NY Newkirk Products Consent to Disclose Tax Return Information 2009-2026 free printable template

Show details

Federal law requires this consent form be provided to you. Unless authorized by law, we cannot disclose, without your consent, your tax-return information to ...

pdfFiller is not affiliated with any government organization

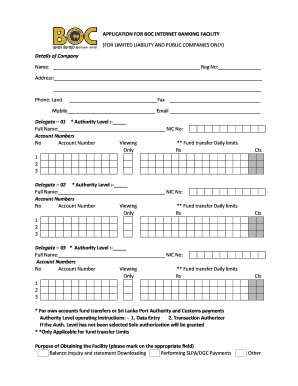

Get, Create, Make and Sign NY Newkirk Products Consent to Disclose Tax

Edit your NY Newkirk Products Consent to Disclose Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY Newkirk Products Consent to Disclose Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY Newkirk Products Consent to Disclose Tax online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY Newkirk Products Consent to Disclose Tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out NY Newkirk Products Consent to Disclose Tax

How to fill out NY Newkirk Products Consent to Disclose Tax Return

01

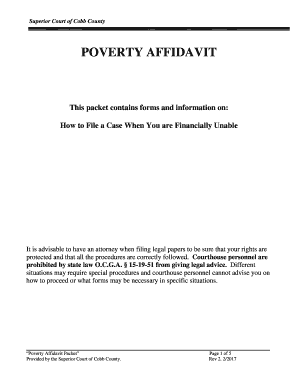

Obtain the NY Newkirk Products Consent to Disclose Tax Return form.

02

Fill in your personal information, including name, address, and social security number.

03

Specify the tax years for which you are granting consent to disclose your tax return.

04

Indicate the purpose for which the tax return information will be used.

05

Sign and date the form to authorize the disclosure.

06

Submit the completed form to NY Newkirk Products or the relevant party requesting the information.

Who needs NY Newkirk Products Consent to Disclose Tax Return?

01

Individuals who want to authorize NY Newkirk Products to access their tax return information for review or processing purposes.

02

Taxpayers seeking to provide their tax information to lenders, vendors, or other institutions through NY Newkirk Products.

Fill

form

: Try Risk Free

People Also Ask about

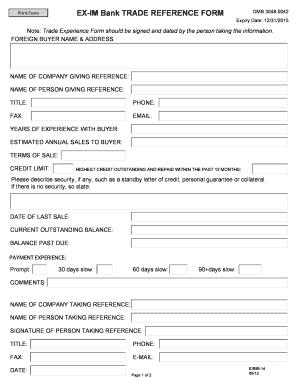

What is the 7216 consent to use tax return?

7216 is a criminal provision enacted by the U.S. Congress in 1971 that prohibits preparers of tax returns from knowingly or recklessly disclosing or using tax return information. A convicted preparer may be fined not more than $1,000, or imprisoned not more than one year or both, for each violation.

What is 7216 form?

What is a 7216 consent form? Internal Revenue Code Section 7216 is a provision that prohibits tax professionals from knowingly or recklessly disclosing taxpayer information.

What is violation of section 7216?

Section 7216(a) also establishes a criminal penalty for tax return preparers who knowingly or recklessly disclose or use taxpayer information without consent.

Who needs a form 7216?

If you are offering any services in addition to tax preparation (Bank Products, Insurance, Investments, etc.), the IRC Section 7216 consent form must be signed by each taxpayer prior to you discussing these services or sharing any of their information with another party.

What is the 7216 consent to use?

In plain English, you must obtain 7216 consent if: You plan to use a 1040 client's information for anything other than tax return preparation. You plan to share your 1040 client's information outside the United States.

What is a 7216 tax form?

§7216 is a criminal statute that applies to preparers of individual, corporate and partnership tax returns. It governs the disclosure and use of information that is gathered, processed, computed and applied in the preparation of those returns. Penalties for violations of this section include fines and jail time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NY Newkirk Products Consent to Disclose Tax from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including NY Newkirk Products Consent to Disclose Tax. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit NY Newkirk Products Consent to Disclose Tax straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing NY Newkirk Products Consent to Disclose Tax, you can start right away.

How do I edit NY Newkirk Products Consent to Disclose Tax on an iOS device?

Create, modify, and share NY Newkirk Products Consent to Disclose Tax using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is NY Newkirk Products Consent to Disclose Tax Return?

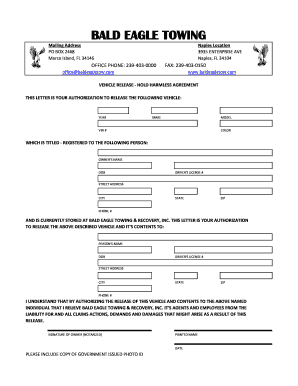

NY Newkirk Products Consent to Disclose Tax Return is a form that allows individuals or entities to give consent for the disclosure of their tax return information to a specified third party, usually for purposes related to tax compliance, loan applications, or other financial matters.

Who is required to file NY Newkirk Products Consent to Disclose Tax Return?

Typically, individuals or entities who need to authorize a third party to access their tax return information are required to file the NY Newkirk Products Consent to Disclose Tax Return.

How to fill out NY Newkirk Products Consent to Disclose Tax Return?

To fill out the NY Newkirk Products Consent to Disclose Tax Return, you must provide your personal or business information, specify the tax years for which consent is being granted, identify the third party authorized to receive the tax return information, and sign the form.

What is the purpose of NY Newkirk Products Consent to Disclose Tax Return?

The purpose of the NY Newkirk Products Consent to Disclose Tax Return is to ensure that the individual's or entity's tax return information can be shared legally with a designated third party for necessary and specified purposes.

What information must be reported on NY Newkirk Products Consent to Disclose Tax Return?

Information that must be reported on the NY Newkirk Products Consent to Disclose Tax Return includes the taxpayer's name, address, taxpayer identification number, the name of the third party, the tax years covered, and any other relevant details necessary for proper identification and consent.

Fill out your NY Newkirk Products Consent to Disclose Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY Newkirk Products Consent To Disclose Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.