Get the free Voluntary Disclosure Agreement - rev louisiana

Show details

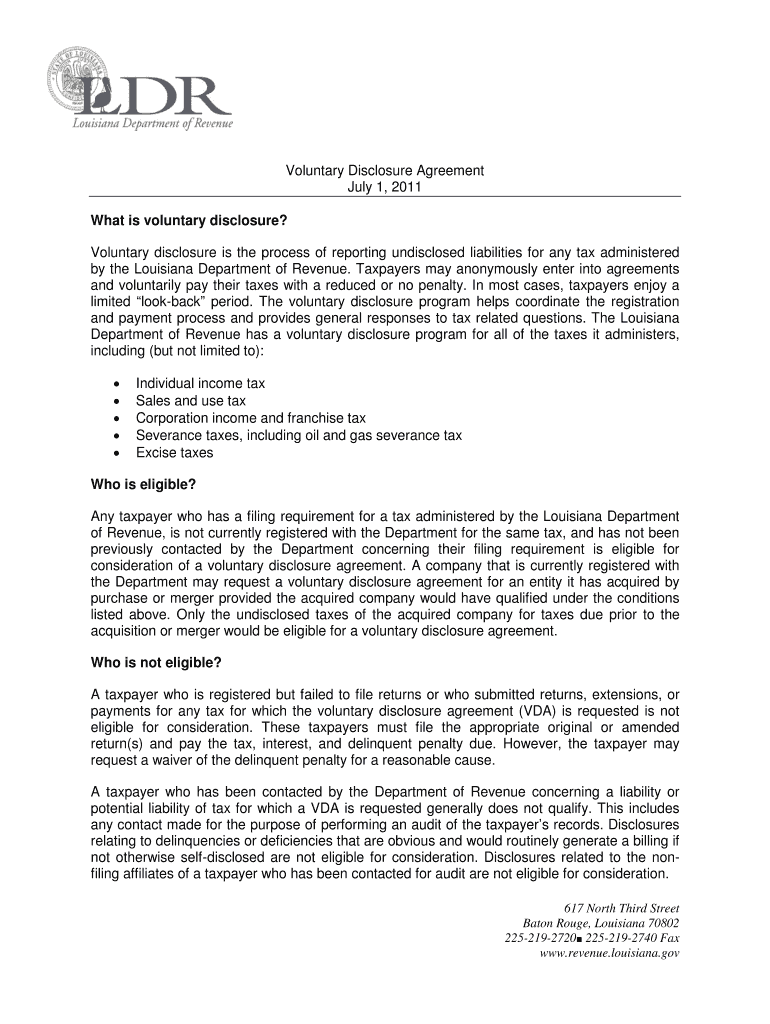

El Acuerdo de Divulgación Voluntaria es un proceso mediante el cual los contribuyentes pueden informar sobre obligaciones no divulgadas para cualquier impuesto administrado por el Departamento de

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary disclosure agreement

Edit your voluntary disclosure agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary disclosure agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voluntary disclosure agreement online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit voluntary disclosure agreement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary disclosure agreement

How to fill out Voluntary Disclosure Agreement

01

Begin with identifying the specific tax issue or concern you wish to disclose.

02

Gather all relevant documentation and information related to the tax issue.

03

Complete the Voluntary Disclosure Agreement form, ensuring that all fields are filled out accurately.

04

Clearly explain the circumstances surrounding the tax issue in the designated section.

05

Calculate and include any unpaid taxes, interest, and penalties that may be applicable.

06

Review the entire agreement to ensure coherence and correctness.

07

Submit the completed form along with any required documentation to the appropriate tax authority.

08

Follow up with the tax authority to confirm receipt and inquire about the next steps.

Who needs Voluntary Disclosure Agreement?

01

Individuals or businesses who have failed to comply with tax obligations and want to rectify their situation.

02

Taxpayers seeking to avoid penalties for unreported income or unpaid taxes.

03

Anyone who wishes to voluntarily disclose tax liabilities before they are discovered by tax authorities.

Fill

form

: Try Risk Free

People Also Ask about

What is a voluntary disclosure agreement?

Submitting a voluntary disclosure agreement (VDA)—an agreement between your business and its jurisdictions to limit lookback periods and generally waive penalties during tax reviews—can be one of the most effective ways to voluntarily meet compliance obligations.

What is a voluntary self disclosure?

A voluntary self-disclosure is an in-depth process that often requires internal investigations, audits, an analysis of the sanctions, and how they apply to a business.

What is a voluntary disclosure?

Voluntary disclosure is financial or operating information related to an issuer's obligations, credit, or operating conditions that an issuer chooses to provide in addition to information required by the issuer's Continuing Disclosure Agreements.

Why would someone need a voluntary disclosure?

If you find yourself in one of these situations, you may benefit from this program and its benefits: A tax return for a previous year was not filed and is now late. Income was not reported or under-reported on a tax return that is already filed. Expenses were claimed on a tax return that was not eligible.

What is the voluntary disclosure?

Voluntary disclosure is financial or operating information related to an issuer's obligations, credit, or operating conditions that an issuer chooses to provide in addition to information required by the issuer's Continuing Disclosure Agreements.

What is an example of a voluntary information disclosure?

Voluntary disclosures can include strategic information such as company characteristics and strategy, nonfinancial information such socially responsible practices, and financial information such as stock price information.

What is the traditional IRS voluntary disclosure program?

The IRS voluntary disclosure program provides a way for taxpayers with previously undisclosed income to contact the IRS and resolve their tax matters. This program does not apply to taxpayers whose income is derived from illegal activities. The voluntary disclosure practice is a longstanding practice of IRS.

What is an example of a voluntary disclosure?

Types and examples Voluntary disclosures can include strategic information such as company characteristics and strategy, nonfinancial information such socially responsible practices, and financial information such as stock price information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Voluntary Disclosure Agreement?

A Voluntary Disclosure Agreement (VDA) is a legal contract that allows taxpayers to voluntarily disclose previous non-compliance with tax obligations to a tax authority, usually in exchange for reduced penalties or avoidance of criminal prosecution.

Who is required to file Voluntary Disclosure Agreement?

Any taxpayer or business that has failed to comply with tax obligations and is seeking to come into compliance may file a VDA. This typically includes individuals, companies, and other entities with tax liabilities.

How to fill out Voluntary Disclosure Agreement?

To fill out a VDA, the taxpayer must provide personal or business information, details about the tax liabilities, and any relevant financial records. Specific forms and requirements can vary by jurisdiction.

What is the purpose of Voluntary Disclosure Agreement?

The purpose of a VDA is to encourage taxpayers to come forward and report unpaid taxes, improve compliance, reduce overall tax evasion, and mitigate penalties by providing an opportunity for voluntary disclosure before enforcement actions are taken.

What information must be reported on Voluntary Disclosure Agreement?

The information reported on a VDA typically includes the taxpayer's identification details, the nature and amount of taxes owed, the period of non-compliance, a description of the underlying transactions, and any steps taken to correct the non-compliance.

Fill out your voluntary disclosure agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Disclosure Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.