Get the free Decision Regarding Reaffirmation Agreement - txwb uscourts

Show details

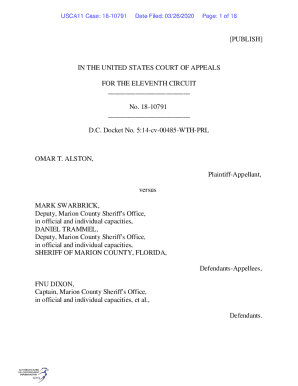

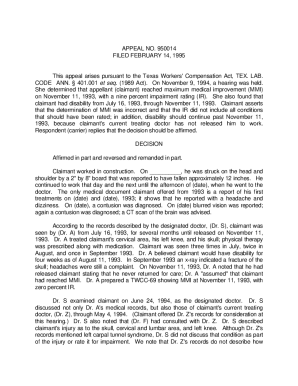

A court decision addressing the approval process of a reaffirmation agreement under U.S. bankruptcy law, outlining obligations for debtors, attorneys, and court procedures related to undue hardship.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign decision regarding reaffirmation agreement

Edit your decision regarding reaffirmation agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your decision regarding reaffirmation agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

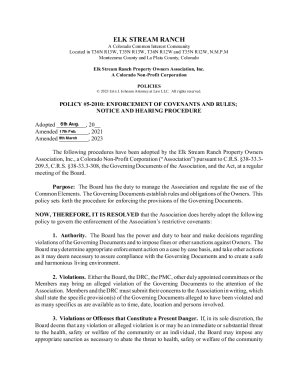

Editing decision regarding reaffirmation agreement online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit decision regarding reaffirmation agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

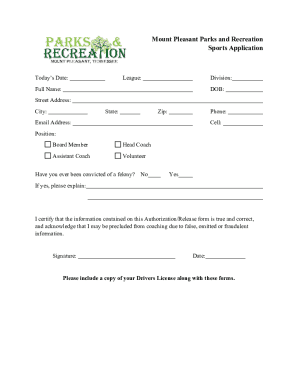

How to fill out decision regarding reaffirmation agreement

How to fill out Decision Regarding Reaffirmation Agreement

01

Obtain the Decision Regarding Reaffirmation Agreement form from your bankruptcy attorney or the court.

02

Begin by filling in your personal information at the top of the form, including your name, address, and case number.

03

Review the terms of the reaffirmation agreement to ensure you understand the implications and obligations.

04

Indicate whether you agree or disagree with the reaffirmation agreement by checking the appropriate box.

05

Provide detailed information about the creditor and the debt being reaffirmed.

06

Sign and date the form at the bottom to confirm your decision.

07

Submit the completed form to the bankruptcy court for approval.

Who needs Decision Regarding Reaffirmation Agreement?

01

Individuals who are filing for Chapter 7 bankruptcy and wish to reaffirm debts such as mortgages or car loans.

02

Debtors who want to retain the benefits of their secured debts while continuing to make payments.

Fill

form

: Try Risk Free

People Also Ask about

What are the legal requirements of a reaffirmation agreement?

Reaffirmation agreements require court approval to make sure the debtor can reasonably afford to continue making the payments. If the debtor has an attorney, the attorney must confirm that the agreement is in the debtor's best interest and won't cause undue financial hardship.

What happens if I did not reaffirm my car loan?

If your bankruptcy case is denied, the court may: Dismiss the case: A dismissal means the process ends without granting you any relief. You'll still owe all your debts and will need to explore other options.

Can you negotiate a reaffirmation agreement?

There is wisdom, too, in reaffirming debts on collateral that are worth substantially more than you owe on it. Remember, too, that you can attempt to negotiate the terms of your loan. “It never hurts to ask,” attorney O'Neill says.

What happens if mortgage is not reaffirmed but still paying?

Consequences of Not Reaffirming a Mortgage As long as you continue making payments, the lender typically will not foreclose. Yet, the consequences of not reaffirming the mortgage include the potential inability to refinance or modify the loan in the future.

Does a creditor have to accept a reaffirmation agreement?

Reaffirmation agreements are entirely voluntary. No creditor can make you reaffirm a debt. This is because a reaffirmation goes against the most basic upside of filing bankruptcy: the fresh start.

What happens if a reaffirmation agreement is denied?

If I deny the motion to reaffirm the debt, you are under no legal responsibility to pay the creditor, but the creditor can seek to repossess the collateral (if there is any). However the creditor cannot obtain a judgment against you for the amount you owe on this debt.

What is the purpose of a reaffirmation agreement?

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Decision Regarding Reaffirmation Agreement?

The Decision Regarding Reaffirmation Agreement is a legal document used in bankruptcy proceedings that allows debtors to reaffirm their debts and obligations, enabling them to retain certain assets while discharging other debts.

Who is required to file Decision Regarding Reaffirmation Agreement?

Debtors who wish to reaffirm their debts and continue making payments on specific loans after filing for bankruptcy are required to file a Decision Regarding Reaffirmation Agreement.

How to fill out Decision Regarding Reaffirmation Agreement?

To fill out the Decision Regarding Reaffirmation Agreement, debtors must provide specific details about the debt, including the creditor's name, the amount owed, and the terms of the reaffirmation, along with their signature and the date.

What is the purpose of Decision Regarding Reaffirmation Agreement?

The purpose of the Decision Regarding Reaffirmation Agreement is to inform the court about the debtor's intent to reaffirm a debt, ensuring transparency and enabling the court to oversee the reaffirmation process.

What information must be reported on Decision Regarding Reaffirmation Agreement?

The information that must be reported on the Decision Regarding Reaffirmation Agreement includes the details of the reaffirmed debt, the reasons for the reaffirmation, the debtor's financial situation, and any potential risks involved with the decision.

Fill out your decision regarding reaffirmation agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Decision Regarding Reaffirmation Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.