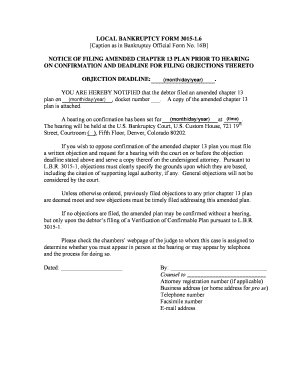

Get the free A fillable chapter 13 plan form - laeb uscourts

Show details

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF LOUISIANA CHAPTER 13 PLAN I. Original Plan (1st, 2nd, etc.) Amended Plan (All changes shall be in bold face type) Relevant Information A. As used

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a chapter 13 plan

Edit your a chapter 13 plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a chapter 13 plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing a chapter 13 plan online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit a chapter 13 plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a chapter 13 plan

How to fill out a chapter 13 plan:

01

Gather all necessary financial information, including income, expenses, assets, and debts.

02

Calculate your disposable income, which is the amount you can realistically put towards your debts each month.

03

Determine a feasible repayment plan, considering your disposable income and the length of the repayment period.

04

List all your debts and categorize them according to priority, such as secured debts (mortgage, car loans) and unsecured debts (credit card debt, medical bills).

05

Allocate your disposable income towards these different categories, ensuring that the higher priority debts receive the necessary funds.

06

Make sure to include details about how your secured debts will be paid, such as directly to the lender or through the bankruptcy trustee.

07

Provide a detailed explanation of the repayment plan, including the monthly payment amount, duration, and interest rates, if applicable.

08

Complete any additional forms or schedules required by your local bankruptcy court or trustee.

09

Review and double-check all information in the chapter 13 plan for accuracy and completeness.

10

Sign and date the plan before submitting it to the bankruptcy court for approval.

Who needs a chapter 13 plan:

01

Individuals or married couples who are facing financial difficulties but have a regular income source.

02

Those who wish to retain their assets, such as a house or car, and repay their debts over time.

03

Individuals who want to halt foreclosure proceedings and catch up on missed mortgage payments.

04

People who have non-exempt property (assets that may not be protected by bankruptcy exemptions) and wish to keep them.

05

Those who want to reorganize their debts and obtain more manageable repayment terms while protected from creditor actions.

06

Debtors who do not qualify for chapter 7 bankruptcy due to their income being above the state median or failing the means test.

Overall, individuals who need a chapter 13 plan are typically looking for a structured and feasible repayment plan that allows them to reorganize their debts while retaining their assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my a chapter 13 plan in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your a chapter 13 plan and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit a chapter 13 plan on an Android device?

You can make any changes to PDF files, like a chapter 13 plan, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out a chapter 13 plan on an Android device?

Use the pdfFiller mobile app to complete your a chapter 13 plan on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is a chapter 13 plan?

A chapter 13 plan, also known as a repayment plan, is a legal document that outlines how a debtor will repay their debts over a period of three to five years. It is a key component of filing for bankruptcy under Chapter 13 of the United States Bankruptcy Code.

Who is required to file a chapter 13 plan?

Individual debtors with a regular income and noncontingent, liquidated, unsecured debts less than $419,275, and secured debts less than $1,257,850, are required to file a chapter 13 plan if they want to pursue debt repayment through Chapter 13 bankruptcy.

How to fill out a chapter 13 plan?

Filling out a chapter 13 plan involves providing detailed information about your finances, including your income, expenses, debts, assets, and proposed repayment plan. It is recommended to consult with an attorney or use online resources to ensure accurate and complete filling of the plan.

What is the purpose of a chapter 13 plan?

The purpose of a chapter 13 plan is to allow individuals with regular incomes to reorganize their debts and create a manageable repayment plan. It provides an opportunity to repay creditors over time while keeping important assets, such as a home or a car, and avoiding foreclosure or repossession.

What information must be reported on a chapter 13 plan?

A chapter 13 plan requires reporting information such as the debtor's income, expenses, debts, assets, exemptions, creditor claims, proposed repayment schedule, and any additional provisions or modifications required.

Fill out your a chapter 13 plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Chapter 13 Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.