Get the free Petition for Payment of Unclaimed Funds - rib uscourts

Show details

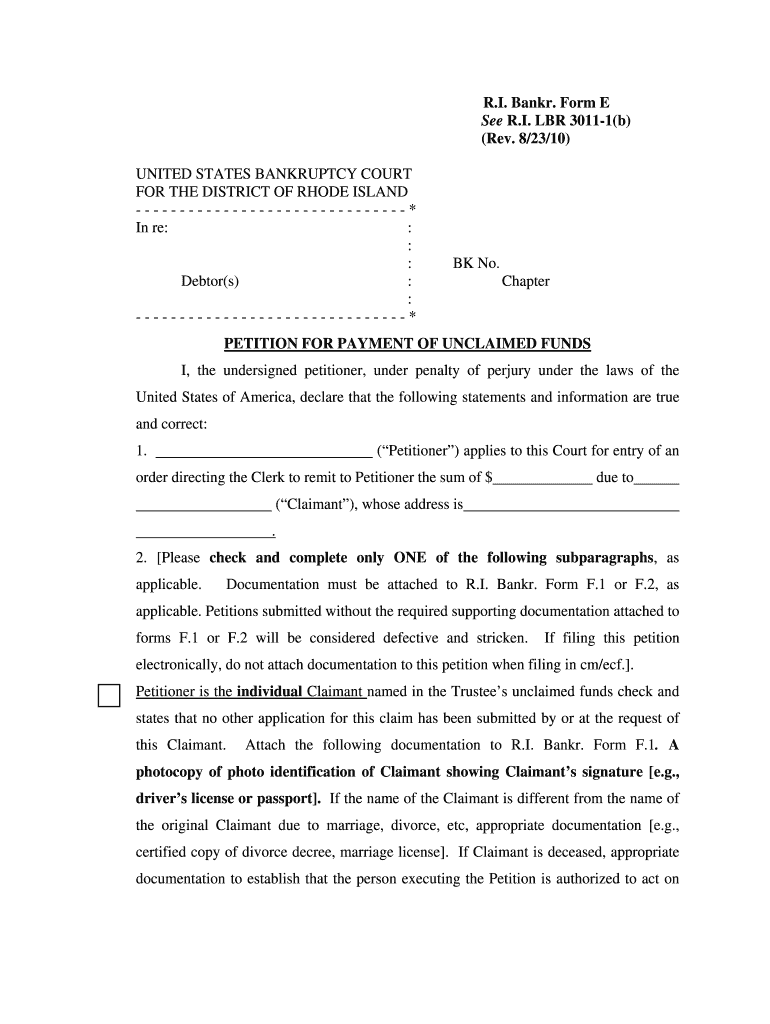

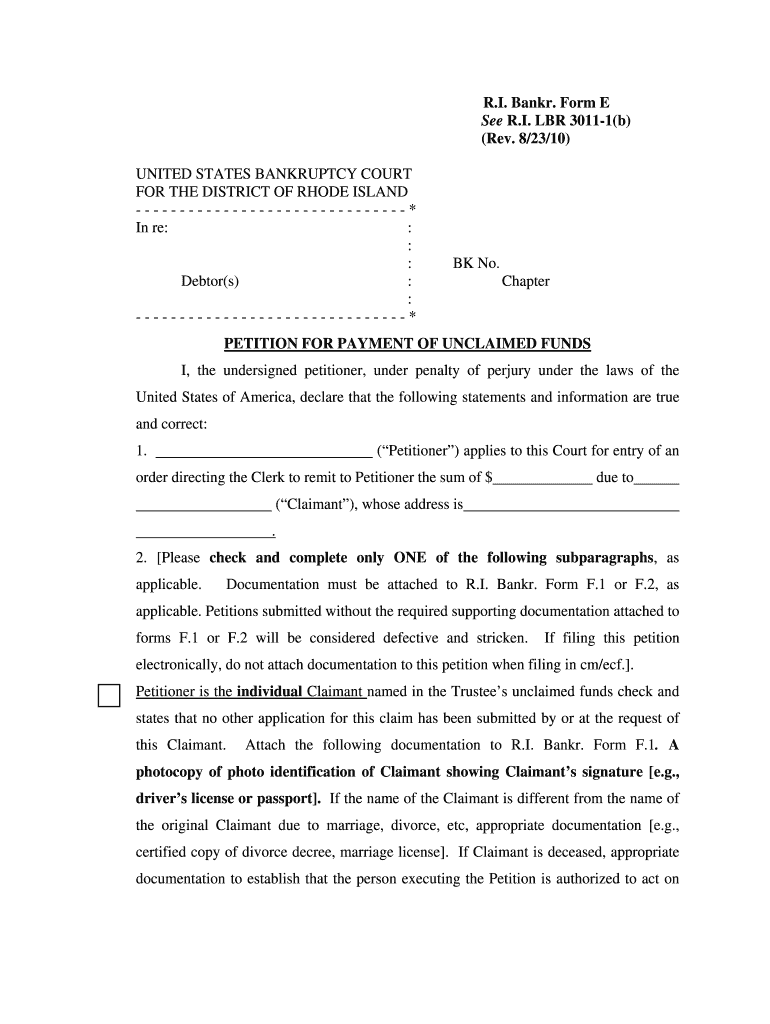

This document is a petition submitted to the U.S. Bankruptcy Court for the District of Rhode Island for the remittance of unclaimed funds to the petitioner, outlining the necessary requirements and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petition for payment of

Edit your petition for payment of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petition for payment of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petition for payment of online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit petition for payment of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petition for payment of

How to fill out Petition for Payment of Unclaimed Funds

01

Gather necessary information: Collect all required documentation such as identification, proof of ownership, and details about the unclaimed funds.

02

Obtain the petition form: Download or request the Petition for Payment of Unclaimed Funds form from the relevant authority or website.

03

Fill out personal information: Complete your name, address, and contact details at the top of the form.

04

Provide details of unclaimed funds: Enter the exact amount of unclaimed funds and any relevant case or reference number.

05

Attach supporting documents: Include copies of identification, proof of ownership, and any other documents required by the authority.

06

Review the application: Double-check that all information is accurate and all necessary documentation is attached.

07

Submit the petition: Send the completed form and documents to the designated office or authority via mail or in person.

08

Await confirmation: After submission, keep track of your application and wait for any confirmation or further instructions from the authority.

Who needs Petition for Payment of Unclaimed Funds?

01

Individuals who believe they are entitled to unclaimed funds due to inheritance, forgotten accounts, or misfiled claims.

02

Businesses or organizations that have unclaimed property or funds they wish to reclaim.

03

Heirs or representatives of deceased persons who are claiming funds from estates or trusts.

Fill

form

: Try Risk Free

People Also Ask about

Are unclaimed funds reported to the IRS?

0:19 1:54 This is because it is seen as a return of your own. Money. It's crucial to report the income earnedMoreThis is because it is seen as a return of your own. Money. It's crucial to report the income earned from unclaimed property on your tax. Return failure to do so can result in penalties.

Is it safe to claim unclaimed money?

If you get a notice about money that could be yours, verify the notice by searching for unclaimed property on a legitimate website. That way, you won't lose cash or risk having your identity compromised when trying to claim the property.

How do I get my unclaimed money?

Most unclaimed money is held by state governments from sources such as bank accounts, insurance policies, or state agencies. Search for unclaimed money from your state's unclaimed property office. If you have lived in other states, check their unclaimed property offices, too.

What happens when you file a claim for unclaimed property?

Once you have submitted your claim, the unclaimed property department for the state will verify your ownership and process the claim. Some states complete this process in less than 30 days.

How to find unclaimed money in your name?

Most unclaimed money is held by state governments from sources such as bank accounts, insurance policies, or state agencies. Search for unclaimed money from your state's unclaimed property office. If you have lived in other states, check their unclaimed property offices, too.

Is unclaimed property a trap?

0:05 1:15 And return the property unclaimed property can be searched for free on state government websitesMoreAnd return the property unclaimed property can be searched for free on state government websites beware of scams that charge a fee to search for unclaimed. Property.

How do I claim unclaimed amount?

You can visit the concerned bank to claim an unclaimed deposit. To find out the details of an unclaimed deposit, you can visit the UDGAM portal. Is there a portal to check unclaimed deposits? Yes, you can check the details of unclaimed deposits on the UDGAM portal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Petition for Payment of Unclaimed Funds?

A Petition for Payment of Unclaimed Funds is a legal request submitted to a court or relevant authority seeking the release of funds that have been deemed unclaimed, typically due to a lack of activity or contact from the account holder.

Who is required to file Petition for Payment of Unclaimed Funds?

Individuals or entities that believe they are the rightful owners of unclaimed funds, such as bank deposits, insurance payouts, or other financial assets, are required to file a Petition for Payment of Unclaimed Funds.

How to fill out Petition for Payment of Unclaimed Funds?

To fill out a Petition for Payment of Unclaimed Funds, one must provide personal information, details about the unclaimed funds, proof of identity and ownership, and any supporting documents required by the specific jurisdiction.

What is the purpose of Petition for Payment of Unclaimed Funds?

The purpose of a Petition for Payment of Unclaimed Funds is to formally request the return of funds that have not been claimed by their rightful owner, ensuring that individuals can recover lost or forgotten financial assets.

What information must be reported on Petition for Payment of Unclaimed Funds?

The information that must be reported includes the claimant's name and contact information, description and amount of the unclaimed funds, relevant account numbers, and documentation that verifies the claimant's entitlement to the funds.

Fill out your petition for payment of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petition For Payment Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.