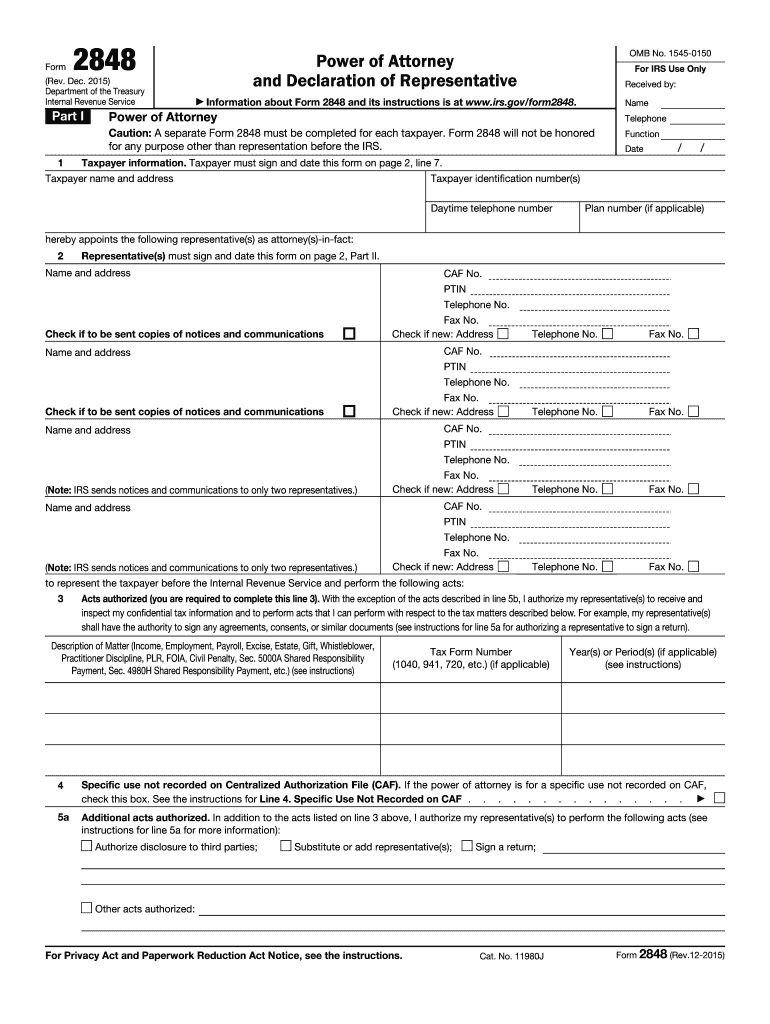

IRS 2848 2015 free printable template

Instructions and Help about IRS 2848

How to edit IRS 2848

How to fill out IRS 2848

About IRS 2 previous version

What is IRS 2848?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 2848

What should I do if I made a mistake on my form 2848 2015 after submitting it?

If you realize that you've made an error on your form 2848 2015 after it has been submitted, you will need to submit a corrected version. Be sure to indicate that this is an amended form and clearly state the corrections made. It's recommended to contact the IRS to confirm that they received your amendment.

How can I verify if my form 2848 2015 has been processed?

To check the status of your form 2848 2015, you can contact the IRS directly or use the IRS online tools available for checking the status of filings. Keep your submission details at hand for reference while inquiring.

Are there special considerations for filing form 2848 2015 for nonresidents?

Yes, nonresidents must ensure that their information is accurately reflected on form 2848 2015 and that they comply with IRS regulations related to foreign payees. It may also be beneficial to consult a tax professional for specific guidance.

What common errors should I watch out for when submitting form 2848 2015?

Some common errors include missing signatures, incorrect taxpayer identification numbers, and not specifying the exact tax matters involved. Review your form carefully before submission to avoid these issues.

Is electronic filing of form 2848 2015 subject to service fees?

While e-filing form 2848 2015 is typically free through IRS services, some third-party e-filing software may charge service fees. Always check the pricing structure of the software you choose to use.

See what our users say