Get the free REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT - washington

Show details

Este formulario se utiliza para establecer los saldos de licencia anual y licencia por enfermedad, y la tasa de acumulación de licencia anual para empleados que se trasladan a empleo en la Universidad

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for crediting of

Edit your request for crediting of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for crediting of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for crediting of online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit request for crediting of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

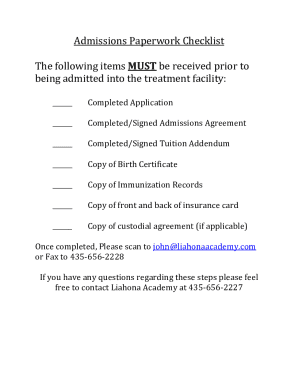

How to fill out request for crediting of

How to fill out REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT

01

Obtain the REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT form.

02

Fill out personal information, including your full name, Social Security number, and contact details.

03

Provide details of previous employment in Washington State, including employer names, job titles, and dates of employment.

04

Gather supporting documentation, such as pay stubs or tax records, to verify your previous employment.

05

Review the completed form for accuracy and completeness.

06

Submit the form and any required documentation to the appropriate state agency.

Who needs REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT?

01

Individuals who have previous employment in Washington State and are seeking to have that service credited for benefits or retirement.

02

Employees who have transitioned between state jobs and need to consolidate their employment history.

03

Job seekers looking to utilize previous state employment to qualify for certain programs or benefits.

Fill

form

: Try Risk Free

People Also Ask about

Does an employer have to pay out unused sick leave in Washington state?

Paid sick leave balances generally do not have to be cashed out or paid when employment ends, unless another state law or a collective bargaining agreement requires it. However, certain workers in the construction industry must receive pay for the balance of their paid sick leave following separation from employment.

Does sick leave transfer to a new employer in Washington state?

Transfer between state of Washington employers If transferring without a break in service from or to a public school or educational service district, employees can transfer their sick time off balance. “Transfer” means moving from one qualifying employer to another qualifying employer without a break in service.

Does sick leave transfer between agencies?

Only leave in whole hour units may be transferred between Federal agencies. Fractional hours of leave are transferable within the Department as long as the gaining organization has a reciprocal leave usage policy; otherwise, they must be forfeited.

How to report new hires in Washington state?

Although we prefer you to report online, you may fax, mail or call in the information. If you chose to fax, you may send W-4 forms, computer printouts, other lists (except I-9 forms), or use our New Hire Reporting Form (DSHS form 18-463).

Does Washington State sick leave rollover?

One of the more unique components of Washington's Paid Sick Leave Law, employers may not “cap” the number of hours that employees can accrue in a given year. In addition, employees must be allowed to carry over a minimum 40 hours of paid sick leave from one year to the next.

What forms are required for new hires in Washington state?

New Hire Paperwork W-4 - send a copy to DES Payroll. W-4 - Spanish version - send a copy to DES Payroll. I-9 Form (I-9 Instructions) - keep at agency. PERS Retirement Status - send a copy to DES Payroll. Direct Deposit Form - send a copy to DES Payroll.

What happens to sick leave when you resign Washington State?

Paid sick leave balances are not required to be reinstated if they are paid in full to the employee when employment ends. Paid sick leave balances generally do not have to be cashed out or paid when employment ends, unless another state law or a collective bargaining agreement requires it.

Can I transfer my sick leave to another employee?

You cannot give your sick leave to someone else. Your link has to do with an individual being advanced sick leave for themselves, after using all of theirs. Not giving banked hours to another employee.

What is the 7 minute rule in Washington state?

The seven-minute rule allows employers to round employee time to the nearest quarter-hour. The seven-minute rule is a payroll rule that allows employers to round down employee time of 1-7 minutes. However, employee work time of 8-14 minutes must be rounded up and counted as a quarter-hour of work.

Is new hire reporting mandatory?

California. All employers must report new hires, rehires, and contractors being paid over $600 within 20 days via Form W-4 or state equivalent form. Employers submit this paperwork to the California Employment Development Department.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

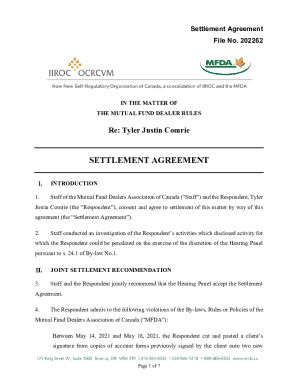

What is REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT?

REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT is a formal application process that allows individuals to request recognition and credit for their previous employment history within the state of Washington for purposes such as pension benefits or employment verification.

Who is required to file REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT?

Individuals who have previously worked in Washington State and wish to have their past employment credited towards certain benefits are required to file this request. This typically includes state employees or those in positions covered by specific pension plans.

How to fill out REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT?

To fill out the REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT, individuals must provide personal identification information, details about their previous employment, including dates of service, job titles, and the names of employers, along with any required supporting documentation.

What is the purpose of REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT?

The purpose of REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT is to enable individuals to formally acknowledge and obtain credit for their past employment in Washington State, which may affect their retirement benefits, eligibility for certain positions, or other employment-related qualifications.

What information must be reported on REQUEST FOR CREDITING OF PREVIOUS WASHINGTON STATE EMPLOYMENT?

The information that must be reported includes the individual's personal identification details, a comprehensive record of all previous employment in Washington State, including start and end dates, job titles, employers' contact information, and any additional documentation requested by the agency processing the request.

Fill out your request for crediting of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Crediting Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.