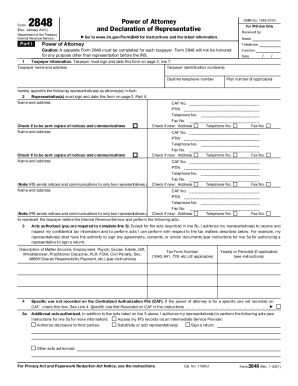

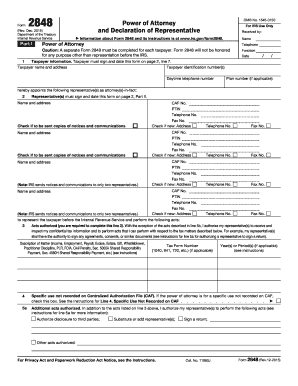

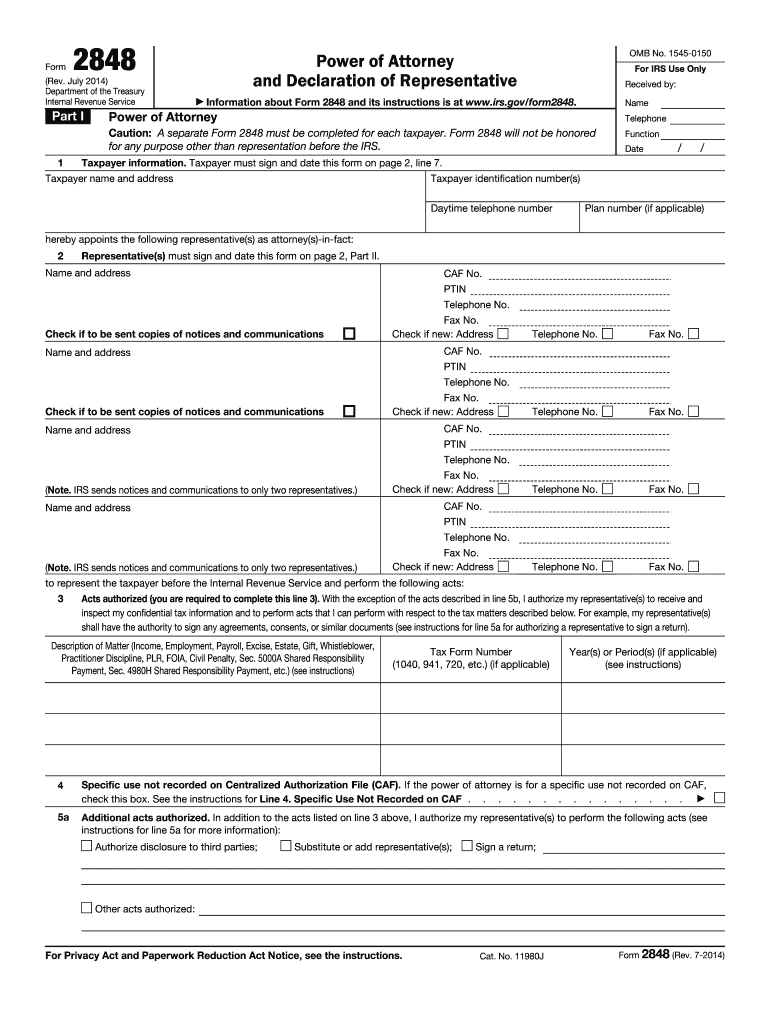

IRS 2848 2014 free printable template

Instructions and Help about IRS 2848

How to edit IRS 2848

How to fill out IRS 2848

About IRS 2 previous version

What is IRS 2848?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 2848

What should I do if I realize I've made a mistake on my already submitted 2848 2014 form?

If you've submitted the 2848 2014 form and notice an error, you can file an amended or corrected form. It's essential to clearly indicate that the new submission is a correction and provide accurate information. Retain copies of both the original and amended forms for your records.

How can I check the status of my filed 2848 2014 form?

You can verify the receipt and processing status of your submitted 2848 2014 form by contacting the IRS directly or using their online tools, if available. Ensure you have your confirmation details handy, such as submission date and form copies.

What should I do if my e-filed 2848 2014 form gets rejected?

In the case of a rejection, the IRS typically provides a reason for the rejection that you can address. Review the specific rejection codes and rectify the issues before resubmitting the 2848 2014 form electronically to avoid further complications.

Are there specific legal or operational issues I should be aware of when filing the 2848 2014 form electronically?

When electronically filing the 2848 2014 form, ensure you are aware of the notice on e-signatures, as they are generally accepted. Also, it's crucial to maintain privacy and data security throughout the process, particularly with sensitive information.

What are some common errors to avoid when filing the 2848 2014 form?

Common errors when submitting the 2848 2014 form include incorrect identification numbers or failure to sign the form. Double-checking the details and ensuring you meet all requirements can significantly reduce the likelihood of submission issues.

See what our users say