Get the free PA SCHEDULE UE

Show details

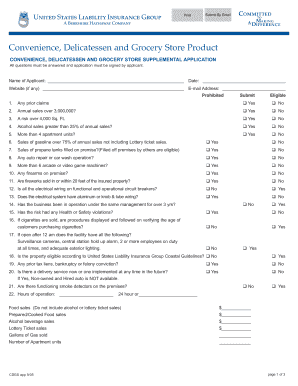

Este formulario permite a los contribuyentes en Pennsylvania reclamar gastos comerciales permitidos incurridos como empleados. Incluye secciones para gastos directos, gastos de viaje comerciales,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pa schedule ue

Edit your pa schedule ue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa schedule ue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pa schedule ue online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pa schedule ue. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pa schedule ue

How to fill out PA SCHEDULE UE

01

Begin by gathering all necessary tax documents, including your income statements and any relevant deductions.

02

Obtain the PA SCHEDULE UE form from the Pennsylvania Department of Revenue website or your tax preparation software.

03

Fill out your personal information at the top of the form, including your name, Social Security number, and address.

04

In the income section, report all eligible unreimbursed employee business expenses.

05

Include details of the expenses in the corresponding sections, making sure to categorize them accurately, such as travel, meals, and supplies.

06

Calculate the total expenses for all categories and enter the total on the form.

07

Review your entries for accuracy and completeness.

08

Sign and date the form before submitting it along with your PA tax return.

Who needs PA SCHEDULE UE?

01

Employees who incur unreimbursed business expenses related to their job duties.

02

Individuals who need to report these expenses to claim deductions on their Pennsylvania state tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is a PA schedule GL?

Use PA Schedule G-L to calculate and report the amount of resident credit claimed for income tax, wage tax or other tax (measured by gross or net earned or unearned income) paid to another state when the other state imposes its tax on income also subject to PA personal income tax in the same taxable year.

What is a PA schedule GL?

Use PA Schedule G-L to calculate and report the amount of resident credit claimed for income tax, wage tax or other tax (measured by gross or net earned or unearned income) paid to another state when the other state imposes its tax on income also subject to PA personal income tax in the same taxable year.

What is Pennsylvania schedule UE?

You can claim a deduction for an unreimbursed employee business expense by filing a PA Schedule UE, Allowable Employee Business Expenses form along with your PA-40 Personal Income Tax Return.

What is the PA Schedule E?

The PA Schedule E should reflect what is reported on federal Form 8825, Rental Real Estate Income and Expenses of a Partnership or S Corporation. For each rental real estate property (e.g., townhouse) and/or royalty income (e.g., mineral extracts), enter street address, city or town, and state and the type of property.

What is PA schedule E?

The PA Schedule E should reflect what is reported on federal Form 8825, Rental Real Estate Income and Expenses of a Partnership or S Corporation. For each rental real estate property (e.g., townhouse) and/or royalty income (e.g., mineral extracts), enter street address, city or town, and state and the type of property.

Are unreimbursed employee expenses still allowed?

Unreimbursed employee expenses were once broadly deductible for W-2 employees, but the Tax Cuts and Jobs Act of 2017 suspended the deductions for most workers from 2018 to 2025.

What is schedule ue TurboTax?

The Schedule UE is for Unreimbursed Employee Expenses. Go back to FEDERAL TAXES Deductions & Credits. Delete any Job Related Expenses. Then go to How do I view and delete forms in TurboTax Online? and Delete the Schedule UE in the state forms.

What is a PA schedule UE?

You can claim a deduction for an unreimbursed employee business expense by filing a PA Schedule UE, Allowable Employee Business Expenses form along with your PA-40 Personal Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PA SCHEDULE UE?

PA SCHEDULE UE is a form used by individuals in Pennsylvania to report and claim expenses related to unreimbursed employee business expenses.

Who is required to file PA SCHEDULE UE?

Employees who incur unreimbursed expenses related to their job and wish to claim these on their Pennsylvania tax return are required to file PA SCHEDULE UE.

How to fill out PA SCHEDULE UE?

To fill out PA SCHEDULE UE, taxpayers must provide details about their employment, itemized expenses, and any other income-related information as detailed in the form's instructions.

What is the purpose of PA SCHEDULE UE?

The purpose of PA SCHEDULE UE is to allow taxpayers to deduct eligible unreimbursed employee business expenses from their taxable income, thereby reducing their overall tax liability.

What information must be reported on PA SCHEDULE UE?

PA SCHEDULE UE requires reporting of various types of expenses such as travel, meals, supplies, and other costs incurred while performing job duties that were not reimbursed by an employer.

Fill out your pa schedule ue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa Schedule Ue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.