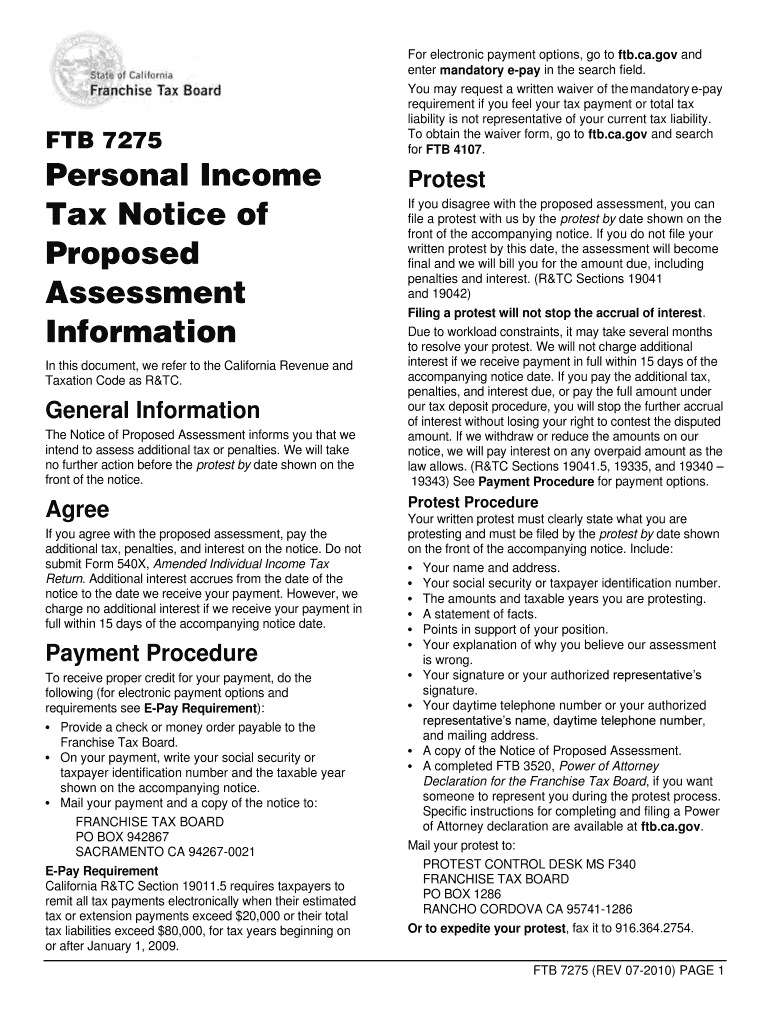

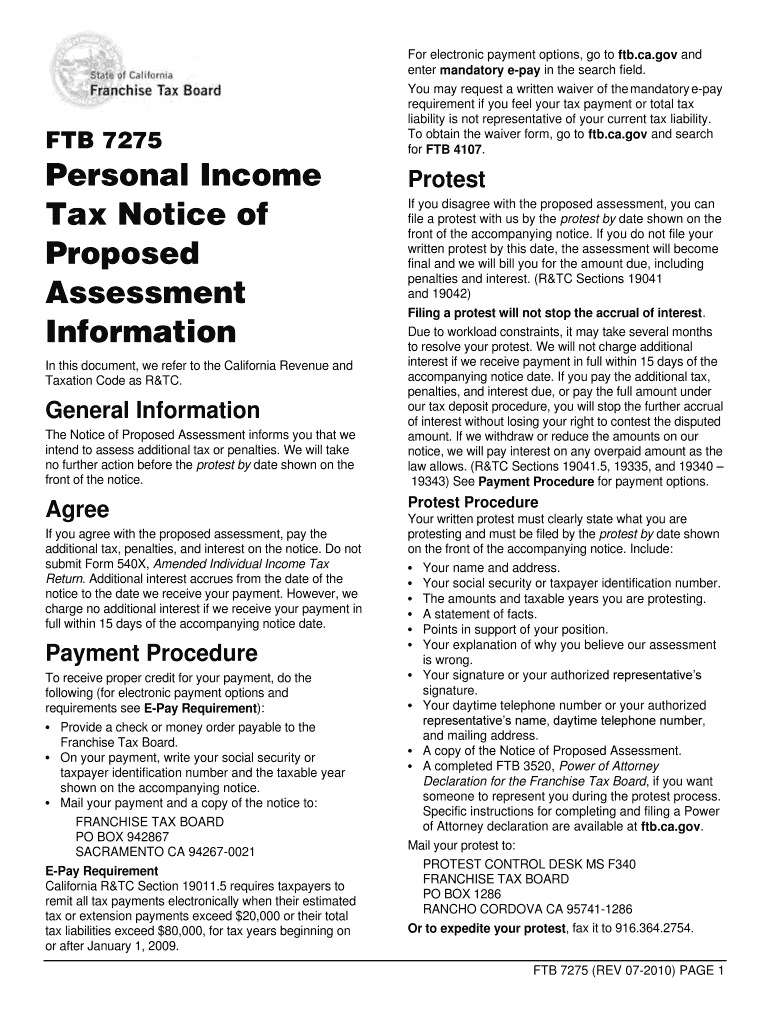

Do not submit Form 540X, Amended Individual Income Tax. Return. Additional interest accrues from the date of the notice to the date we receive your payment. ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ftb 7275 sample letter

Edit your ftb 7275 sample letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb 7275 sample letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ftb 7275 sample letter online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ftb 7275 sample letter. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 7275 Form Versions

Version

Form Popularity

Fillable & printabley

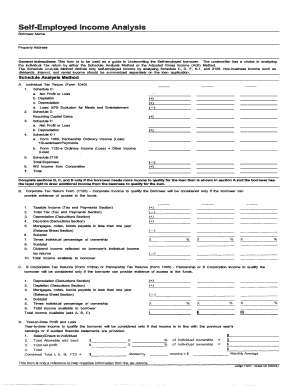

How to fill out ftb 7275 sample letter

How to fill out CA FTB 7275

01

Obtain the CA FTB 7275 form from the California Franchise Tax Board website or a tax resource.

02

Fill in your personal information at the top of the form, including your name, Social Security number, and address.

03

Indicate the tax year for which you are submitting the form.

04

Complete the sections related to your income, deductions, and any credits applicable to your situation.

05

Carefully review your entries for accuracy.

06

Sign and date the form at the bottom.

07

Submit the form either electronically through the FTB’s website or by mailing it to the specified address on the form.

Who needs CA FTB 7275?

01

Individuals or entities that are required to report certain tax information to the California Franchise Tax Board.

02

Taxpayers who are claiming specific deductions or credits that necessitate the use of CA FTB 7275.

Fill

form

: Try Risk Free

People Also Ask about

What does notice of tax return change no balance mean?

IRS Notice CP 13/CP 13A - Changes to Tax Return, No Refund and No Balance Due. The IRS has made changes to your tax return and there is nothing owed or no refund based on the adjustment (CP 13A involves changes to the Earned Income Credit). The notice explains the changes to the tax return (and/or Earned Income Credit)

How do I get a non filing letter from FTB?

This letter is available after June 15 for the current tax year or anytime for the prior three tax years using Get Transcript Online or Form 4506-T. You must use Form 4506-T if you need a letter for tax years older than the prior three years.

Is a letter from FTB legit?

If you receive a suspicious or unsolicited text message claiming to be from FTB, do not respond or click on any links, as the text may be a phishing scam. A phishing text may ask for: Usernames.

What does a notice of tax return change mean?

You receive this notice when we correct one or more mistakes on your tax return. The information is only for the tax year printed at the top of the notice.

Why am I getting a letter from the California Franchise Tax Board?

The Franchise Tax Board will send a notice or letter for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

What does a tax of return change no balance mean?

IRS Notice CP 13/CP 13A - Changes to Tax Return, No Refund and No Balance Due. The IRS has made changes to your tax return and there is nothing owed or no refund based on the adjustment (CP 13A involves changes to the Earned Income Credit). The notice explains the changes to the tax return (and/or Earned Income Credit)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my ftb 7275 sample letter in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your ftb 7275 sample letter right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit ftb 7275 sample letter on an iOS device?

Create, edit, and share ftb 7275 sample letter from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Can I edit ftb 7275 sample letter on an Android device?

With the pdfFiller Android app, you can edit, sign, and share ftb 7275 sample letter on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is CA FTB 7275?

CA FTB 7275 is a form used by the California Franchise Tax Board (FTB) to report certain information related to the tax obligations of non-profit organizations, especially regarding their tax-exempt status.

Who is required to file CA FTB 7275?

Organizations that are operating as non-profits in California and are seeking or maintaining tax-exempt status are required to file CA FTB 7275.

How to fill out CA FTB 7275?

To fill out CA FTB 7275, organizations need to provide their identifying information, such as the tax ID, along with details about their activities, financial information, and compliance with tax regulations as instructed on the form.

What is the purpose of CA FTB 7275?

The purpose of CA FTB 7275 is to facilitate the reporting of information necessary to determine and maintain the tax-exempt status of non-profit organizations in California.

What information must be reported on CA FTB 7275?

Information that must be reported on CA FTB 7275 includes the organization's name, address, tax identification number, financial statements, a list of the activities performed, and details relevant to their compliance with tax-exempt requirements.

Fill out your ftb 7275 sample letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb 7275 Sample Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.