Get the free NPS-8C - bjs ojp usdoj

Show details

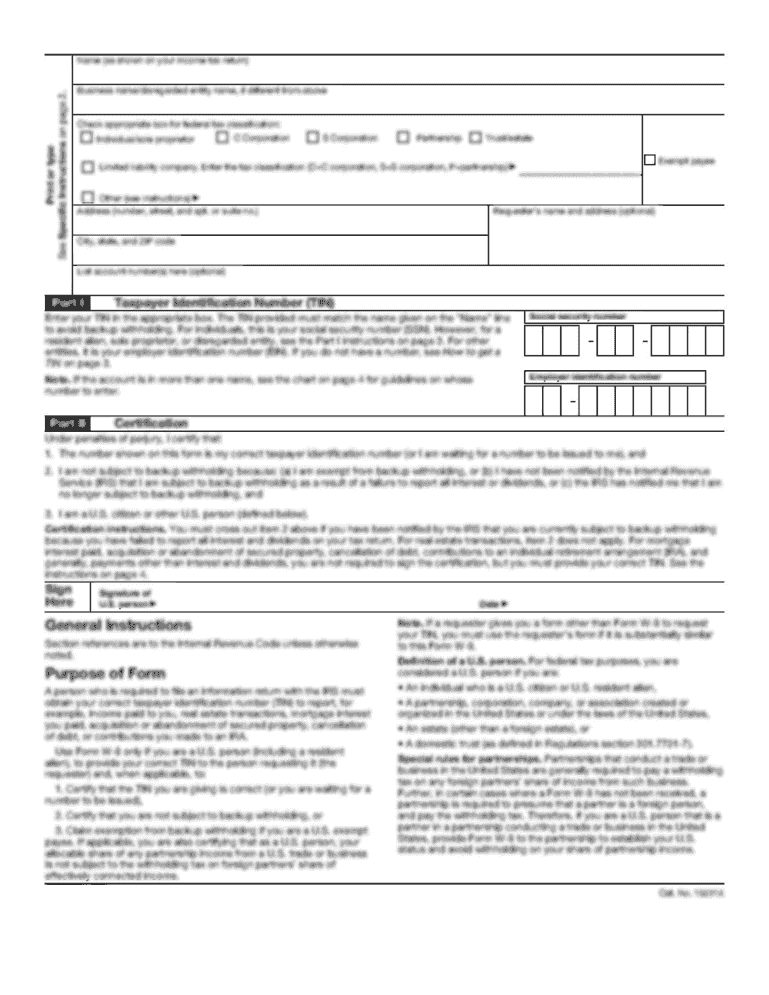

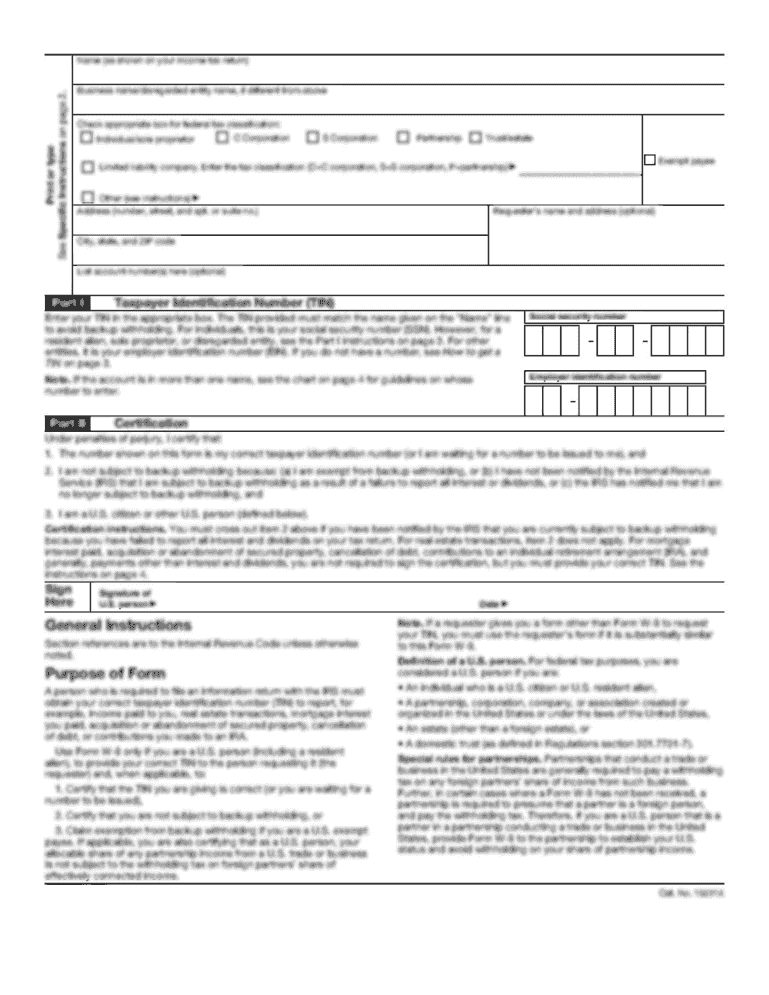

This form collects data on death penalty statutes from jurisdictions in the United States, specifically regarding their status and any changes over a specified period.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nps-8c - bjs ojp

Edit your nps-8c - bjs ojp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nps-8c - bjs ojp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nps-8c - bjs ojp online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nps-8c - bjs ojp. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nps-8c - bjs ojp

How to fill out NPS-8C

01

Obtain the NPS-8C form from the relevant authority or website.

02

Read the instructions carefully before filling out the form.

03

Fill in your personal information, including name, address, and contact details.

04

Provide details about the specific application or service for which you are applying.

05

Include any necessary supporting documents as specified in the guidelines.

06

Review your entries for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form by the designated method (mail, email, or online submission).

Who needs NPS-8C?

01

Individuals applying for certain federal benefits or permits.

02

Organizations requiring approval for specific projects or services.

03

Anyone who needs to provide information to governmental agencies for regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is considered for 80C?

The premiums paid for a life insurance policy qualify for deductions under Section 80C of The Income Tax Act, 1961. This deduction is applicable to all types of life insurance policies, including term plans, Unit Linked Insurance Plans (ULIPs), endowment plans, guaranteed income plans and more.

Is NPS under Section 80CCE?

Employees contributing to NPS are eligible for following tax benefits on their own contribution: Tax deduction up to 10% of salary (Basic + DA) under section 80 CCD(1) within the overall ceiling of ₹1.50 lakh under Sec 80 CCE.

What is the deduction for 80CCD?

Section 80CCD(1) gives a tax deduction on NPS contributions up to 10% of their salary (basic salary + DA) made by employees. However, the total amount of deduction of 80C and 80CCD(1) cannot exceed Rs.1.50 lakhs in the previous year.

What is NPS scale English?

An NPS survey asks how likely a customer is to recommend your business to others on a scale of 1 to 10. Teams collect customer survey responses and separate respondents into three categories: Promoters: Respondents who answer 9 or 10 will likely recommend your business through word of mouth.

What is the ceiling under section 80CCE?

Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD (1) with in the overall ceiling of Rs. 1.5 lac under Sec 80 CCE. An additional deduction for investment up to Rs. 50,000 in NPS (Tier I account) is available exclusively to NPS subscribers under subsection 80CCD (1B).

What is the difference between tier 1 and tier 2 in NPS?

There are two types of NPS accounts - Tier I and Tier II. While NPS Tier I is well-suited for retirement planning, Tier II NPS accounts act as a voluntary savings account. Tier I NPS investment is a long-term one and the amount cannot be withdrawn until retirement. This is not the case with Tier II NPS accounts.

Is 80CCE part of 80C?

It's important to understand that the Rs. 1.5 lakh deduction limit under Section 80CCE includes other sections like 80C, 80CCC, and 80CCD. Taxpayers must assess their investments and expenses across these sections collectively to ensure they remain within the total limit.

Are 80C and 80CCE the same?

Yes, the repayment of the principal amount of a home loan is eligible for deduction under Section 80C, which falls within the limit of Section 80CCE. However, the maximum deduction for all eligible investments and expenses under 80CCE remains capped at Rs. 1.5 lakhs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NPS-8C?

NPS-8C is a tax form used by certain taxpayers to report specific financial information required by regulatory authorities.

Who is required to file NPS-8C?

Individuals and businesses that meet certain taxable thresholds or engage in specific financial activities are required to file NPS-8C.

How to fill out NPS-8C?

To fill out NPS-8C, taxpayers must provide their identifying information, financial details, and any other required information as specified in the form instructions.

What is the purpose of NPS-8C?

The purpose of NPS-8C is to collect data for taxation and compliance purposes, ensuring that taxpayers report their income and financial transactions accurately.

What information must be reported on NPS-8C?

The information that must be reported on NPS-8C generally includes identification details, income details, deductions, and any relevant financial statements.

Fill out your nps-8c - bjs ojp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nps-8c - Bjs Ojp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.